- United States

- /

- Retail Distributors

- /

- NasdaqGM:GCT

3 US Growth Companies With 32% Insider Ownership

Reviewed by Simply Wall St

In the current market environment, where major indices like the Dow Jones and Nasdaq are experiencing fluctuations amidst significant corporate earnings announcements and record highs in cryptocurrency, investors are keenly observing growth opportunities. Companies with substantial insider ownership often attract attention as they can indicate confidence in the business's potential, making them noteworthy considerations for those navigating today's volatile financial landscape.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Victory Capital Holdings (NasdaqGS:VCTR) | 10.5% | 31.5% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 24.3% |

| Coastal Financial (NasdaqGS:CCB) | 18% | 46.1% |

| On Holding (NYSE:ONON) | 19.1% | 29.7% |

| Clene (NasdaqCM:CLNN) | 21.6% | 60.7% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 84.9% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.8% | 95% |

| Credit Acceptance (NasdaqGS:CACC) | 14.1% | 50% |

| Alkami Technology (NasdaqGS:ALKT) | 11% | 98.6% |

| BBB Foods (NYSE:TBBB) | 22.9% | 51.2% |

Let's review some notable picks from our screened stocks.

GigaCloud Technology (NasdaqGM:GCT)

Simply Wall St Growth Rating: ★★★★★☆

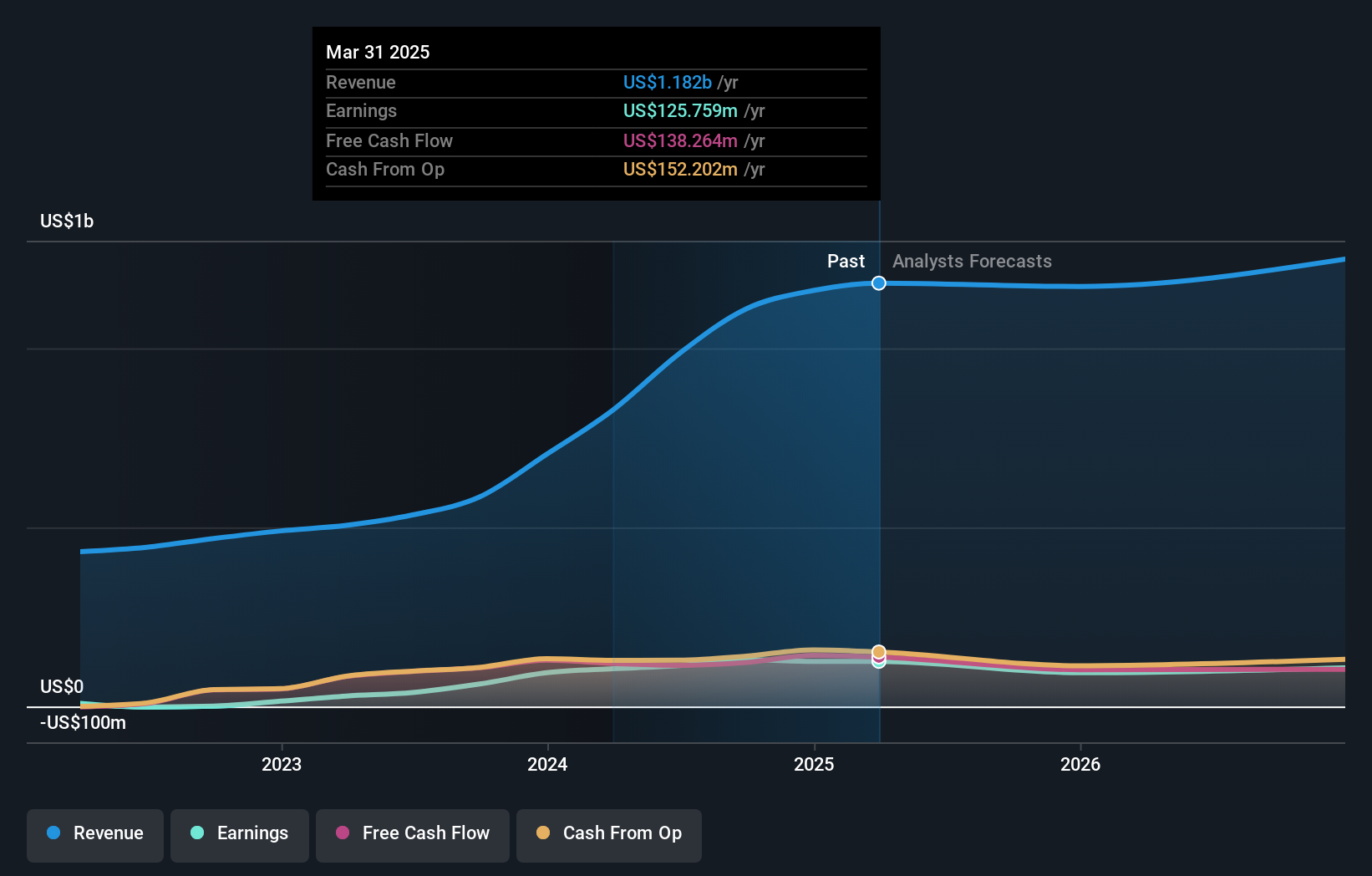

Overview: GigaCloud Technology Inc. offers comprehensive B2B ecommerce solutions for large parcel merchandise both in the United States and internationally, with a market cap of approximately $989.47 million.

Operations: The company's revenue is primarily derived from its online retailers segment, which generated $1.11 billion.

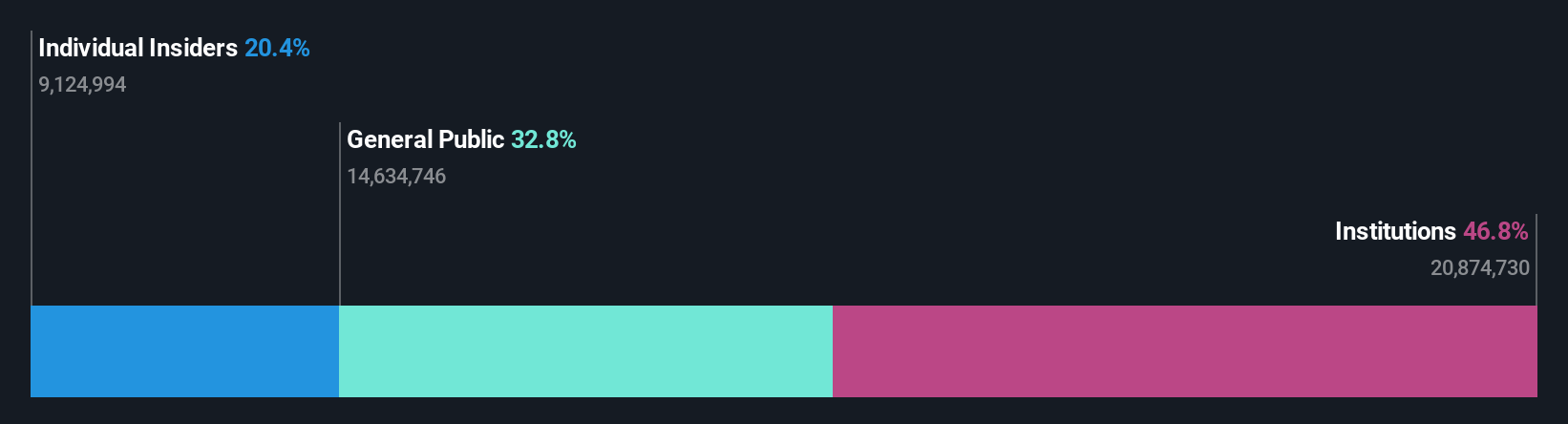

Insider Ownership: 25.8%

GigaCloud Technology, with substantial insider ownership, is positioned for significant growth, boasting a forecasted annual earnings increase of 22.3%, outpacing the US market. Despite its high share price volatility, it trades at a substantial discount to its estimated fair value and offers good relative value compared to peers. Recent earnings showed strong performance with Q3 revenue reaching US$303.32 million, marking notable year-over-year growth amid strategic board changes and an active share repurchase program.

- Click here and access our complete growth analysis report to understand the dynamics of GigaCloud Technology.

- In light of our recent valuation report, it seems possible that GigaCloud Technology is trading behind its estimated value.

Bridge Investment Group Holdings (NYSE:BRDG)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Bridge Investment Group Holdings Inc. operates in the United States as a real estate investment management firm, with a market cap of approximately $1.21 billion.

Operations: The company's revenue is primarily generated from its role as a fully integrated real estate investment manager, amounting to $404.93 million.

Insider Ownership: 11.3%

Bridge Investment Group Holdings demonstrates strong growth potential with forecasted annual earnings growth of 51.4%, significantly outpacing the US market. Despite recent shareholder dilution and a high debt level, it trades at a substantial discount to its estimated fair value. Recent Q3 results show improved profitability with net income rising to US$10.83 million from US$2.06 million year-over-year, while revenue slightly declined to US$101.51 million from US$106.27 million, reflecting solid operational performance amidst strategic community-focused initiatives like affordable housing projects.

- Dive into the specifics of Bridge Investment Group Holdings here with our thorough growth forecast report.

- The analysis detailed in our Bridge Investment Group Holdings valuation report hints at an inflated share price compared to its estimated value.

P10 (NYSE:PX)

Simply Wall St Growth Rating: ★★★★☆☆

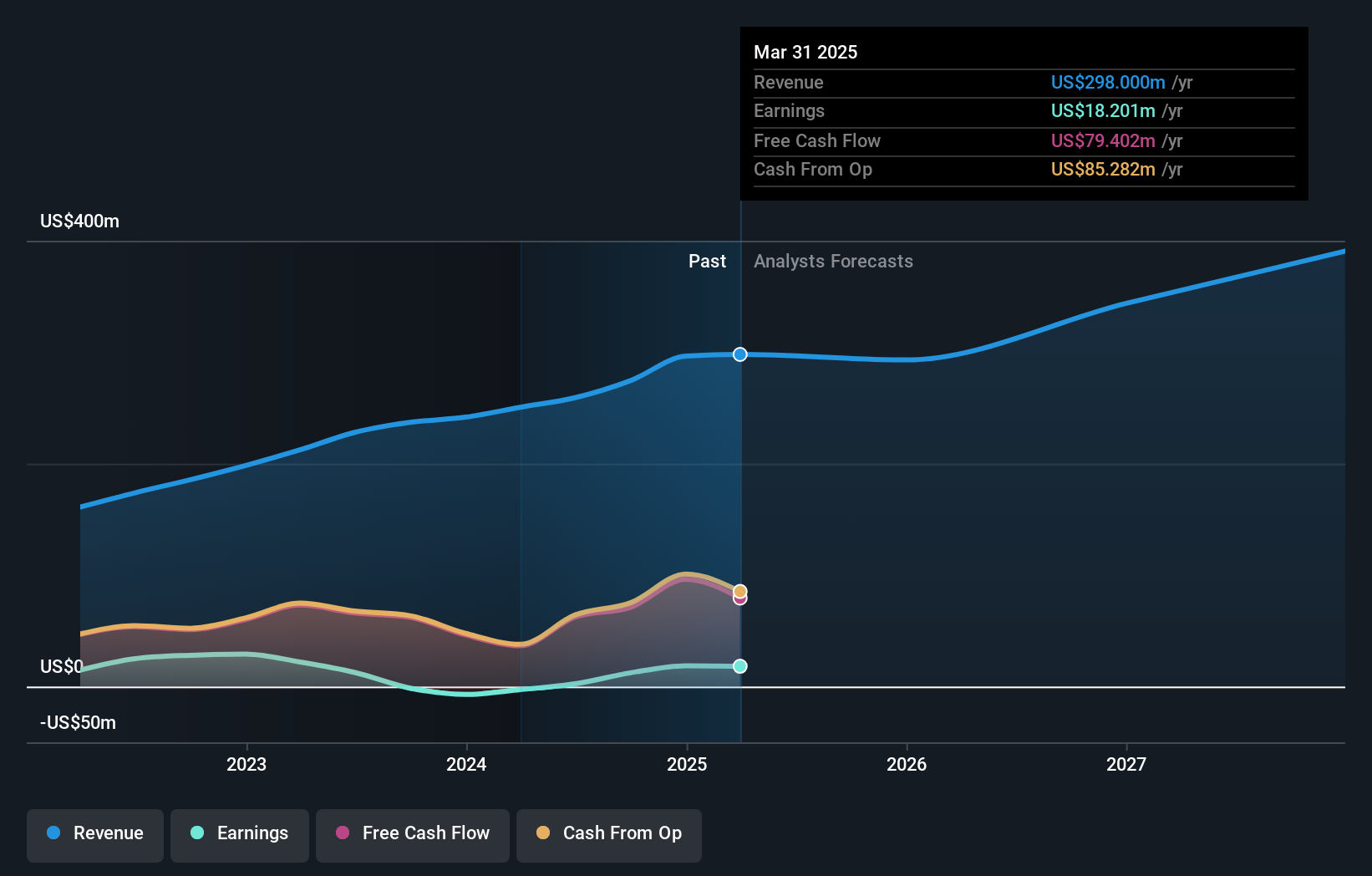

Overview: P10, Inc. operates as a multi-asset class private market solutions provider in the U.S. alternative asset management industry, with a market cap of approximately $1.37 billion.

Operations: P10, Inc.'s revenue is primarily derived from its asset management segment, which generated $274.50 million.

Insider Ownership: 32.3%

P10 has shown a turnaround with net income of US$1.41 million in Q3 2024, reversing a loss from the previous year, and revenues increasing to US$74.24 million. Despite slower revenue growth forecasts at 7.1% annually, earnings are expected to grow significantly at 50% per year, outpacing the broader market. Recent board changes did not stem from conflicts within the company, and insider activity has been more buying than selling recently, indicating confidence in its strategic direction.

- Get an in-depth perspective on P10's performance by reading our analyst estimates report here.

- Our valuation report unveils the possibility P10's shares may be trading at a premium.

Where To Now?

- Delve into our full catalog of 208 Fast Growing US Companies With High Insider Ownership here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:GCT

GigaCloud Technology

Provides end-to-end B2B ecommerce solutions for large parcel merchandise in the United States and internationally.

Outstanding track record with flawless balance sheet.