- United States

- /

- Machinery

- /

- NYSE:HY

Undiscovered Gems With Strong Fundamentals In November 2024

Reviewed by Simply Wall St

Over the last 7 days, the United States market has remained flat, yet over the past 12 months, it has risen by an impressive 31%, with earnings forecasted to grow by 15% annually. In this context of growth and stability, identifying stocks with strong fundamentals can be key to uncovering potential opportunities that may not yet be widely recognized.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 169.49% | 12.30% | 1.92% | ★★★★★★ |

| Franklin Financial Services | 222.36% | 5.55% | -1.86% | ★★★★★★ |

| Parker Drilling | 46.25% | -0.33% | 53.04% | ★★★★★★ |

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| AirJoule Technologies | NA | nan | 127.67% | ★★★★★☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Heritage Insurance Holdings (NYSE:HRTG)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Heritage Insurance Holdings, Inc. operates through its subsidiaries to offer personal and commercial residential insurance products, with a market cap of approximately $354.57 million.

Operations: Heritage Insurance Holdings generates revenue primarily from its property and casualty insurance segment, amounting to $793.69 million. The company's market cap is approximately $354.57 million.

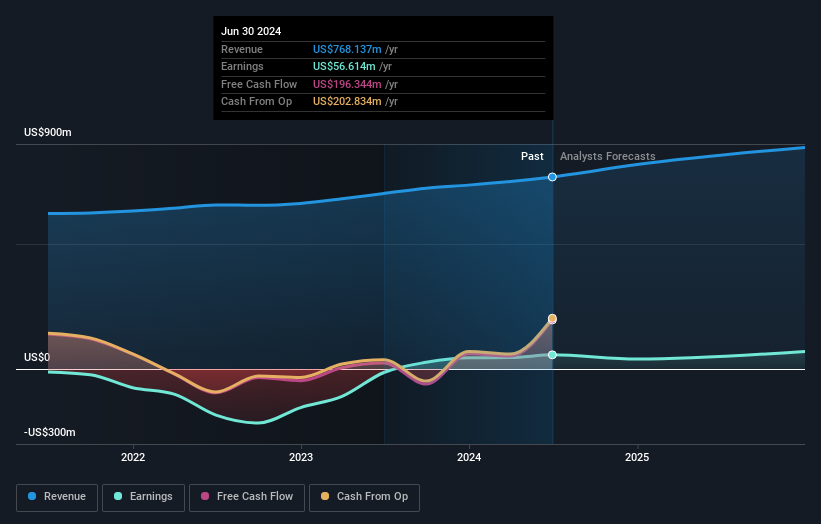

Heritage Insurance Holdings is navigating the insurance landscape with strategic underwriting and geographic focus, aiming to boost profitability. Recent earnings reports show a turnaround, with Q3 revenue at US$211.85 million compared to US$186.3 million last year and net income swinging from a loss of US$7.42 million to a gain of US$8.15 million. The company’s price-to-earnings ratio stands at 5x, below the market average of 18.9x, indicating potential value for investors despite recent shareholder dilution and increased debt-to-equity ratio from 29% to 42% over five years.

Hyster-Yale (NYSE:HY)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Hyster-Yale, Inc. operates globally through its subsidiaries by designing, engineering, manufacturing, selling, and servicing lift trucks and related products, with a market cap of approximately $948.24 million.

Operations: Hyster-Yale generates revenue primarily from its Lift Truck Business across the Americas ($3.13 billion), EMEA ($753.30 million), and JAPIC ($189.70 million) regions, along with contributions from Bolzoni at $383.50 million and Nuvera at $1.20 million.

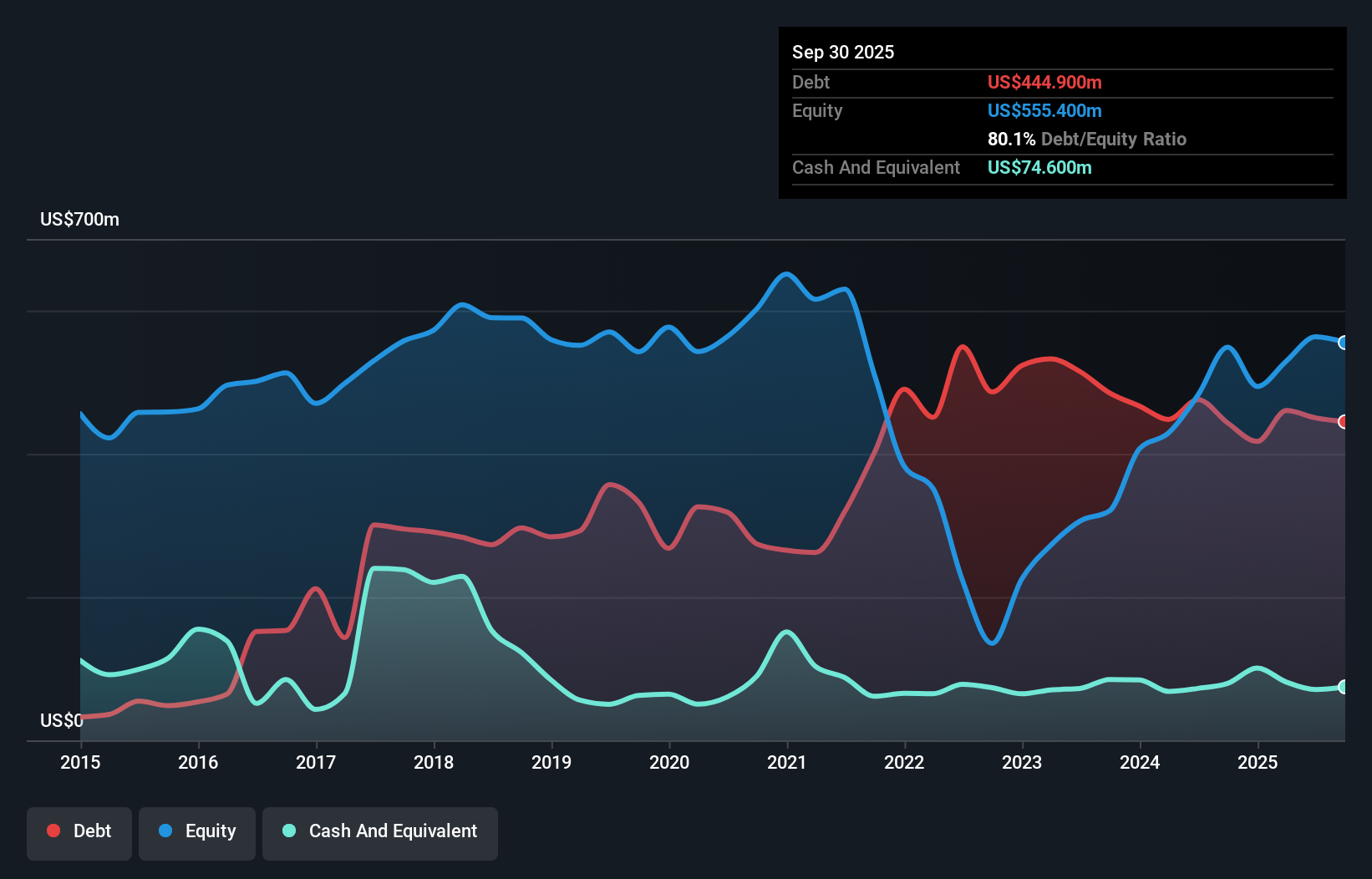

Hyster-Yale, a notable player in the machinery sector, is experiencing mixed fortunes. The company has seen a robust 45% earnings growth over the past year, outpacing the industry average of 11.5%. Despite this, its debt to equity ratio has risen from 61% to 81% over five years, indicating financial leverage concerns. Trading at nearly 66% below estimated fair value suggests potential undervaluation. Recent announcements include a $50 million share repurchase program and board expansion with Ann O’Hara's appointment. With net income for nine months rising to US$132 million from US$100 million last year, investors remain cautious about future earnings declines projected at an average of 7.8%.

SITE Centers (NYSE:SITC)

Simply Wall St Value Rating: ★★★★★☆

Overview: SITE Centers is a company that owns and manages open-air shopping centers in suburban areas with high household incomes, with a market cap of $845.17 million.

Operations: SITE Centers generates revenue primarily through the leasing of retail spaces in its open-air shopping centers. The company's cost structure includes expenses related to property management and maintenance. The net profit margin has shown variability, reflecting changes in operational efficiency and market conditions.

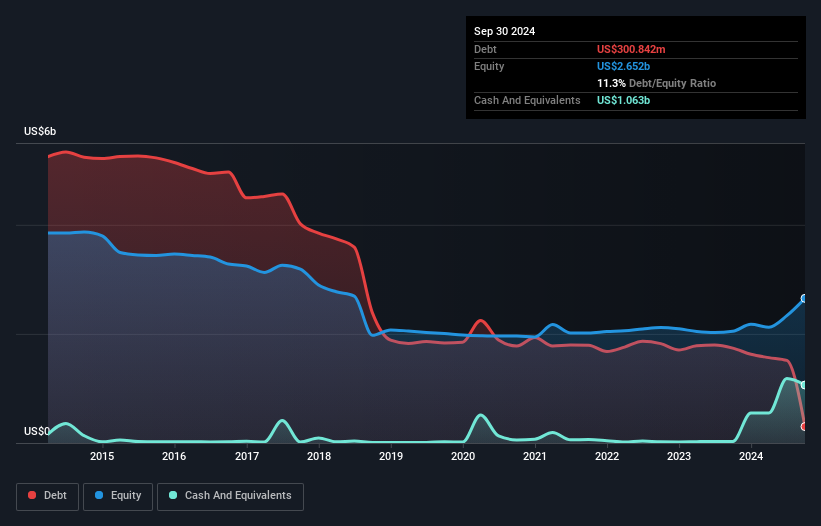

SITE Centers, a small player in the retail REIT sector, has seen its earnings skyrocket by 740.8% over the past year, significantly outpacing the industry's 2.1%. This surge was influenced by a substantial one-off gain of US$677 million. The company's debt to equity ratio impressively dropped from 91.3% to 11.3% over five years, indicating strong financial management and more cash than total debt enhances its stability further. However, interest payments are not well covered with EBIT at just 2.4 times coverage, suggesting potential concerns in managing financial obligations despite positive free cash flow and trading below estimated fair value by about 5.9%.

Next Steps

- Take a closer look at our US Undiscovered Gems With Strong Fundamentals list of 229 companies by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hyster-Yale might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HY

Hyster-Yale

Through its subsidiaries, designs, engineers, manufactures, sells, and services a line of lift trucks, attachments, and aftermarket parts worldwide.

Undervalued with solid track record and pays a dividend.