- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:EBAY

Does eBay’s Innovation Push Mark a New Chapter for Its Marketplace Strategy (EBAY)?

Reviewed by Simply Wall St

- eBay recently marked its 30th anniversary with high-profile celebrations in New York City, including a Nasdaq bell ringing and the debut of the immersive '95 Shop pop-up experience showcasing nostalgic, iconic items.

- These events highlighted eBay’s focus on innovation, with advancements like AI-powered tools, expanded live shopping features, and curated partnerships underscoring its drive to enhance the marketplace for both buyers and sellers.

- We’ll explore how eBay’s emphasis on technological innovation and live shopping could influence its investment narrative moving forward.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

eBay Investment Narrative Recap

To be a shareholder in eBay, you generally need to believe that its investments in AI-driven tools, live shopping, and streamlined logistics can deliver meaningful GMV and revenue growth, particularly by expanding in focus categories and improving the platform for users globally. The launch of eBay International Shipping in Canada builds on this narrative, but is unlikely to materially change the most important near-term catalyst: sustained performance in collectibles and key verticals. The biggest risk remains a slowdown in those categories, which could limit overall revenue growth, and the recent news does not significantly alter that risk profile.

Among recent announcements, the expansion of eBay International Shipping into Canada stands out as closely related to global GMV growth potential. This new program promises to reduce friction for international sellers and buyers, supporting broader cross-border trade, a central pillar for platform growth, even as eBay faces tough year-over-year comparisons in its core focus categories and macroeconomic challenges abroad.

Yet, in contrast to these positive developments, there remains the question of what might happen if sales in collectibles, trading cards, and other focus categories start to falter...

Read the full narrative on eBay (it's free!)

eBay's outlook projects $12.3 billion in revenue and $2.3 billion in earnings by 2028. This requires 5.4% annual revenue growth and a $0.1 billion increase in earnings from the current $2.2 billion.

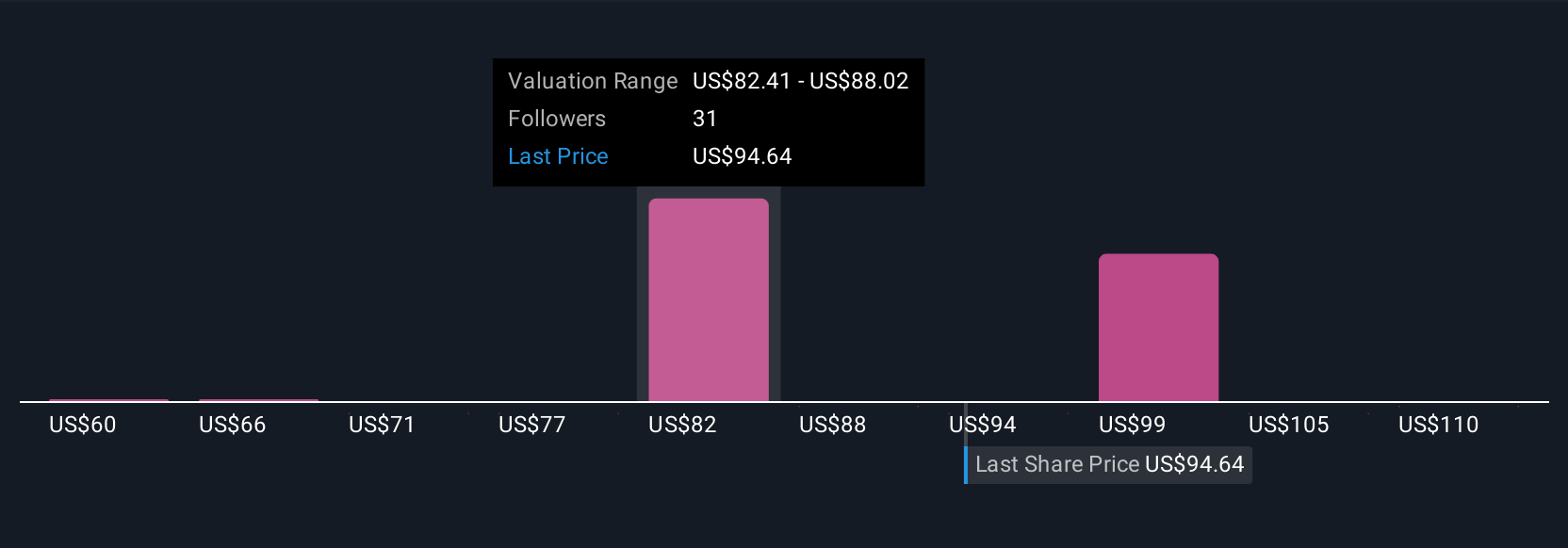

Uncover how eBay's forecasts yield a $88.07 fair value, a 5% downside to its current price.

Exploring Other Perspectives

Nine recent fair value estimates from the Simply Wall St Community range between US$60 and US$139.90 per share. With outlooks this broad, remember that revenue growth in core categories remains highly dependent on demand cycles and broader ecommerce trends, so take time to compare multiple viewpoints before forming your own outlook.

Explore 9 other fair value estimates on eBay - why the stock might be worth as much as 51% more than the current price!

Build Your Own eBay Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your eBay research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free eBay research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate eBay's overall financial health at a glance.

No Opportunity In eBay?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EBAY

eBay

Operates marketplace platforms that connect buyers and sellers in the United States, the United Kingdom, China, Germany, and internationally.

Good value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives