- United States

- /

- Retail REITs

- /

- NYSE:O

The Bull Case For Realty Income (O) Could Change Following 661st Consecutive Monthly Dividend Announcement – Learn Why

Reviewed by Simply Wall St

- Realty Income Corporation announced on July 8, 2025, that it declared its 661st consecutive monthly common stock dividend of $0.269 per share, payable August 15 to shareholders of record on August 1.

- This remarkably consistent monthly dividend record highlights Realty Income’s emphasis on stability and appeals to investors seeking reliable income streams.

- Given this renewed dividend commitment, we'll consider how Realty Income’s steady payout bolsters confidence in its investment narrative going forward.

Realty Income Investment Narrative Recap

To be a Realty Income shareholder, you need to believe in the company's ability to deliver steady, reliable income through monthly dividends, backed by a diverse portfolio of commercial properties and disciplined management. The recent announcement of a 661st consecutive monthly dividend underscores this income reliability. However, while the renewed dividend demonstrates consistency, it does not materially shift the primary short-term catalyst, expansion into European markets, or the key risk, which remains the impact of macroeconomic and geopolitical uncertainties in Europe. Of the recent developments, Realty Income’s June €1.3 billion bond issuance stands out for its relevance to this dividend event. Raising new capital through European notes adds financing flexibility to support acquisitions and operational upkeep, helping maintain dividend stability even as interest rates and credit markets remain unpredictable. Yet, investors should be aware that, despite the reassuring dividend track record, the effect of changing financing conditions on Realty Income’s cost of capital may become increasingly important for those relying on...

Read the full narrative on Realty Income (it's free!)

Realty Income's narrative projects $5.9 billion in revenue and $1.6 billion in earnings by 2028. This requires 2.8% yearly revenue growth and a $632 million earnings increase from current earnings of $968 million.

Uncover how Realty Income's forecasts yield a $61.54 fair value, a 5% upside to its current price.

Exploring Other Perspectives

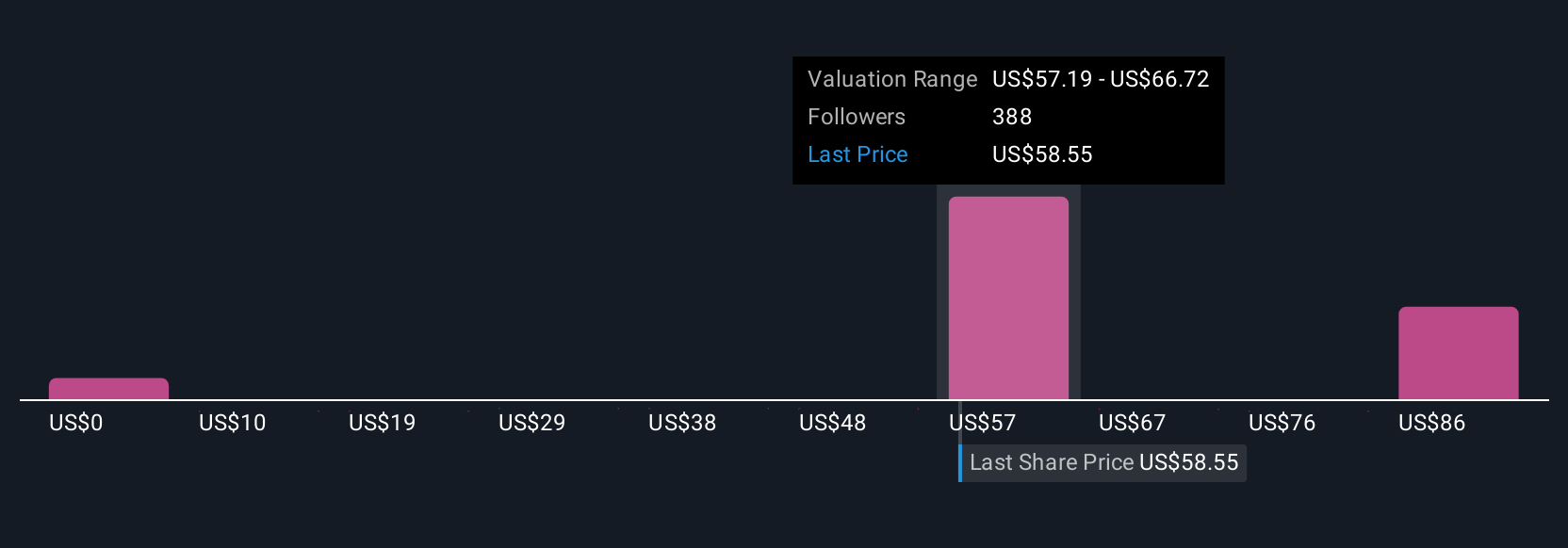

Across 30 community opinions on Simply Wall St, Realty Income’s fair value estimates span from US$10.82 to US$108.24, highlighting broad differences. While many expect dependable income, evolving credit conditions could shape outcomes for both yield and growth.

Build Your Own Realty Income Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Realty Income research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Realty Income research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Realty Income's overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:O

Realty Income

Realty Income (NYSE: O), an S&P 500 company, is real estate partner to the world's leading companies.

6 star dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives