- United States

- /

- Retail REITs

- /

- NYSE:SKT

Tanger (SKT): What Recent Gains Signal About Its True Value

Reviewed by Simply Wall St

Tanger (SKT) has quietly caught the attention of investors as its share price has enjoyed a steady upward glide in recent months. While there hasn't been a single headline-grabbing event behind this move, the stock's rise still sparks questions about whether underlying fundamentals or subtle shifts in the retail landscape are helping fuel this performance. For anyone trying to figure out their next play, the current setup offers an intriguing window—one that is worth a deeper look, especially for those interested in the real estate sector.

This year, Tanger has posted a 17% return, adding to an impressive multi-year run. Built on a backdrop of rising annual revenue and net income growth, the company’s recent momentum has outpaced many in the retail REIT space. The absence of a major catalyst hints that investors are perhaps growing more comfortable with the risks, or are starting to see new opportunities emerging at the margins.

So after this stretch of growth, is Tanger trading at an attractive entry point, or is the market already pricing in the company’s next phase of expansion?

Most Popular Narrative: 2.2% Undervalued

According to the most widely followed narrative, Tanger trades just below its estimated fair value, suggesting there could be a modest upside for investors who align with these forward-looking assumptions.

The continued migration of population and densification in Sunbelt and key U.S. regions, alongside shifts turning tourist-heavy areas into permanent residential communities, is increasing local demand and foot traffic at Tanger's centers. This is supporting sustained rent growth, higher occupancy, and ultimately driving revenue and NOI expansion. Consumer preference for value-oriented retail, particularly among younger and newly converted outlet shoppers, is fueling ongoing traffic and sales growth at Tanger's properties. This creates stability and upside for both revenues and net operating income as shoppers trade down or seek discounts in any macro environment.

Curious how this valuation stacks up? The narrative hinges on some ambitious projections for revenue and margin expansion, alongside a future profit multiple that rivals the sector’s best. Wondering how bold these assumptions really are? Explore the details to see the exact growth forecasts and profit levers anchoring this fair value target.

Result: Fair Value of $35.55 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, a sharp rise in e-commerce adoption or key tenant closures could challenge Tanger’s growth outlook and push the company’s valuation off course.

Find out about the key risks to this Tanger narrative.Another View: Relative Industry Valuation

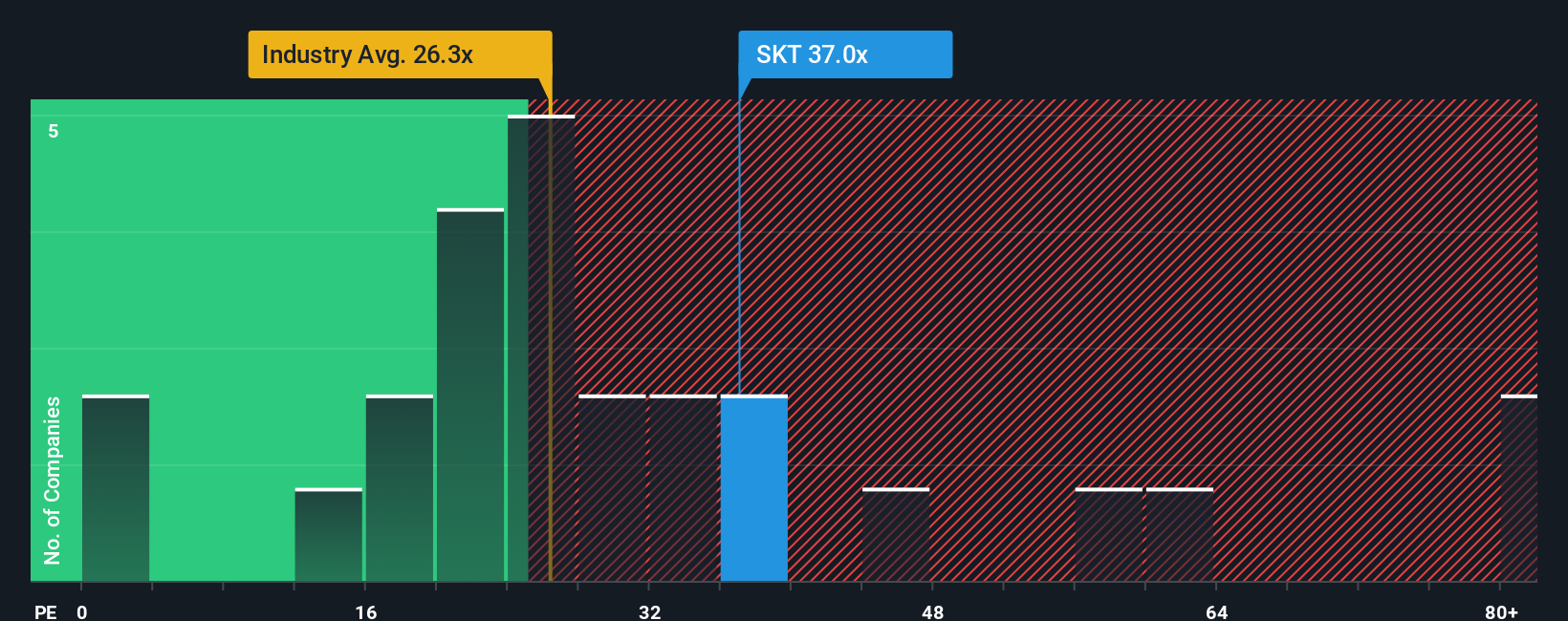

Looking through a different lens, compared to companies across the US Retail REITs sector, Tanger actually appears pricey. This approach challenges the optimism of prior analysis. Which method better reflects what lies ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Tanger to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Tanger Narrative

If you think there’s a different angle to Tanger’s story or want to test your own data-driven case, you can easily dig in and craft your own view. Do it your way with Do it your way.

A great starting point for your Tanger research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Want an edge in your portfolio? Use the Simply Wall Street Screener to filter winning stocks in seconds and snag opportunities others might overlook.

- Spot undervalued gems primed for growth by tracking companies screened as undervalued stocks based on cash flows while they are still flying under the radar.

- Target steady income and stability by checking out leading companies known for dividend stocks with yields > 3% with yields that outperform the market.

- Jump on the tech wave with innovative AI penny stocks powering breakthroughs in artificial intelligence and transforming entire sectors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Tanger might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:SKT

Tanger

Tanger Inc. (NYSE: SKT) is a leading owner and operator of outlet and open-air retail shopping destinations, with over 44 years of expertise in the retail and outlet shopping industries.

Average dividend payer with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)