- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:EBAY

eBay (NasdaqGS:EBAY) Partners With Checkout.com To Enhance Global Payment Platform

Reviewed by Simply Wall St

Last week, eBay (NasdaqGS:EBAY) announced a partnership with Checkout.com to enhance its global payment platform, a move aimed at improving transaction efficiency and user experience. This announcement coincides with a 5.66% increase in eBay's stock price over the past week. Despite broader market indices showing mixed results, with the S&P 500 and Nasdaq slightly higher while the Dow experienced a notable dip due to external factors, eBay's enhancements in payment systems may have supported its positive stock performance, counterbalancing broader market declines driven by concerns around tariffs and trade restrictions.

Buy, Hold or Sell eBay? View our complete analysis and fair value estimate and you decide.

eBay's recent partnership with Checkout.com has the potential to further enhance its revenue and earnings forecasts. By improving transaction efficiency and user experience, this initiative could lead to increased customer engagement and conversion rates, thereby impacting revenue positively. Over the past five years, the company's total return, which combines share price growth and dividends, reached 86.60%, offering substantial returns to investors during that period. Despite this long-term positive performance, eBay's one-year return outpaced both the US Market and the US Multiline Retail industry with returns of 5.9% and 3.4%, respectively.

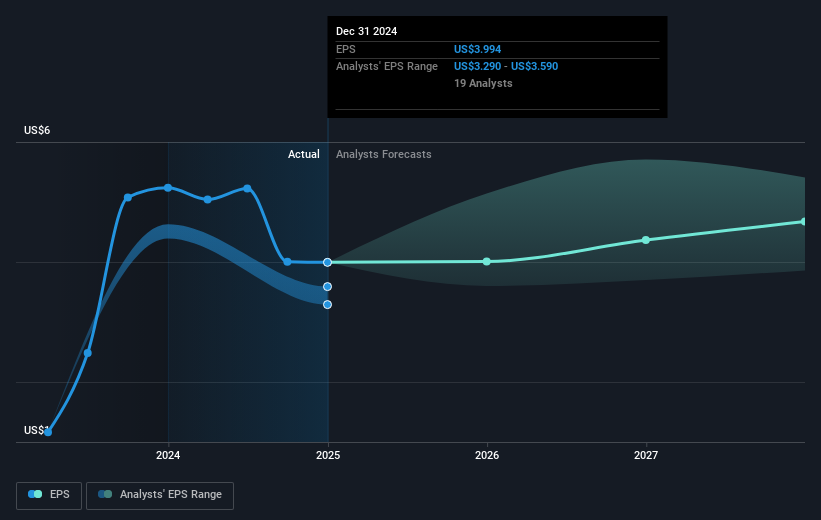

The strong recent price movement should be viewed against the analyst consensus price target of US$64.79. With eBay's current share price at US$59.52, the proximity to this target suggests that the company's valuation is generally aligned with analyst expectations. However, the news regarding eBay's collaboration with Checkout.com could alter revenue and earnings dynamics positively, potentially influencing future price targets. As analysts predict diverse earnings estimates, with a range between US$1.8 billion and US$2.4 billion by 2028, the success of new initiatives like these could be critical in determining future stock performance.

Jump into the full analysis health report here for a deeper understanding of eBay.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade eBay, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EBAY

eBay

Operates marketplace platforms that connect buyers and sellers in the United States, the United Kingdom, China, Germany, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives