- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:AMZN

Should Amazon.com’s (AMZN) Expanded Enterprise Partnerships Signal a Shift in Its Cloud AI Strategy?

Reviewed by Simply Wall St

- In August 2025, Amazon's clients and partners announced several collaborations, including LPL Financial expanding its use of Amazon Business nationwide, new strategic agreements with DoiT and West Loop Strategy to enhance AWS generative AI capabilities, and Procore Technologies bringing its construction platform to the AWS Marketplace.

- These partnerships underscore Amazon's growing impact in the enterprise technology and procurement sectors, reflecting its expanding reach in cloud AI services and digital infrastructure for business clients.

- We'll explore how Amazon Business's nationwide rollout with LPL Financial and enhanced AI partnerships could influence the company's forward investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Amazon.com Investment Narrative Recap

To hold Amazon.com stock, you need to believe that the company’s leadership in cloud technology and business procurement gives it the tools to outpace rivals, especially as enterprises accelerate digital transformation and AI adoption. The latest series of partnerships, including LPL Financial’s nationwide rollout of Amazon Business and deeper generative AI collaborations in AWS, reinforce Amazon’s relevance to enterprise clients, but these moves have limited impact on near-term catalysts or the company’s main risks, which remain concentrated in AWS competition and capital intensity.

Among recent announcements, LPL Financial’s adoption of Amazon Business stands out, highlighting Amazon’s expanding influence in the B2B procurement market. This expansion is interesting in the context of short-term catalysts, as it offers incremental growth avenues beyond core retail and cloud, even if it does not move the needle materially for AWS’s earnings power or the competitive risks in AI and infrastructure currently shaping sentiment.

Yet, in contrast to Amazon’s big recent wins, investors should remain aware of the margin risks tied to AWS’s high capital intensity if cloud growth, pricing, or technological edge falter...

Read the full narrative on Amazon.com (it's free!)

Amazon.com's narrative projects $905.8 billion in revenue and $112.0 billion in earnings by 2028. This requires 10.6% yearly revenue growth and a $41.4 billion earnings increase from the current $70.6 billion.

Uncover how Amazon.com's forecasts yield a $262.21 fair value, a 16% upside to its current price.

Exploring Other Perspectives

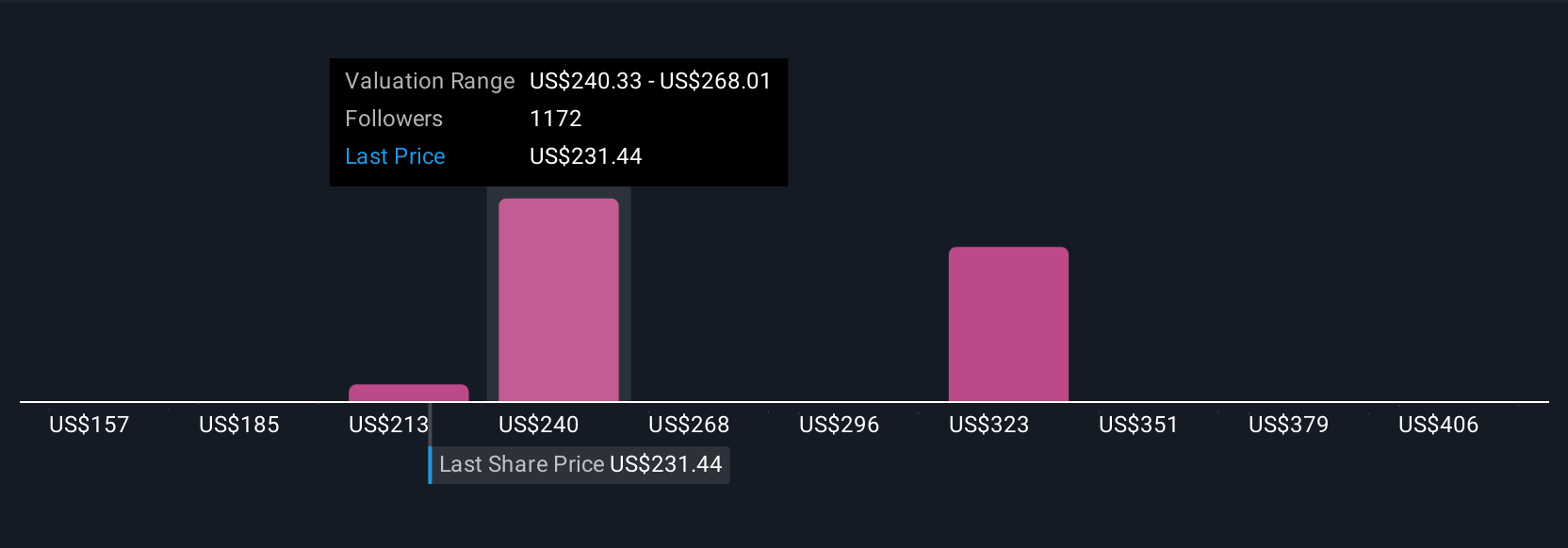

Community fair value estimates for Amazon.com span from US$166 to US$434.13, with 164 submissions from the Simply Wall St Community. Many focus on AWS’s potential to capture global IT spend shifts, highlighting just how differently market participants size up the company’s short and long-term opportunities and risks.

Explore 164 other fair value estimates on Amazon.com - why the stock might be worth as much as 93% more than the current price!

Build Your Own Amazon.com Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Amazon.com research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Amazon.com research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Amazon.com's overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMZN

Amazon.com

Engages in the retail sale of consumer products, advertising, and subscriptions service through online and physical stores in North America and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives