- United States

- /

- Retail REITs

- /

- NYSE:O

Realty Income (O): Is There Untapped Value in Today’s Valuation?

Reviewed by Kshitija Bhandaru

See our latest analysis for Realty Income.

While Realty Income’s share price has put in a modest advance in recent weeks, the bigger story is its steady pace over the past year. The 12-month total shareholder return sits just above 1%, signaling that while momentum has yet to fully build, the stock has shown some resilience during a period of subdued sector sentiment.

If you’re tracking trends in real estate, it might be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

The question now is whether Realty Income’s shares represent untapped value at these levels, or if the market has already adjusted for upcoming growth. Could this be a buying opportunity, or is everything priced in?

Most Popular Narrative: 1.9% Undervalued

According to andre_santos, Realty Income’s recent share price is just a touch below the estimated fair value, hinting at a slight market discount. The current last close of $60.08 is compared to a narrative-derived fair value of $61.26, sparking debate over future income prospects.

Introduction: Realty Income (O) is a Real Estate Investment Trust (REIT) known for its consistent monthly dividends. It has increased its dividend for 30 consecutive years, reflecting a stable and predictable income stream. Given its predictable payout structure and dividend growth in line with inflation and the risk-free rate, the most suitable valuation methods are:

Want to know the secret behind this nearly fair-priced call? This narrative hinges on long-term dividend reliability, subtle growth adjustments, and some bold weighting choices. Curious what numbers tip the scale to “HOLD” rather than “BUY”? Uncover the exact assumptions that drive this precise valuation.

Result: Fair Value of $61.26 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifts in interest rates or weaker rental income growth could challenge Realty Income’s outlook and affect its perceived value in the months ahead.

Find out about the key risks to this Realty Income narrative.

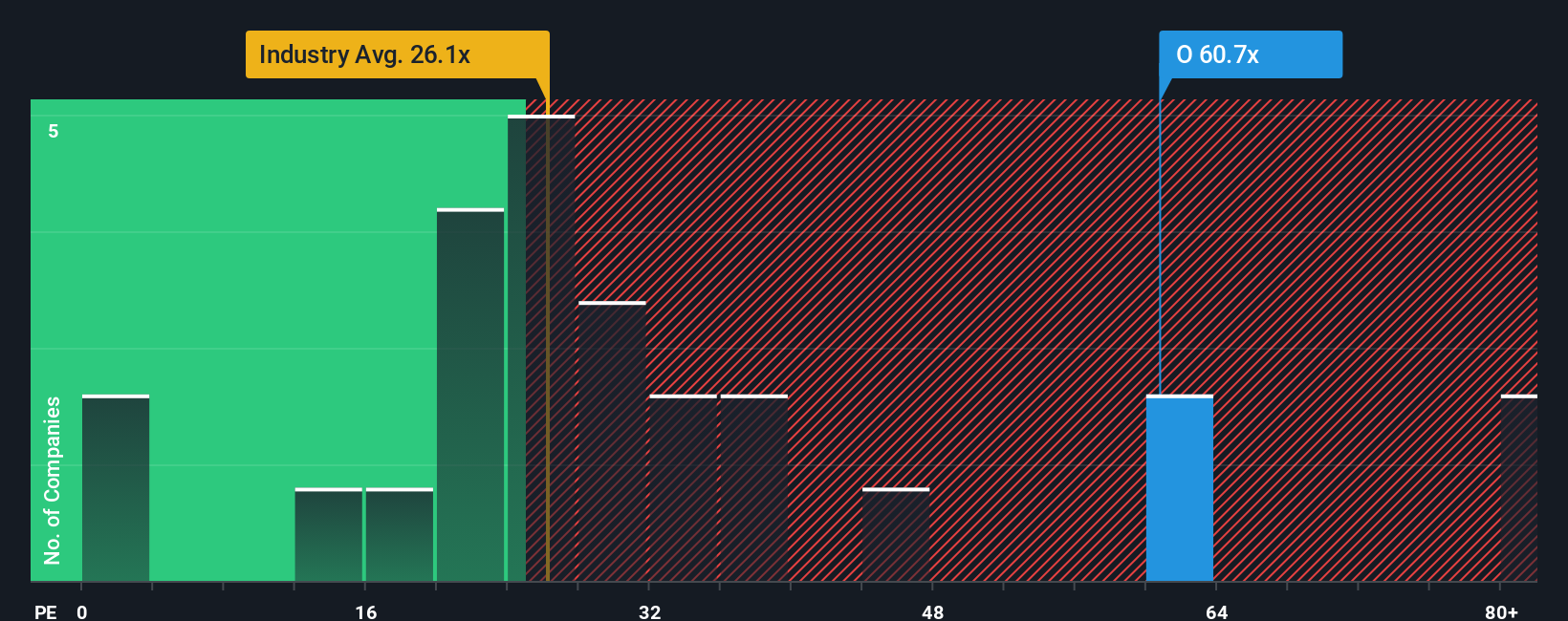

Another View: Multiples Tell a Different Story

Looking beyond dividend-based valuation, Realty Income appears pricey on a price-to-earnings basis. The company trades at 60.5 times earnings, outpacing both major peers (32.9x) and the US Retail REITs industry average (25.9x). Even compared to the fair ratio of 38.5x, the gap is significant. This suggests that the optimistic market pricing leaves less room for error. Is the safety of its dividend enough to justify paying this premium, or could investors be taking on more risk than they realize?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Realty Income Narrative

If you have a different perspective or want to dig into the numbers firsthand, you can assemble your own Realty Income story in just a few minutes, Do it your way

A great starting point for your Realty Income research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never limit their options, and the market has countless stories beyond Realty Income. If you want to be in on tomorrow’s leaders, check out these opportunities:

- Tap into the relentless growth of artificial intelligence companies by following these 24 AI penny stocks, which are poised to transform entire industries with innovation and rapid adoption.

- Seize the chance for reliable returns with these 19 dividend stocks with yields > 3%, offering attractive yields and the stability that income-focused shareholders appreciate.

- Capture potential upside with these 909 undervalued stocks based on cash flows, giving you a shot at picking up future winners before they rally, as the market may have overlooked them.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:O

Realty Income

Realty Income (NYSE: O), an S&P 500 company, is real estate partner to the world's leading companies.

6 star dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives