- United States

- /

- Specialty Stores

- /

- NasdaqGS:FIVE

Five Below (FIVE) Valuation in Focus After Upbeat Earnings, Guidance Raise and Non-Holiday Sales Milestone

Reviewed by Simply Wall St

When a company beats earnings expectations and then raises its own guidance, investors always sit up and take notice. That is exactly what just happened with Five Below (FIVE), as it posted second-quarter results that came in above estimates and nudged its outlook for both the third quarter and full year even higher. Perhaps most intriguing, Five Below crossed a milestone by surpassing $1 billion in sales outside of its typical holiday-driven quarter. This signals that shoppers' demand for its discount goods is no longer just a seasonal trend.

This upbeat news arrives with shares having returned nearly 80% over the past year and a remarkable 53% year-to-date. While momentum is clearly building, the company has also been executing on store expansions in key markets like Baltimore and Richland, as well as delivering ongoing annual revenue and net income growth above 8%. With the consistent raise in guidance, there is real evidence of operational strength as Five Below heads into the all-important holiday shopping season.

With the stock on a hot streak and management signaling further growth, the big question is whether Five Below is undervalued right now or if the market has already priced in next year’s gains.

Most Popular Narrative: 3.7% Undervalued

The most widely followed narrative suggests Five Below is currently undervalued by 3.7%, implying modest upside relative to its calculated fair value.

Five Below's commitment to providing extreme value and trend-right products at low price points is driving broad-based transaction growth. This growth is especially notable as consumers across demographics become increasingly value-focused due to persistent economic pressures. These factors are expanding store traffic and the addressable market, supporting higher revenue and the potential for sustained comparable sales growth.

Want to know what sends Five Below’s valuation above peers and keeps analysts bullish? This story is powered by aggressive growth forecasts and surprisingly ambitious assumptions about its future market reach and profitability. Curious how these strong expectations shape the share price? Read on to see which financial leaps drive this fair value call.

Result: Fair Value of $157.11 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing tariff pressures and rising labor costs could quickly erode margins. This could make it harder for Five Below to meet growth expectations.

Find out about the key risks to this Five Below narrative.Another View: Is the Market Overlooking Something?

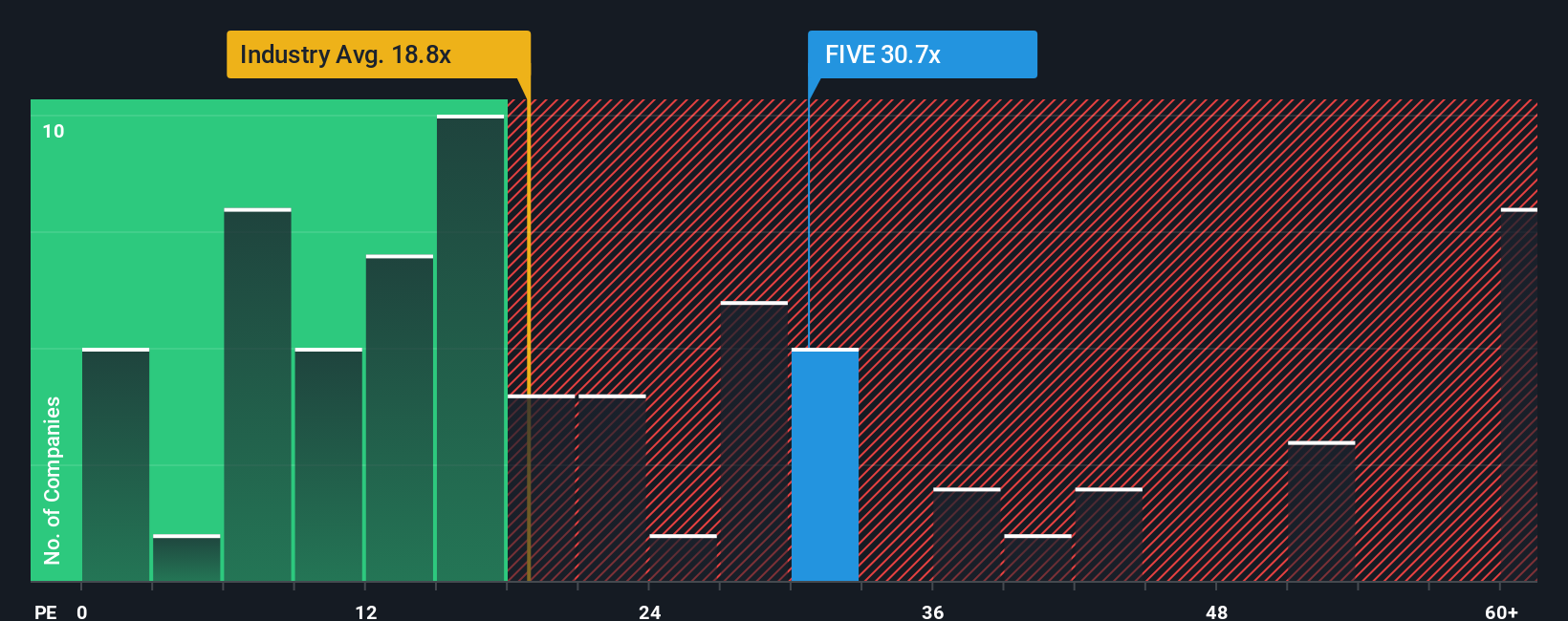

Looking at Five Below’s valuation through the lens of its price-to-earnings ratio compared to the industry puts things in a different light. This approach actually suggests the stock is overvalued. Could expectations be running ahead of reality?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Five Below to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Five Below Narrative

If you want to dig deeper or see the story from your own perspective, you can quickly build your own unique narrative and analysis. Do it your way.

A great starting point for your Five Below research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Opportunities?

Take action before your next move slips by. Outsmart the crowd by targeting new trends and under-the-radar opportunities using our handpicked investment screens below.

- Uncover stocks trading below their true value and position yourself ahead of the market using our undervalued stocks based on cash flows.

- Seize growth potential in the era of artificial intelligence by browsing firms at the forefront of innovation with AI penny stocks.

- Tap into steady income streams and build a powerful portfolio with companies offering robust yields through our dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:FIVE

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)