- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:AMZN

Amazon.com (AMZN) Expands Music Discovery With Auddia's Free AI-Powered Ad-Free Streaming

Reviewed by Simply Wall St

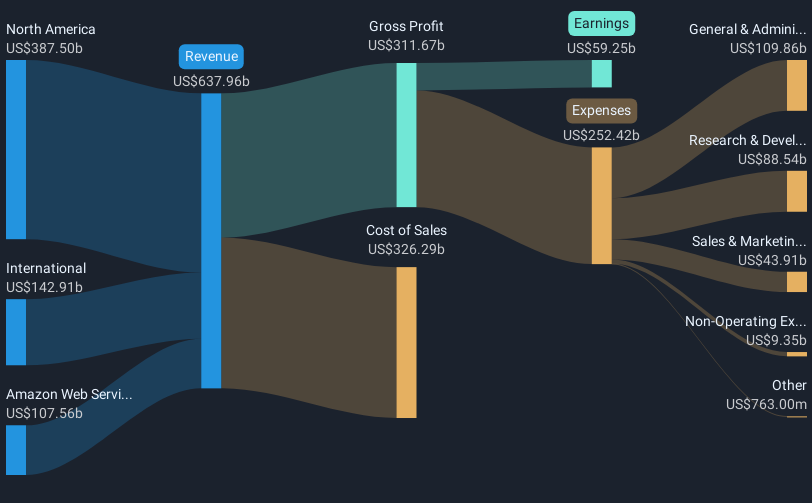

Amazon.com (AMZN) experienced a price increase of 10% over the last quarter. This period included several significant developments: the company reported robust quarterly earnings with revenue and net income records, while guidance for the next quarter anticipated continued sales growth. Meanwhile, Amazon encountered legal challenges, including a class-action lawsuit on market dominance. Amazon's expansion efforts, such as substantial investments in data infrastructure in Taiwan and North Carolina, underscored growth intentions amid fluctuating market conditions. While broader market trends reflected downturns in the technology sector, Amazon's expansion strategies and strong earnings added weight to its positive share price movement.

We've spotted 1 possible red flag for Amazon.com you should be aware of.

The recent 10% share price increase for Amazon (AMZN) aligns with the company's strong quarterly earnings and ambitious expansion initiatives, which have set a positive tone for the future. Despite legal challenges related to market dominance, the robust guidance and investments in infrastructure in Taiwan and North Carolina signal Amazon's commitment to growth. These factors could potentially enhance Amazon's revenue and earnings forecasts, as continued expansion in cloud services and AI adoption could bolster both its top line and margins in the coming years. However, competitive pressures and regulatory scrutiny remain as potential obstacles that could affect profitability.

Over a longer-term period of three years, Amazon's total shareholder return, inclusive of share price and dividends, was 67.27%. This performance stands out when viewed against the previous year's returns, where Amazon surpassed the US Market by delivering higher returns than the 14.4% market average. For context, its current share performance should be considered in light of a price target of US$262.21, with a current share price of US$223.81 representing a discount. This implies potential upside, but whether it aligns with analyst expectations depends on the company's ability to navigate ongoing challenges and sustain its growth trajectory.

Unlock comprehensive insights into our analysis of Amazon.com stock in this financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMZN

Amazon.com

Engages in the retail sale of consumer products, advertising, and subscriptions service through online and physical stores in North America and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)