- United States

- /

- Retail REITs

- /

- NYSE:SPG

Simon Property Group (SPG) Partners With Humana To Launch Health Initiative Across 21 Centers

Reviewed by Simply Wall St

Simon Property Group (SPG) recently announced a partnership with Humana to launch the Humana Walking Club at 21 of its centers. This initiative aims to foster community engagement and promote health and well-being, particularly among older adults. The company's stock experienced a 6% price increase over the past month. During this period, market conditions showed mixed signals with a temporary tempering of rate-cut expectations due to inflation data. While the overall market gained ground, Simon's executive changes and positive earnings guidance, alongside its new health initiative, may have supported the upward price movement by adding interest in its stock.

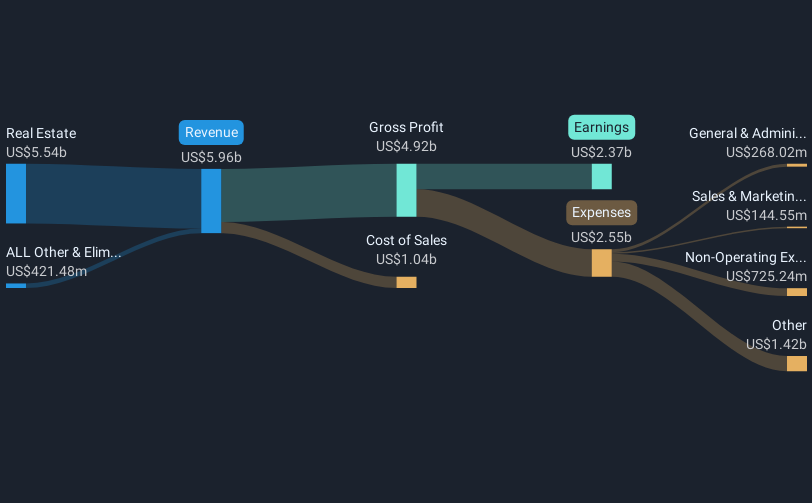

The launch of the Humana Walking Club by Simon Property Group could strengthen its community engagement, potentially boosting foot traffic to its centers. This aligns with the company's strategy of transforming properties into experience-focused environments, which could contribute to stable rent growth and diversified income streams over time. Simon's long-term performance has been robust, with total returns including dividends reaching 256.01% over the past five years. However, in the past year, Simon's performance was mixed, outperforming the US Retail REITs industry, which saw a 1.2% decline, but underperforming the broader US market's 19.6% gain.

Recent executive changes and positive earnings guidance, along with this new community initiative, may support revenue and earnings forecasts by enhancing the appeal and value of Simon's retail spaces. Nevertheless, the consensus analyst price target for Simon Property Group is US$182.25, which is slightly below the current price of US$172.59, suggesting analysts view the company as fairly valued. The potential impact of this initiative appears to align with the company's strategy but may already be reflected in current valuations. The expectation of stable growth amid resilient performance indicates continued investor interest in the stock, despite some market challenges.

Our valuation report here indicates Simon Property Group may be undervalued.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SPG

Simon Property Group

Simon Property Group, Inc. (NYSE:SPG) is a self-administered and self-managed real estate investment trust (“REIT”).

Undervalued established dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)