- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:EBAY

eBay (EBAY): Exploring Valuation After Recent Share Price Volatility

Reviewed by Kshitija Bhandaru

eBay (EBAY) has shown some intriguing moves recently. Its share price tracked lower over the past month, but the stock delivered strong gains during the past 3 months. Investors are now taking a closer look at what lies ahead for the platform.

See our latest analysis for eBay.

eBay's story isn't just about the past month; its momentum has been steadily building, with a 90-day share price return of nearly 15% and an impressive 42% gain year-to-date. Over the long run, the company’s total shareholder return stands out even more, up 35% in the past year and more than doubling investors’ money over three years. With this kind of track record, recent market dips look more like a breather rather than a setback, and many see room for further growth as the retail platform adapts and expands.

If you're wondering where else strong momentum and growth potential are surfacing, it's worth taking a look at fast growing stocks with high insider ownership.

But with eBay’s recent gains and positive outlook, is the market leaving room for a bargain? Or have shares already priced in all the growth that lies ahead?

Most Popular Narrative: Fairly Valued

eBay's most widely followed narrative offers a fair value close to the stock's current price, suggesting the market is largely in agreement with the consensus outlook. Recent price actions leave little gap between analyst expectations and where shares are trading now.

“Enhanced mobile experiences and AI-driven tools are increasing engagement, user growth, and listings, boosting top-line revenue and market relevance. Expansion of high-value categories, value-added services, and first-party advertising is driving higher margins, take rates, and diversified high-margin revenue streams.”

Want to see what’s fueling eBay’s valuation? The secret lies in bold growth projections and big earnings assumptions that could reshape the company’s future. Curious which financial forecasts analysts are betting on? Explore the narrative to uncover the details shaping this fair value.

Result: Fair Value of $88.07 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing macroeconomic pressures and the potential volatility in key categories like trading cards could quickly challenge eBay’s current growth outlook.

Find out about the key risks to this eBay narrative.

Another View: A Different Take on Value

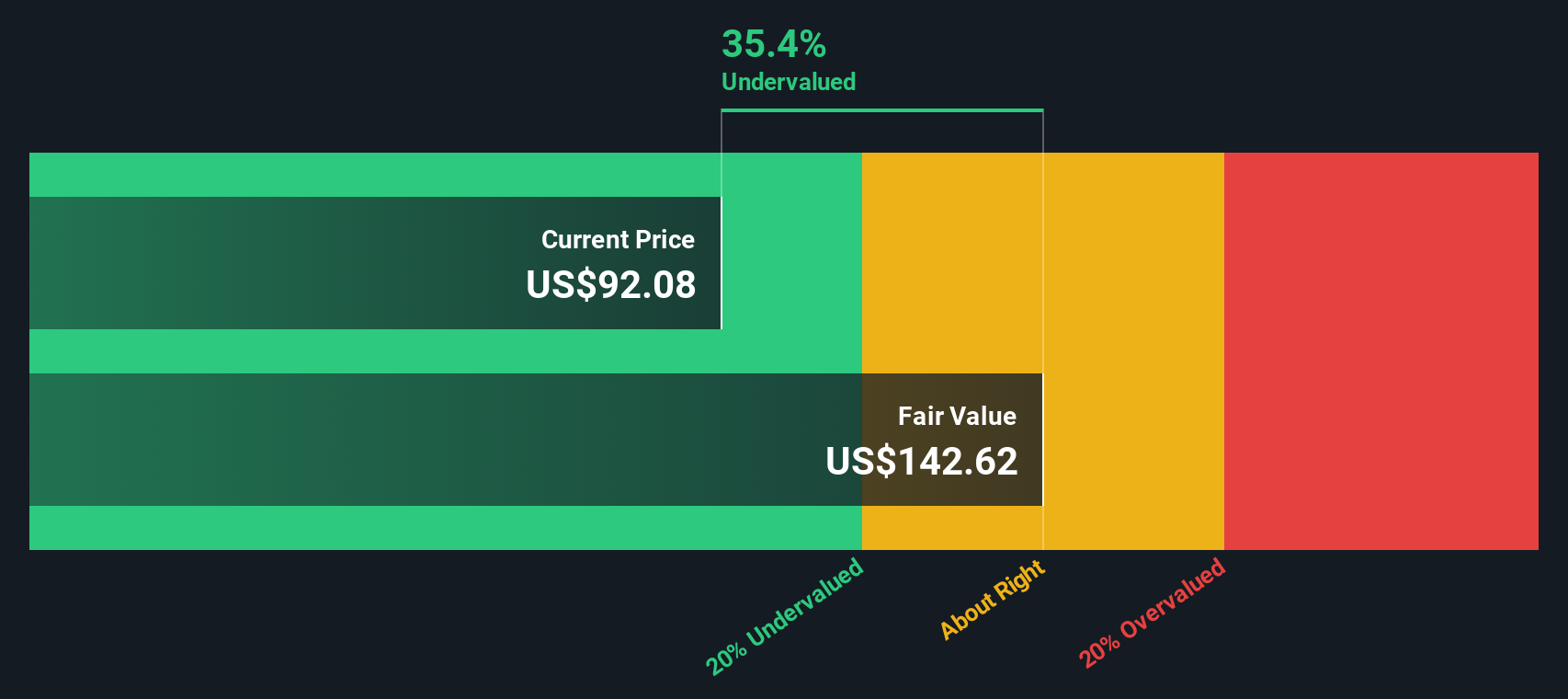

While the consensus price target suggests eBay is fairly valued, the SWS DCF model paints a more optimistic picture, estimating a fair value of $141.82, which is about 37% above the current price. This gap hints at untapped upside if eBay achieves its future cash flow potential. But does this model account for all the real-world risks?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own eBay Narrative

If you see things differently or want to dig deeper into the numbers yourself, it's quick and easy to craft your own view in just a few minutes. Do it your way

A great starting point for your eBay research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t let your next opportunity pass you by. Expand your watchlist and unlock new possibilities with these hand-picked themes you can act on today:

- Uncover potential bargains as you zero in on these 898 undervalued stocks based on cash flows, offering strong value based on robust cash-flow metrics and growth prospects others might overlook.

- Capitalize on high yields by targeting these 19 dividend stocks with yields > 3%, perfect for building steady income from companies with reliable payout histories.

- Step into a new era of innovation when you analyze these 26 quantum computing stocks, featuring companies pioneering advancements in quantum computing and next-generation technology breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EBAY

eBay

Operates marketplace platforms that connect buyers and sellers in the United States, the United Kingdom, China, Germany, and internationally.

Good value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives