- United States

- /

- REITS

- /

- NYSE:WPC

If EPS Growth Is Important To You, W. P. Carey (NYSE:WPC) Presents An Opportunity

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

In contrast to all that, many investors prefer to focus on companies like W. P. Carey (NYSE:WPC), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for W. P. Carey

How Fast Is W. P. Carey Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. That means EPS growth is considered a real positive by most successful long-term investors. Impressively, W. P. Carey has grown EPS by 25% per year, compound, in the last three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. It's noted that W. P. Carey's revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. While W. P. Carey did well to grow revenue over the last year, EBIT margins were dampened at the same time. So it seems the future may hold further growth, especially if EBIT margins can remain steady.

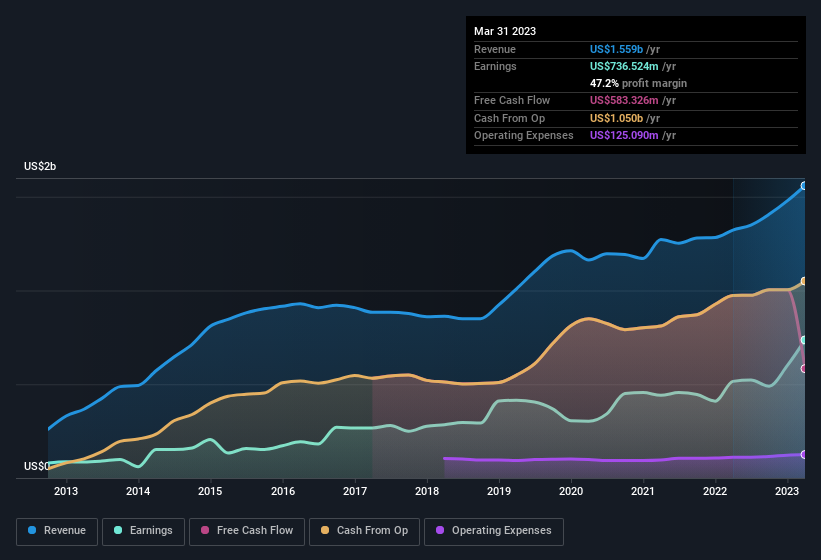

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for W. P. Carey's future profits.

Are W. P. Carey Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Our analysis into W. P. Carey has shown that insiders have sold US$17k worth of shares over the last 12 months. This falls short of the share acquisition by Independent Director Mark Alexander, who has acquired US$72k worth of shares, at an average price of US$72.48. Overall, that is something good to take away.

Along with the insider buying, another encouraging sign for W. P. Carey is that insiders, as a group, have a considerable shareholding. Notably, they have an enviable stake in the company, worth US$161m. Investors will appreciate management having this amount of skin in the game as it shows their commitment to the company's future.

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. That's because W. P. Carey's CEO, Jason Fox, is paid at a relatively modest level when compared to other CEOs for companies of this size. Our analysis has discovered that the median total compensation for the CEOs of companies like W. P. Carey, with market caps over US$8.0b, is about US$12m.

W. P. Carey offered total compensation worth US$9.4m to its CEO in the year to December 2022. That is actually below the median for CEO's of similarly sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Is W. P. Carey Worth Keeping An Eye On?

If you believe that share price follows earnings per share you should definitely be delving further into W. P. Carey's strong EPS growth. Moreover, the management and board of the company hold a significant stake in the company, with one party adding to this total. Astute investors will want to keep this stock on watch. Before you take the next step you should know about the 5 warning signs for W. P. Carey (2 shouldn't be ignored!) that we have uncovered.

Keen growth investors love to see insider buying. Thankfully, W. P. Carey isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if W. P. Carey might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:WPC

W. P. Carey

W. P. Carey ranks among the largest net lease REITs with a well-diversified portfolio of high-quality, operationally critical commercial real estate, which includes 1,430 net lease properties covering approximately 172 million square feet and a portfolio of 78 self-storage operating properties as of September 30, 2024.

Average dividend payer and fair value.