- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:EBAY

Did AI Tools and Authentication Initiatives Just Shift eBay's (EBAY) Investment Narrative?

Reviewed by Sasha Jovanovic

- In recent months, eBay has adopted AI-powered tools to enhance seller experiences, expanded its Authenticity Guarantee service in Germany, and implemented management changes to drive growth in advertising and core product categories.

- These actions reflect a focus on trusted transactions, technology-driven efficiency, and increasing engagement across key verticals such as jewelry, collectibles, and luxury goods.

- We'll explore how eBay's rollout of new AI-driven seller tools and category authentication initiatives could influence its investment narrative.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

eBay Investment Narrative Recap

To be a shareholder in eBay, you need to believe in the company's ability to drive sustainable growth through vertical expansion, technology investment, and strong global engagement, especially as it aims to deepen trust and streamline seller and buyer experiences. Recent news showing comparisons to TripAdvisor in analyst rankings and valuation does not materially affect eBay's immediate catalysts or core risk profile, though it does raise attention to competitive pressure and the need for continued market relevance.

Among eBay's latest moves, the launch of AI-powered seller tools and expansion of the Authenticity Guarantee in Germany are the most relevant to short-term catalysts. These initiatives target high-value categories like jewelry and collectibles, aiming to increase engagement and build trust with buyers, both central to sustaining growth in eBay’s focus verticals and supporting overall revenue acceleration.

In contrast, investors should be aware that increased seller pushback and competitive threats to eBay’s advertising and core categories could...

Read the full narrative on eBay (it's free!)

eBay's outlook anticipates $12.3 billion in revenue and $2.3 billion in earnings by 2028, with analysts forecasting annual revenue growth of 5.4%. This reflects a $0.1 billion increase in earnings from the current $2.2 billion.

Uncover how eBay's forecasts yield a $89.00 fair value, in line with its current price.

Exploring Other Perspectives

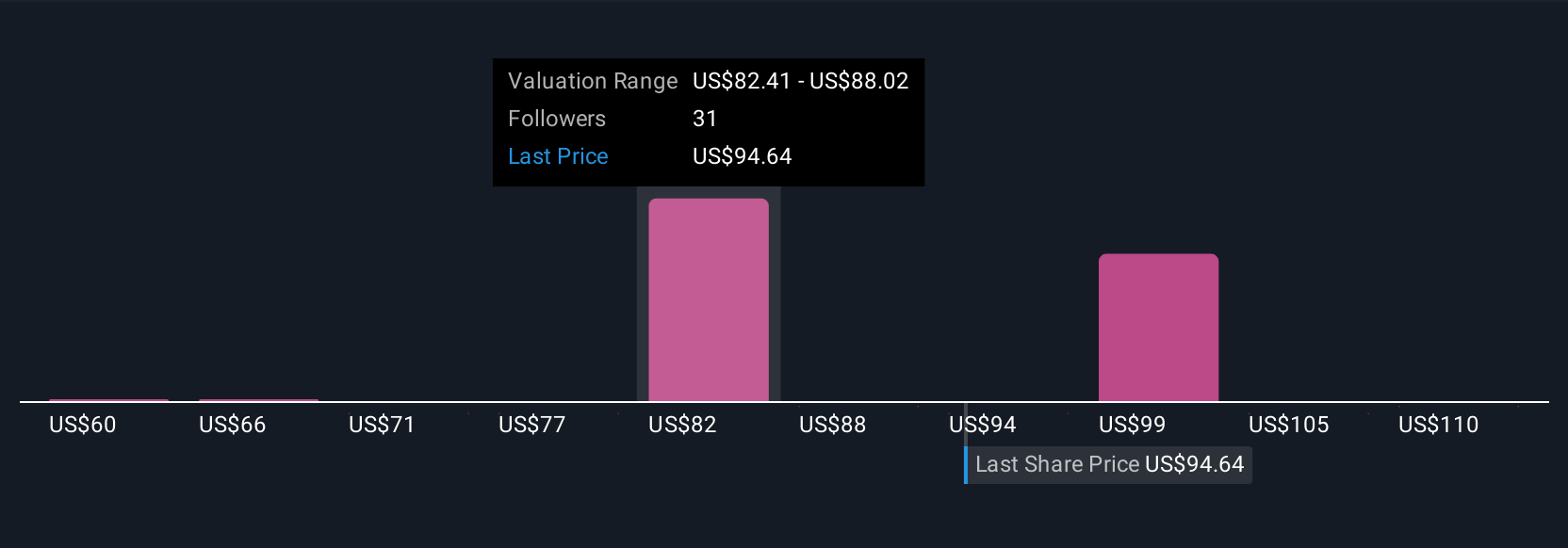

Nine different Simply Wall St Community fair value estimates for eBay range from US$60 to US$141.89, with several seeing the stock as deeply undervalued. While this diversity reflects broad optimism, the company's continued reliance on a handful of focus categories highlights the importance of monitoring eBay's revenue consistency over time. Check out how other retail investors are interpreting these signals and see if their outlook matches yours.

Explore 9 other fair value estimates on eBay - why the stock might be worth as much as 59% more than the current price!

Build Your Own eBay Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your eBay research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free eBay research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate eBay's overall financial health at a glance.

Seeking Other Investments?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EBAY

eBay

Operates marketplace platforms that connect buyers and sellers in the United States, the United Kingdom, China, Germany, and internationally.

Good value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives