- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:AMZN

Amazon.com (AMZN) Partners to Expand Nuclear Reactor Tech and Launches New AI Guide

Reviewed by Simply Wall St

Amazon.com (AMZN) has seen a recent price move of 11% over the last quarter, coinciding with several notable developments. The company announced a key partnership aimed at advancing nuclear technology, involving significant collaborations that signal a future strategic focus on sustainable energy sources. Concurrently, Amazon's launch of a practical AI guidebook and positive financial projections, including a reported Q2 revenue growth to $168 billion, provide additional context to its market performance. The broader market, influenced by potential interest rate cuts and macroeconomic shifts, showed similar upward trends, suggesting these events likely contributed to bolstering Amazon's share performance.

The recent developments around Amazon's embrace of nuclear technology and AI signal pivotal advancements in its strategic goals, with potential long-term effects on both revenue and earnings. These initiatives could bolster Amazon's growth trajectory by enhancing its technological prowess and sustainability efforts, positioning it further along the forefront of innovation. Over the last three years, Amazon's shares have delivered a total return of 75.62%, reflecting strong investor confidence despite recent competitive, regulatory, and market challenges. This performance is notable when juxtaposed with the broader US market's return of 15.5% over the past year.

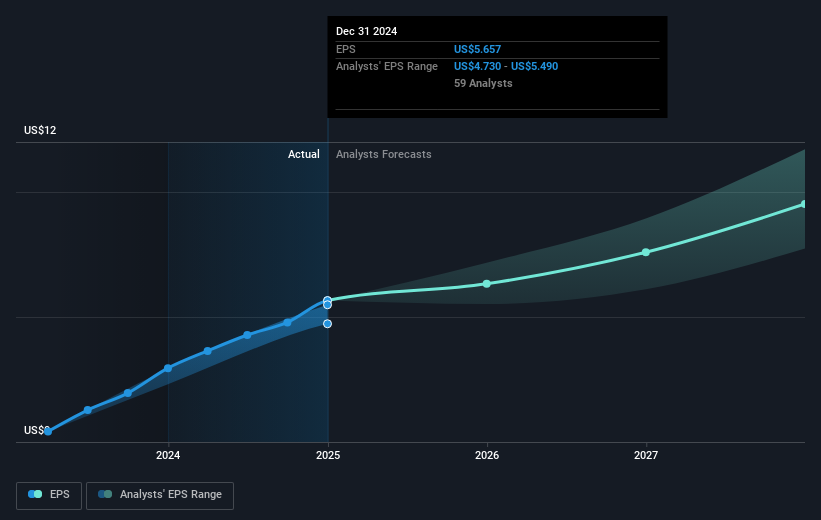

Amazon's share price, currently at $227.94, indicates a proximate match to analysts' forecasted value amid broader market influences. The consensus price target of $262.34 suggests a potential 13.1% improvement, and the company's forward-looking revenue and earnings projections appear optimistic against this backdrop. Notably, recent advancements could potentially drive sustained revenue growth, estimated at 9.5% annually, with earnings forecast at a 15.3% annual increase over the coming years. However, this optimism is tempered by ongoing industry pressures that may impact margins and profitability, as outlined in the analysis. The overall integration of innovative solutions seems poised to be an essential revenue and earnings growth driver moving forward.

Examine Amazon.com's earnings growth report to understand how analysts expect it to perform.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMZN

Amazon.com

Engages in the retail sale of consumer products, advertising, and subscriptions service through online and physical stores in North America and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026