- United States

- /

- Retail REITs

- /

- NYSE:O

Kim Hourihan's Board Appointment Could Be a Game Changer for Realty Income (O)

Reviewed by Sasha Jovanovic

- On October 14, 2025, Realty Income Corporation announced the appointment of Kim Hourihan to its Board of Directors, increasing the board to eleven members and adding her extensive global real estate investment expertise.

- This appointment is being highlighted as a milestone for corporate governance, positioning Realty Income to further strengthen its leadership amid ambitious global expansion and diversification initiatives.

- We’ll examine how Kim Hourihan’s leadership background could shape Realty Income’s global diversification and long-term growth strategy.

Find companies with promising cash flow potential yet trading below their fair value.

Realty Income Investment Narrative Recap

Shareholders in Realty Income need to believe in the company’s ability to capture stable, long-term rental income by expanding its globally diversified, necessity-based property portfolio while managing risks from international exposure and shifting retail trends. The recent appointment of Kim Hourihan to the Board brings recognized global investment expertise but does not materially impact the most important short-term catalyst, Realty Income’s potential to drive earnings through accretive acquisitions, or the biggest current risk, which remains concentrated exposure to European market fluctuations.

Among recent news, the declaration of Realty Income’s 664th consecutive monthly dividend at US$0.2695 per share stands out. This dividend consistency signals the company’s ongoing commitment to income-focused investors, a factor increasingly relevant as Realty Income seeks to manage risks tied to foreign currency and international acquisitions while pursuing global growth.

In contrast, investors should be aware that growing European investment concentration introduces additional risks, particularly around currency volatility and regulatory shifts...

Read the full narrative on Realty Income (it's free!)

Realty Income's outlook anticipates $6.2 billion in revenue and $1.6 billion in earnings by 2028. This outcome assumes an annual revenue growth rate of 4.1% and an earnings increase of $691.9 million from the current earnings of $908.1 million.

Uncover how Realty Income's forecasts yield a $62.79 fair value, a 7% upside to its current price.

Exploring Other Perspectives

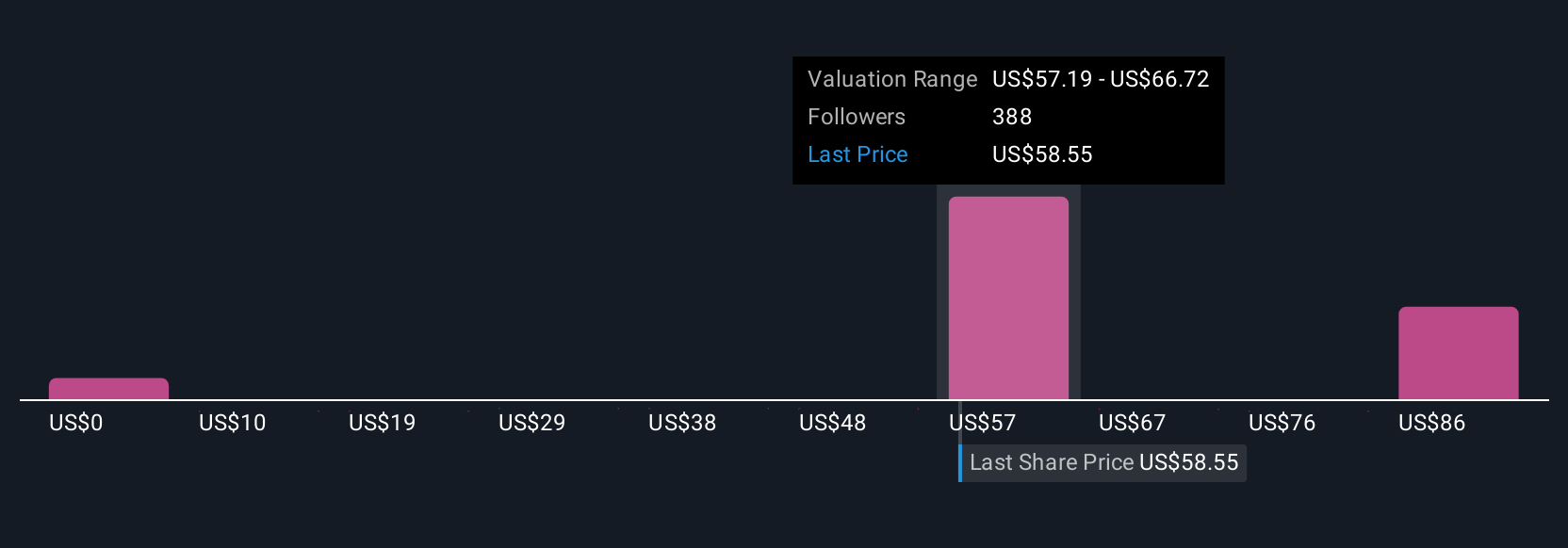

Nineteen members of the Simply Wall St Community estimate Realty Income’s fair value from US$50 to US$93.80 per share. With an increasing portion of acquisitions in Europe, the potential for earnings volatility remains a key point for you to consider among these many viewpoints.

Explore 19 other fair value estimates on Realty Income - why the stock might be worth 15% less than the current price!

Build Your Own Realty Income Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Realty Income research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Realty Income research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Realty Income's overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:O

Realty Income

Realty Income (NYSE: O), an S&P 500 company, is real estate partner to the world's leading companies.

6 star dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives