- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:AMZN

Amazon (AMZN): Evaluating Valuation After Strong Earnings and New AI Partnerships Strengthen Growth Narrative

Reviewed by Simply Wall St

If you’ve been tracking Amazon.com (AMZN) lately, chances are the company’s latest quarterly earnings and its push into generative AI have caught your eye. The tech giant just unveiled stronger-than-expected growth in retail and advertising, with AWS steady enough to quell some market jitters about cloud momentum. Amazon’s work with West Loop Strategy to bring generative AI and business intelligence modernization to its cloud customers is just one of several high-profile partnerships showcasing the company’s ongoing innovation streak. For investors, these steps may feel like Amazon is leaning into its strengths after years of scaling every corner of e-commerce and enterprise tech.

What’s especially interesting is how the market is responding to this blend of solid execution and new initiatives. The stock is up 30% over the past year, outpacing much of the sector and reflecting mounting optimism about the company’s future. While shares have cooled a bit over the past month, the long-term momentum remains strong, driven in part by recurring headlines about new ventures in healthcare, streaming, and AI-powered analytics. The company continues to ramp up in areas where growth appears promising and competitive threats are rising.

After a year of strong returns and major moves in AI, the big question remains: is there still unrealized upside in Amazon, or are investors simply paying up for tomorrow’s growth today?

Most Popular Narrative: 2.8% Overvalued

According to the narrative by MichaelP, Amazon is currently trading just above its estimated fair value, with aggressive reinvestment expected to limit near-term free cash flows despite impressive profit generation in core businesses.

This can be explained by how the $46bn operating cash flow that was generated for 2022 was lowered to a -$16bn free cash flow loss because the “Purchase of Property, Plant and Equipment (PPE)” equaled $58bn. The $46bn of operating cash flows illustrates how profitable the businesses are, while the $58bn investment in PPE highlights the scale of reinvestment in growth (including software and web development, capital and finance leases, and build-to-suit leases on property and equipment).

What truly sets this valuation apart? The narrative relies on bold forecasts for Amazon’s revenue growth, operating margins, and cash flow. This creates a valuation based on significant capital deployment and expectations of long-term dominance. Want to uncover the numbers and projections that support this ambitious price target? Dive into the full narrative to see exactly what assumptions drive this provocative fair value call.

Result: Fair Value of $222.55 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, regulatory crackdowns or a prolonged recession could both meaningfully dampen Amazon’s growth story and challenge even the most bullish forecasts.

Find out about the key risks to this Amazon.com narrative.Another View: Discounted Cash Flow Perspective

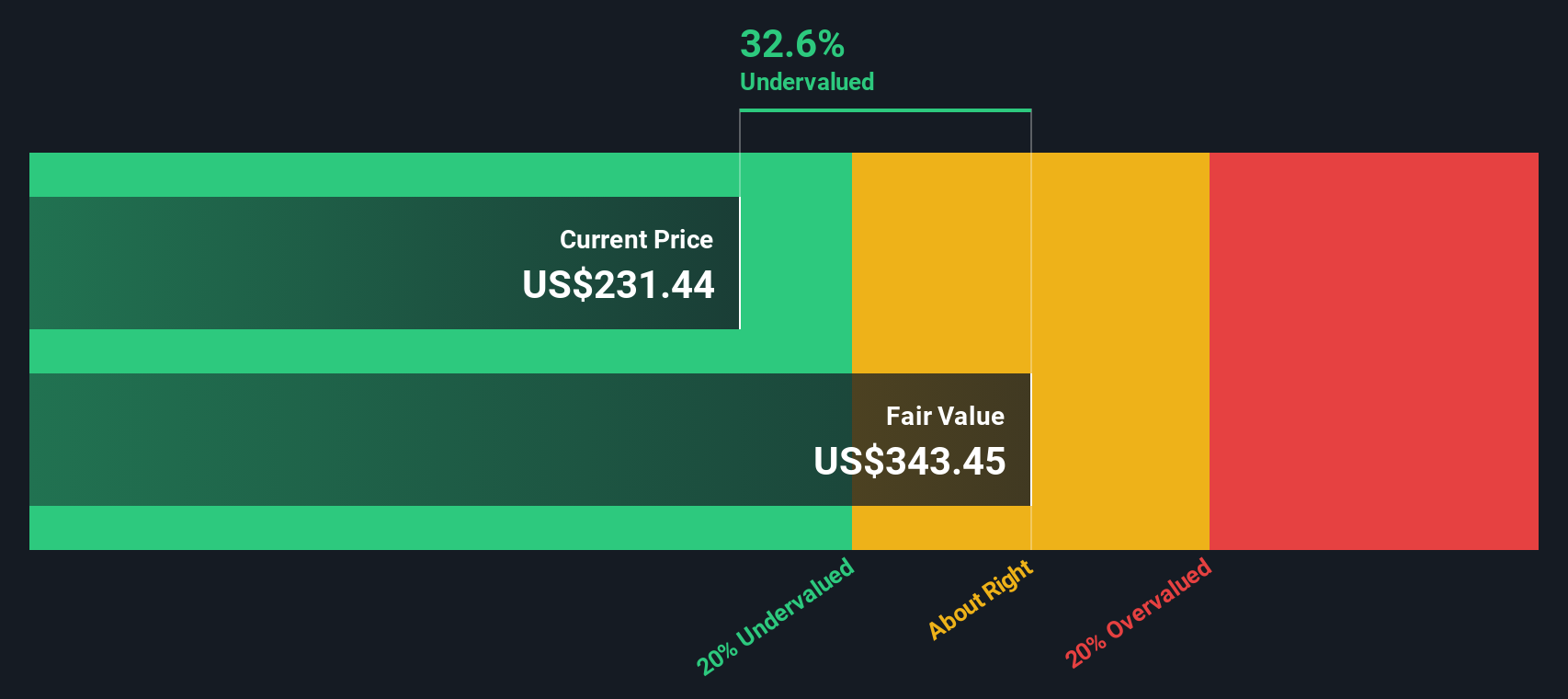

Looking at Amazon through the lens of our SWS DCF model offers a very different perspective. This approach considers future cash flows and suggests the shares might actually be undervalued. This contrasts with the narrative’s concerns about reinvestment suppressing profits. Which version of value is most important when evaluating the stock's upside?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Amazon.com Narrative

If you see things differently or want to draw your own conclusions from Amazon’s numbers, you can shape your own view in just a few minutes. So why not do it your way?

A great starting point for your Amazon.com research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Why stop at Amazon when there could be unique opportunities waiting elsewhere? With the Simply Wall Street Screener, you can quickly uncover stocks matching your goals, whether you care about value, innovation, or income. Skip the guesswork and put yourself in a position to seize tomorrow’s winners before everyone else notices.

- Tap into long-term income by checking out dividend stocks with yields > 3%, which features companies with strong yields and stability for your portfolio.

- Get ahead of market shifts with AI penny stocks, where high-potential tech stocks are capitalizing on rapid advances in artificial intelligence.

- Begin your search for exceptional bargains in undervalued stocks based on cash flows and find stocks trading below their intrinsic value based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMZN

Amazon.com

Engages in the retail sale of consumer products, advertising, and subscriptions service through online and physical stores in North America and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives