- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:BZUN

Baozun Inc.'s (NASDAQ:BZUN) 27% Dip In Price Shows Sentiment Is Matching Revenues

The Baozun Inc. (NASDAQ:BZUN) share price has softened a substantial 27% over the previous 30 days, handing back much of the gains the stock has made lately. The recent drop has obliterated the annual return, with the share price now down 8.3% over that longer period.

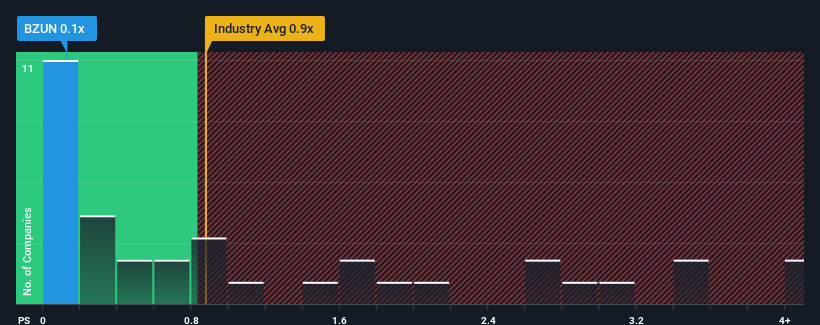

Following the heavy fall in price, Baozun may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.1x, since almost half of all companies in the Multiline Retail industry in the United States have P/S ratios greater than 0.9x and even P/S higher than 3x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Baozun

How Baozun Has Been Performing

Baozun could be doing better as it's been growing revenue less than most other companies lately. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Baozun will help you uncover what's on the horizon.How Is Baozun's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Baozun's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 5.6% last year. However, this wasn't enough as the latest three year period has seen an unpleasant 5.5% overall drop in revenue. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next three years should generate growth of 5.0% per year as estimated by the eight analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 12% per annum, which is noticeably more attractive.

With this in consideration, its clear as to why Baozun's P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Key Takeaway

Baozun's P/S has taken a dip along with its share price. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Baozun maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

It is also worth noting that we have found 1 warning sign for Baozun that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Baozun might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:BZUN

Baozun

Through its subsidiaries, engages in the provision of end-to-end e-commerce solutions in the People's Republic of China.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026