- United States

- /

- Specialty Stores

- /

- NasdaqGS:FIVE

Why Five Below (FIVE) Is Down 11.3% After Executive Shakeup and Ongoing Financial Investigations

Reviewed by Sasha Jovanovic

- In early October 2025, Five Below announced several executive changes, naming Daniel Sullivan as Chief Financial Officer and Michelle Israel as Chief Merchandising Officer, amid ongoing investigations into the company’s financial disclosures and operational leadership transitions following the sudden exit of its former CEO.

- This leadership turnover comes during heightened scrutiny of Five Below’s recent sales performance and financial outlook, amplifying uncertainty around its direction and resilience in a competitive retail landscape.

- We'll examine how the introduction of experienced new executives influences Five Below's investment narrative amid concerns about ongoing investigations.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Five Below Investment Narrative Recap

To be a shareholder of Five Below right now, you need to believe in the company's ability to drive transaction growth through value pricing, appealing trend-driven products, and rapid store expansion, even as the market faces choppy retail conditions. The recent appointment of seasoned executives offers stability amid ongoing investigations, but does not materially shift the immediate catalyst: improving comparable sales trends. However, legal scrutiny tied to past financial disclosures remains the primary risk for investors’ confidence in the short term.

Of Five Below’s recent announcements, the elevation of Daniel Sullivan to Chief Financial Officer stands out. Sullivan's extensive experience at major retailers aligns closely with the company's target to expand 150-plus new stores this year, a key growth driver but also a potential source of margin strain if store productivity falters or tariff headwinds persist.

By contrast, one issue that could catch investors off-guard is the lingering legal uncertainty around...

Read the full narrative on Five Below (it's free!)

Five Below's outlook anticipates $5.7 billion in revenue and $352.1 million in earnings by 2028. This scenario relies on a 10.6% annual revenue growth rate and a $79 million earnings increase from the current earnings of $273.1 million.

Uncover how Five Below's forecasts yield a $159.48 fair value, a 15% upside to its current price.

Exploring Other Perspectives

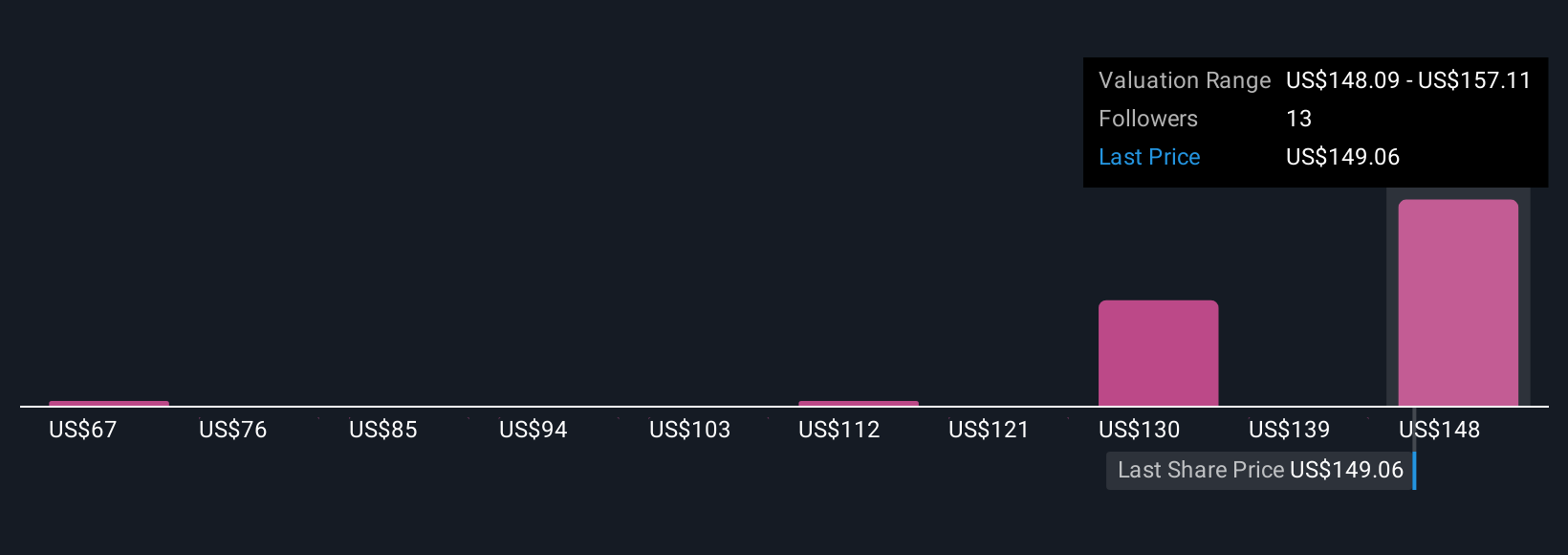

Four fair value estimates from the Simply Wall St Community range widely, from US$67 to US$159.48 per share. With aggressive store expansion plans facing margin risks from tariffs, consider how differing outlooks may shape your expectations.

Explore 4 other fair value estimates on Five Below - why the stock might be worth less than half the current price!

Build Your Own Five Below Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Five Below research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Five Below research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Five Below's overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FIVE

Excellent balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives