- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:AMZN

Amazon.com (AMZN) Partners With Rockbot And Xylem To Advance Digital Signage And Water Solutions

Reviewed by Simply Wall St

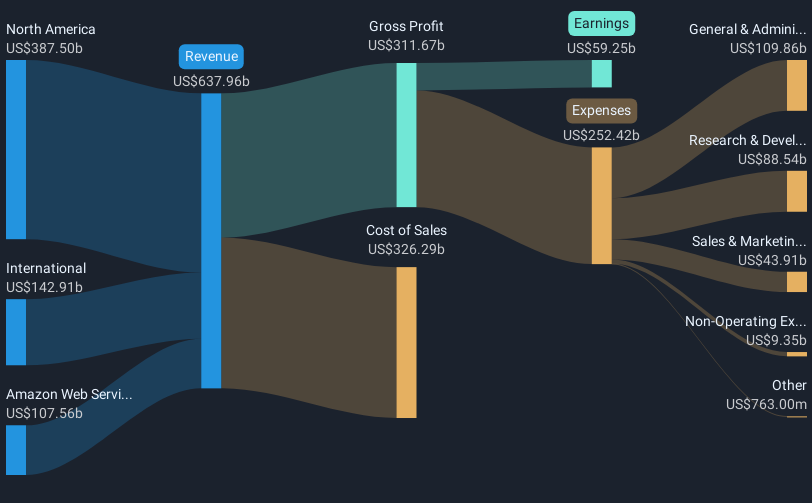

Amazon.com (AMZN) has recently announced a pivotal collaboration with Rockbot to offer digital signage solutions via the Amazon Signage Stick, and a significant partnership with Xylem for water management in Mexico City and Monterrey. Over the last quarter, Amazon's stock price moved 8%, largely reflecting the positive reception of these initiatives alongside a robust financial performance, with Q2 2025 revenue rising to $167.7 billion. This period saw the Nasdaq reach record highs, aligning Amazon's upward movement with broader tech sector gains despite mixed results in major U.S. indices. These progressive business developments have potentially supported Amazon's overall market positioning.

We've spotted 1 possible red flag for Amazon.com you should be aware of.

Find companies with promising cash flow potential yet trading below their fair value.

The collaboration with Rockbot and partnership with Xylem could bolster Amazon's market presence by enhancing its offering with digital signage solutions and expanding its influence in water management technology. These ventures may contribute to Amazon's narrative of growth through cloud and AI innovations, potentially driving revenue and enhancing operational efficiency. Such initiatives align with Amazon's aim for high-margin growth areas, supporting its long-term strategy.

Over a three-year span, Amazon's shares achieved a total return of 82.10%, reflecting significant shareholder value growth. However, over the past year, Amazon's performance lagged behind the US Multiline Retail industry, which saw returns of 29.7%. This discrepancy highlights the volatile nature of the stock, despite its strong long-term gains.

The partnership announcements could impact revenue forecasts by boosting AWS's appeal and accelerating cloud and AI service adoption. These developments might further influence earnings projections positively, as they align with expected high-margin growth sectors. With a current share price of US$229.95, close to consensus analyst price targets of US$263.18, there is still a reasonable margin for potential upside, contingent on realizing projected revenue and earnings targets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMZN

Amazon.com

Engages in the retail sale of consumer products, advertising, and subscriptions service through online and physical stores in North America and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026