- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:AMZN

Amazon.com (NasdaqGS:AMZN) Teams With Demandbase To Launch AI Agents On AWS Platform

Reviewed by Simply Wall St

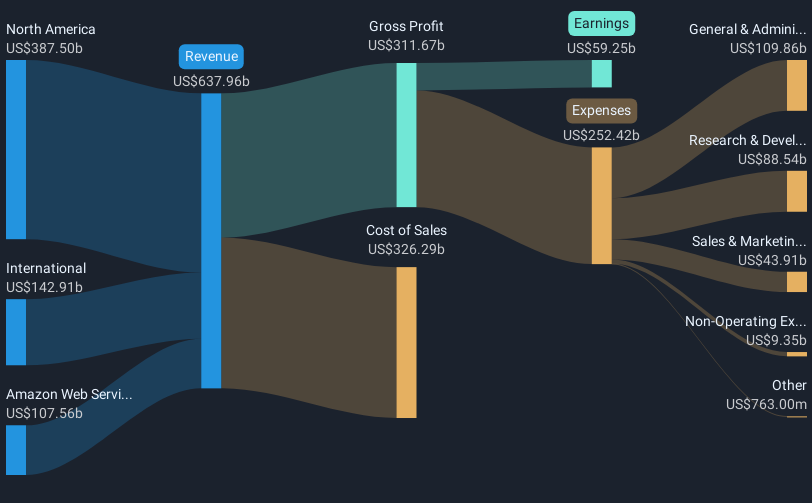

In May 2025, Demandbase launched Agentbase in collaboration with Amazon Web Services, aiming to enhance campaign performance through AI. Meanwhile, Amazon.com (NasdaqGS:AMZN) saw its stock rise by 14% over the past month. Significantly contributing to this growth were strong quarterly earnings, with a notable 8% revenue increase and improved financial guidance. Additionally, Amazon announced future infrastructure expansions, likely supporting longer-term growth prospects. While major tech indices like the Nasdaq rose due to renewed trade optimism and easing inflation, Amazon's initiatives and financial performance bolstered investor confidence amid broad market tailwinds.

Buy, Hold or Sell Amazon.com? View our complete analysis and fair value estimate and you decide.

The partnership between Demandbase and Amazon Web Services to launch Agentbase signifies a step forward in Amazon's drive to integrate artificial intelligence across its operations. This initiative could enhance the efficiency of digital marketing campaigns, thereby supporting Amazon's advertising services—a critical growth area identified in the company's strategic narrative. With Amazon's ongoing expansion in AWS and the introduction of new AI services, such advancements could lead to further revenue growth, adding depth to analysts' current forecasts.

Over the past three years, Amazon's total shareholder return, including share price and dividends, increased by 83.21%. This extended growth period showcases the company's ability to generate substantial returns for its investors. In the last year alone, Amazon's stock performance outpaced the general US Market return of 11.5%, albeit underperforming compared to its own historical growth rates.

The recent 14% monthly share price increase and the long-term returns are reflected in the analyst consensus price target, which is currently 22.7% higher than the existing share price of US$185.01. This suggests that there is still optimism about Amazon's future earnings potential, as evidenced by the robust revenue and earnings forecasts. Current price movement towards the consensus target reflects investor confidence in Amazon's execution of its future strategies, especially in enhancing operational efficiencies.

Explore Amazon.com's analyst forecasts in our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMZN

Amazon.com

Engages in the retail sale of consumer products, advertising, and subscriptions service through online and physical stores in North America and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)