- United States

- /

- Transportation

- /

- OTCPK:DIDI.Y

US Penny Stocks Spotlight: 1stdibs.Com And Two More To Watch

Reviewed by Simply Wall St

As the U.S. stock market experiences mixed results with a recent recovery from a sell-off losing momentum, investors are keenly observing the potential of various investment avenues. Penny stocks, often associated with smaller or newer companies, continue to intrigue investors despite their vintage terminology. These stocks can offer growth opportunities at lower price points, especially when backed by strong financial health and fundamentals.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| Inter & Co (NasdaqGS:INTR) | $4.04 | $1.73B | ★★★★☆☆ |

| BAB (OTCPK:BABB) | $0.893925 | $6.49M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $105.8M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.76 | $84.32M | ★★★★★★ |

| Pangaea Logistics Solutions (NasdaqCM:PANL) | $4.99 | $236.39M | ★★★★★☆ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.44 | $47.69M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $0.95 | $17.08M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.82 | $71.95M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $3.50 | $382.26M | ★★★★☆☆ |

Click here to see the full list of 742 stocks from our US Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

1stdibs.Com (NasdaqGM:DIBS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: 1stdibs.Com, Inc. operates an online marketplace for luxury design products worldwide and has a market cap of $127.80 million.

Operations: The company generates revenue from its online retail segment, amounting to $86.41 million.

Market Cap: $127.8M

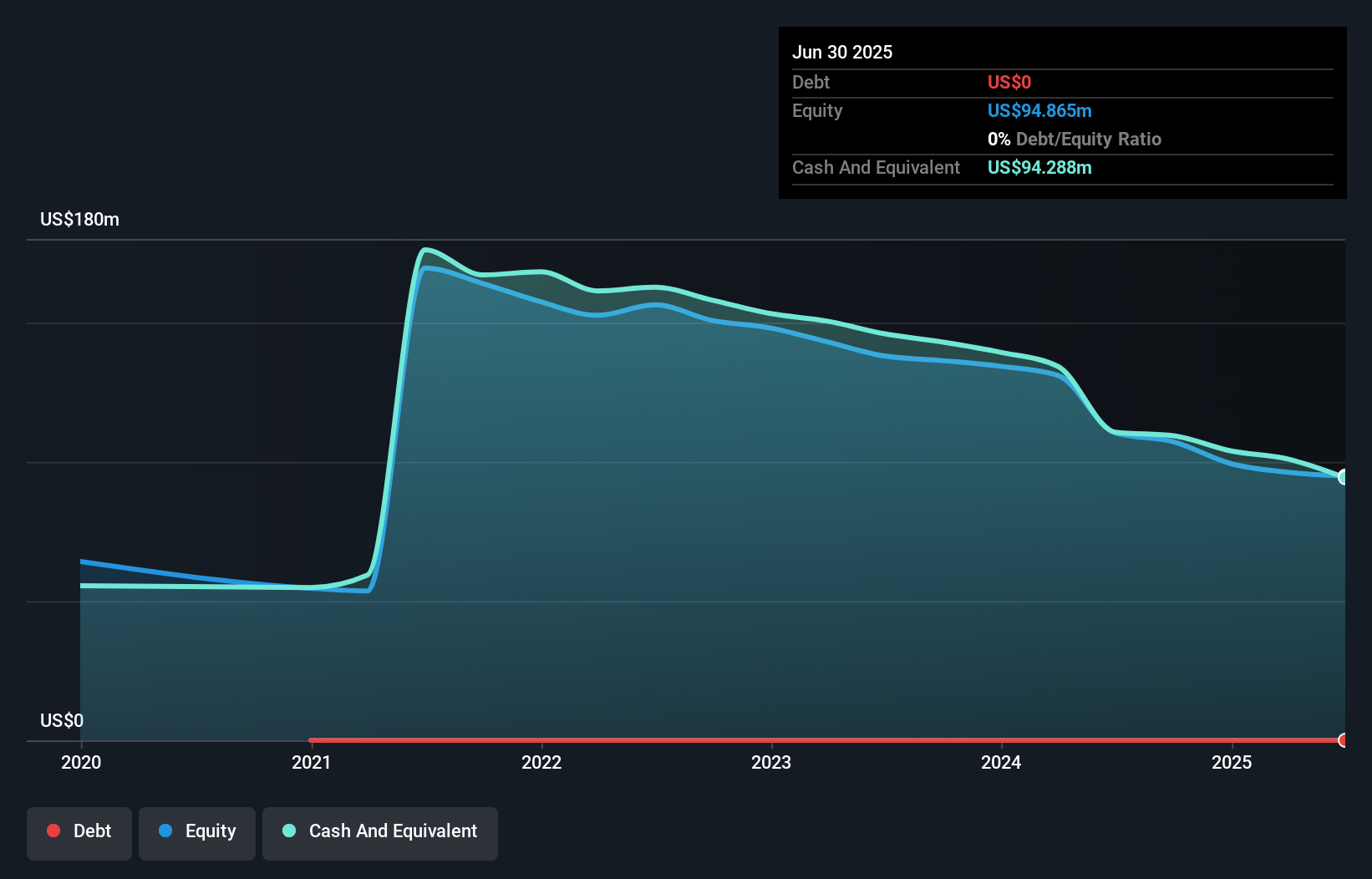

1stdibs.Com, Inc. operates in the online luxury marketplace with a market cap of US$127.80 million and generated US$86.41 million in revenue over the past year. Recent earnings show a slight increase in sales to US$21.19 million for Q3 2024, though the company remains unprofitable with a net loss of US$5.68 million for the quarter. Despite this, it has reduced losses over five years by 13.9% annually and maintains a strong cash runway exceeding three years without debt concerns, supported by assets covering both short- and long-term liabilities effectively while avoiding shareholder dilution recently through buybacks.

- Navigate through the intricacies of 1stdibs.Com with our comprehensive balance sheet health report here.

- Gain insights into 1stdibs.Com's outlook and expected performance with our report on the company's earnings estimates.

DiDi Global (OTCPK:DIDI.Y)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: DiDi Global Inc. operates a mobility technology platform offering various services in China, Brazil, Mexico, and internationally with a market cap of approximately $22.56 billion.

Operations: The company's revenue is primarily generated from China Mobility (CN¥183.21 billion), followed by International operations (CN¥10.26 billion) and Other Initiatives (CN¥9.84 billion).

Market Cap: $22.56B

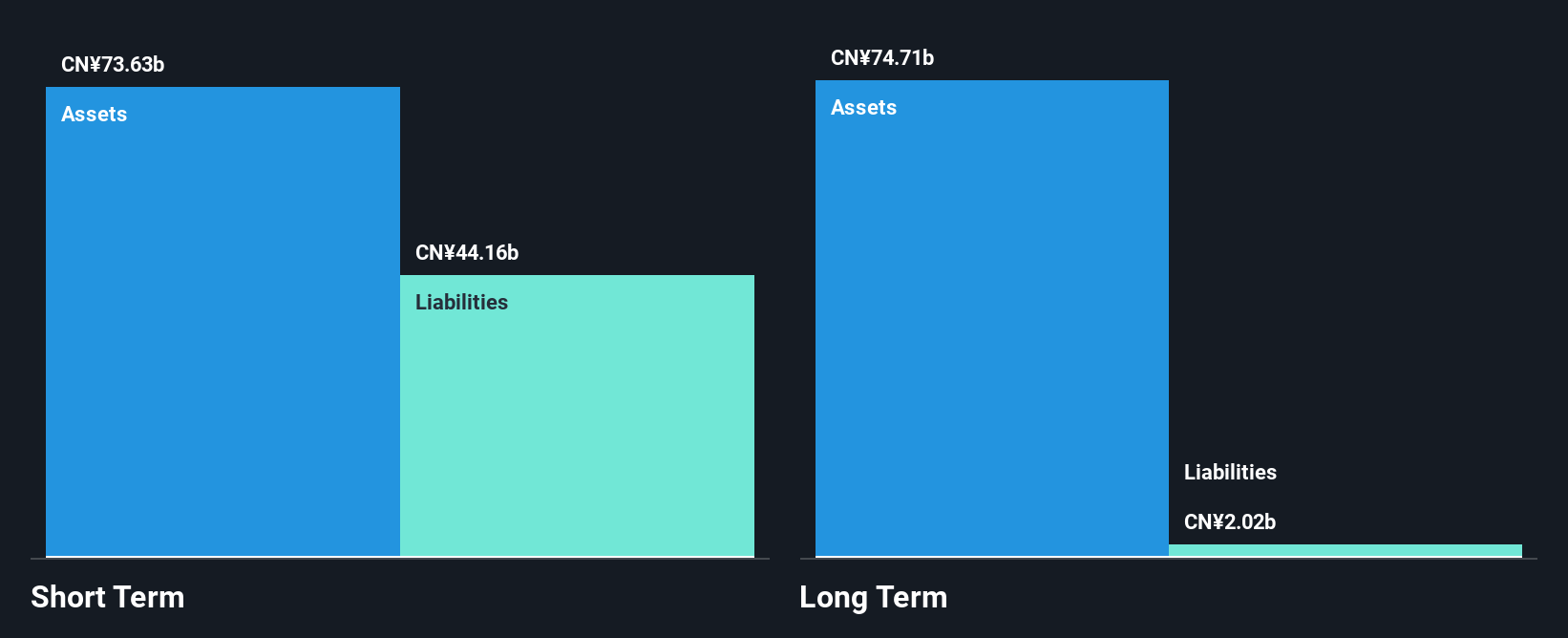

DiDi Global Inc. has transitioned to profitability, reporting a net income of CN¥929 million for Q3 2024, reversing a loss from the previous year. Its revenue grew to CN¥53.95 billion, indicating robust performance in its core markets. The company benefits from strong asset coverage over liabilities and maintains more cash than its total debt, suggesting financial stability despite an increased debt-to-equity ratio over five years. Trading significantly below estimated fair value and with no recent shareholder dilution, DiDi presents potential value among penny stocks while analysts anticipate further price appreciation based on current market conditions.

- Unlock comprehensive insights into our analysis of DiDi Global stock in this financial health report.

- Review our growth performance report to gain insights into DiDi Global's future.

Elite Pharmaceuticals (OTCPK:ELTP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Elite Pharmaceuticals, Inc. is a specialty pharmaceutical company focused on developing, manufacturing, and selling oral controlled-release products and generic pharmaceuticals with a market cap of $589.69 million.

Operations: The company generates revenue of $71.17 million from its Abbreviated New Drug Applications (ANDA) segment.

Market Cap: $589.69M

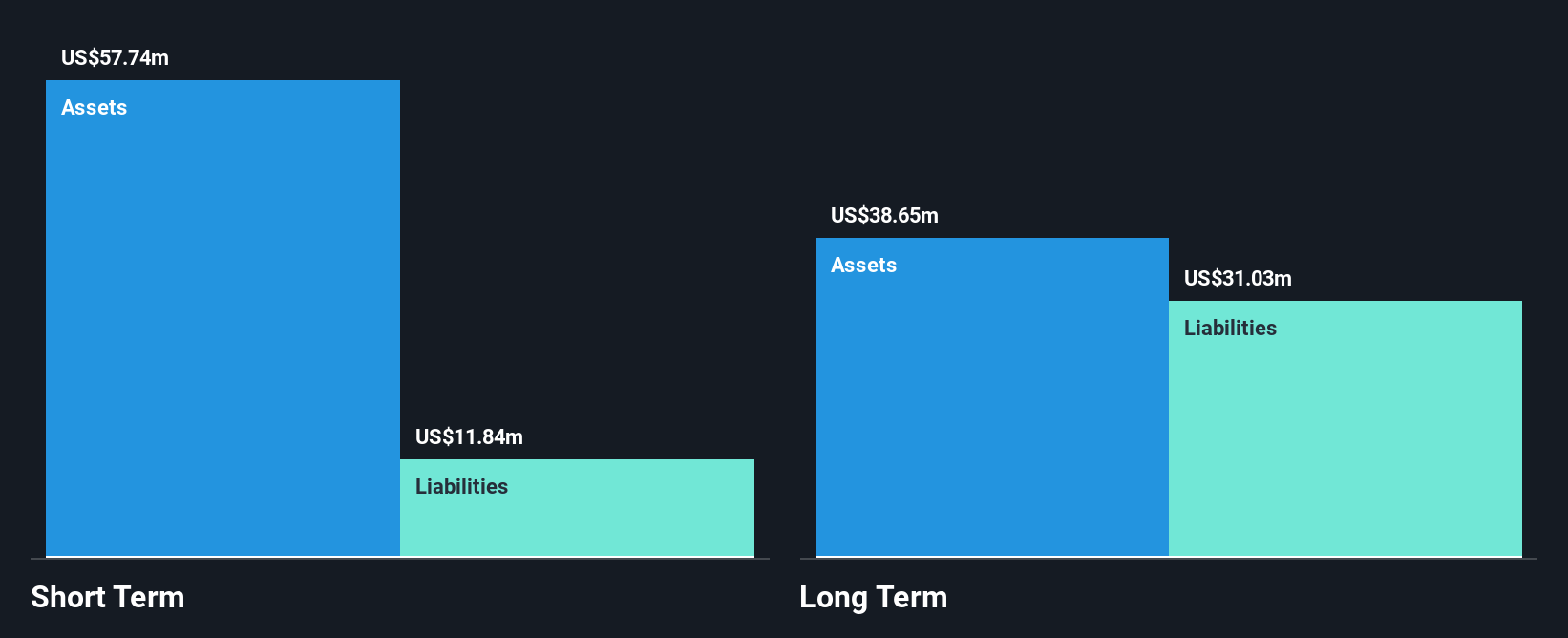

Elite Pharmaceuticals, Inc. remains unprofitable but has reduced its losses over the past five years by 40% annually. The company reported a revenue increase to US$18.88 million for Q2 2024, yet faced a net loss of US$11.04 million, contrasting with a prior year's net income. Despite shareholder dilution and significant insider selling recently, Elite maintains more cash than total debt and covers both short- and long-term liabilities with its assets. Its seasoned management team supports stability amidst high share price volatility and increased weekly volatility from 12% to 17%.

- Click here to discover the nuances of Elite Pharmaceuticals with our detailed analytical financial health report.

- Explore historical data to track Elite Pharmaceuticals' performance over time in our past results report.

Key Takeaways

- Unlock our comprehensive list of 742 US Penny Stocks by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:DIDI.Y

DiDi Global

Operates a mobility technology platform that provides various mobility and other services in the People's Republic of China, Brazil, Mexico, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives