- United States

- /

- Specialized REITs

- /

- NYSE:MRP

Discover 3 Stocks Priced Below Estimated Value

Reviewed by Simply Wall St

As the U.S. stock market navigates a period of volatility with major indices like the Dow Jones and S&P 500 experiencing fluctuations ahead of a critical Federal Reserve decision on interest rates, investors are keenly watching for opportunities amidst these shifts. In this environment, identifying stocks that are priced below their estimated value can offer potential advantages, as they may present opportunities for growth when market conditions stabilize or improve.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Super Group (SGHC) (SGHC) | $11.23 | $21.55 | 47.9% |

| Perfect (PERF) | $1.79 | $3.41 | 47.6% |

| Pattern Group (PTRN) | $13.31 | $25.44 | 47.7% |

| Palomar Holdings (PLMR) | $116.42 | $224.09 | 48% |

| MoneyHero (MNY) | $1.26 | $2.40 | 47.5% |

| Investar Holding (ISTR) | $26.03 | $51.21 | 49.2% |

| DexCom (DXCM) | $65.49 | $127.10 | 48.5% |

| Chagee Holdings (CHA) | $14.58 | $28.55 | 48.9% |

| BioLife Solutions (BLFS) | $25.46 | $49.97 | 49.1% |

| Beacon Financial (BBT) | $25.16 | $48.39 | 48% |

Underneath we present a selection of stocks filtered out by our screen.

SharpLink Gaming (SBET)

Overview: SharpLink Gaming, Inc. focuses on developing a treasury strategy centered on Ether, with a market cap of $2.11 billion.

Operations: The company generates revenue primarily through its Affiliate Marketing Services segment, which accounts for $2.80 million.

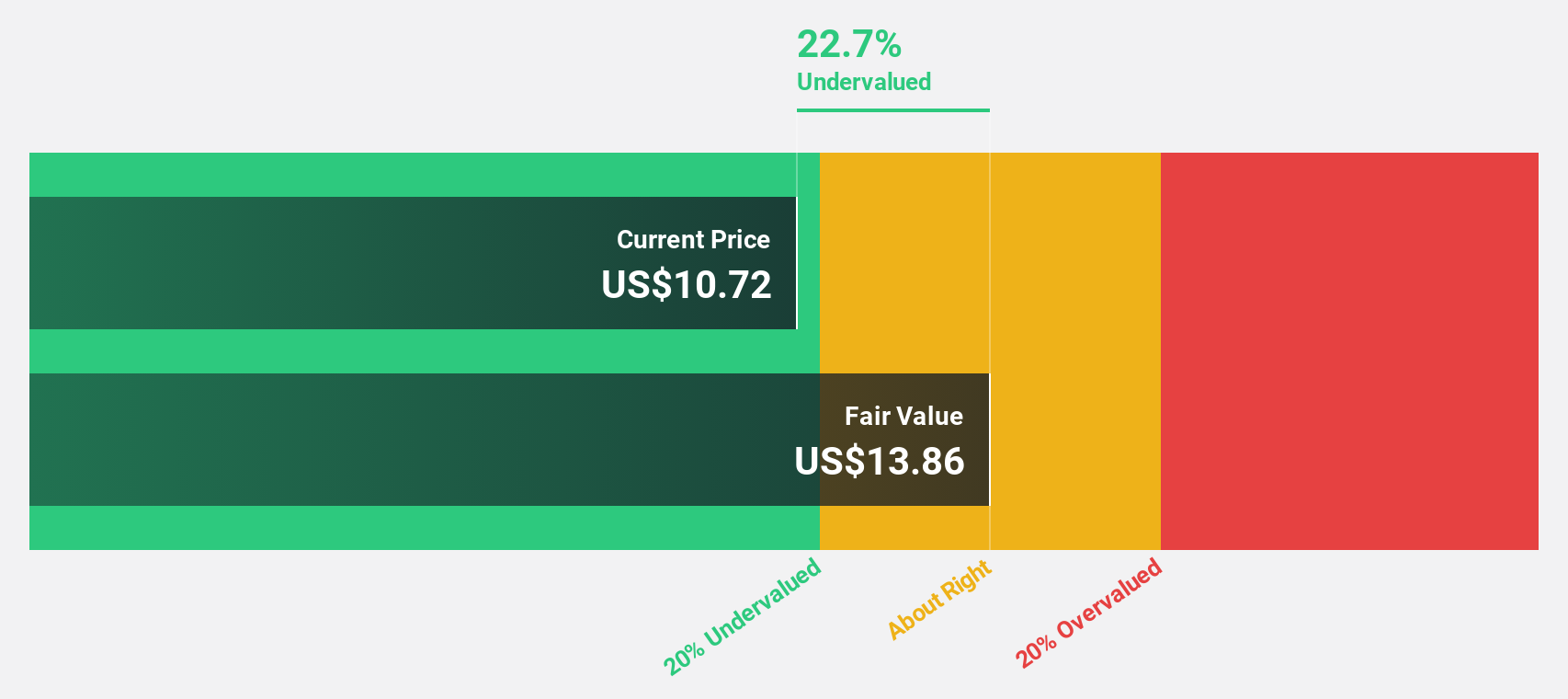

Estimated Discount To Fair Value: 22.7%

SharpLink Gaming's recent earnings report shows a significant improvement in net income, reaching US$104.27 million compared to a loss last year. The stock is trading at US$10.72, which is 22.7% below its estimated fair value of US$13.86, indicating it may be undervalued based on cash flows despite past shareholder dilution. Revenue growth is forecasted at 97.1% annually, outpacing the market significantly and suggesting potential profitability within three years.

- Our comprehensive growth report raises the possibility that SharpLink Gaming is poised for substantial financial growth.

- Take a closer look at SharpLink Gaming's balance sheet health here in our report.

Warrior Met Coal (HCC)

Overview: Warrior Met Coal, Inc. produces and exports non-thermal steelmaking coal for metal manufacturers in Europe, South America, and Asia, with a market cap of approximately $4.29 billion.

Operations: The company generates its revenue primarily from the mining segment, which accounted for $1.20 billion.

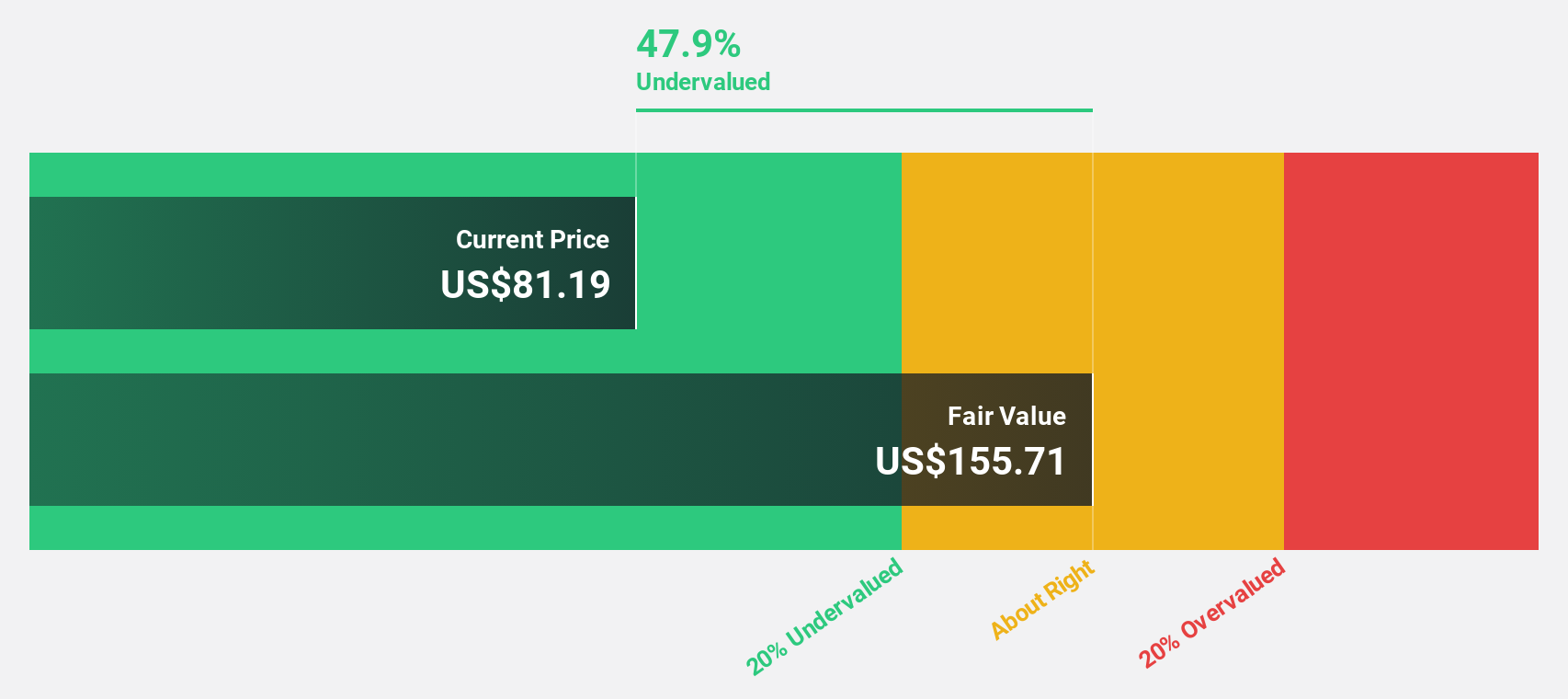

Estimated Discount To Fair Value: 46.3%

Warrior Met Coal's stock price of US$81.61 is significantly undervalued compared to its estimated fair value of US$152.05, with strong cash flow prospects despite recent profit margin declines from 23.8% to 2.9%. The company forecasts substantial annual earnings growth of over 90%, outpacing the broader market, and anticipates revenue growth exceeding 20% annually. Recent earnings reports show stable revenue year-over-year, while updated guidance projects increased production and sales volumes for 2025.

- Our growth report here indicates Warrior Met Coal may be poised for an improving outlook.

- Click to explore a detailed breakdown of our findings in Warrior Met Coal's balance sheet health report.

Millrose Properties (MRP)

Overview: Millrose Properties (ticker: MRP) engages in purchasing and developing residential land to sell finished homesites to homebuilders through option contracts, with a market cap of $5.26 billion.

Operations: Millrose Properties generates revenue by acquiring and developing residential land and then selling the completed homesites to homebuilders under option contracts with predetermined costs and schedules.

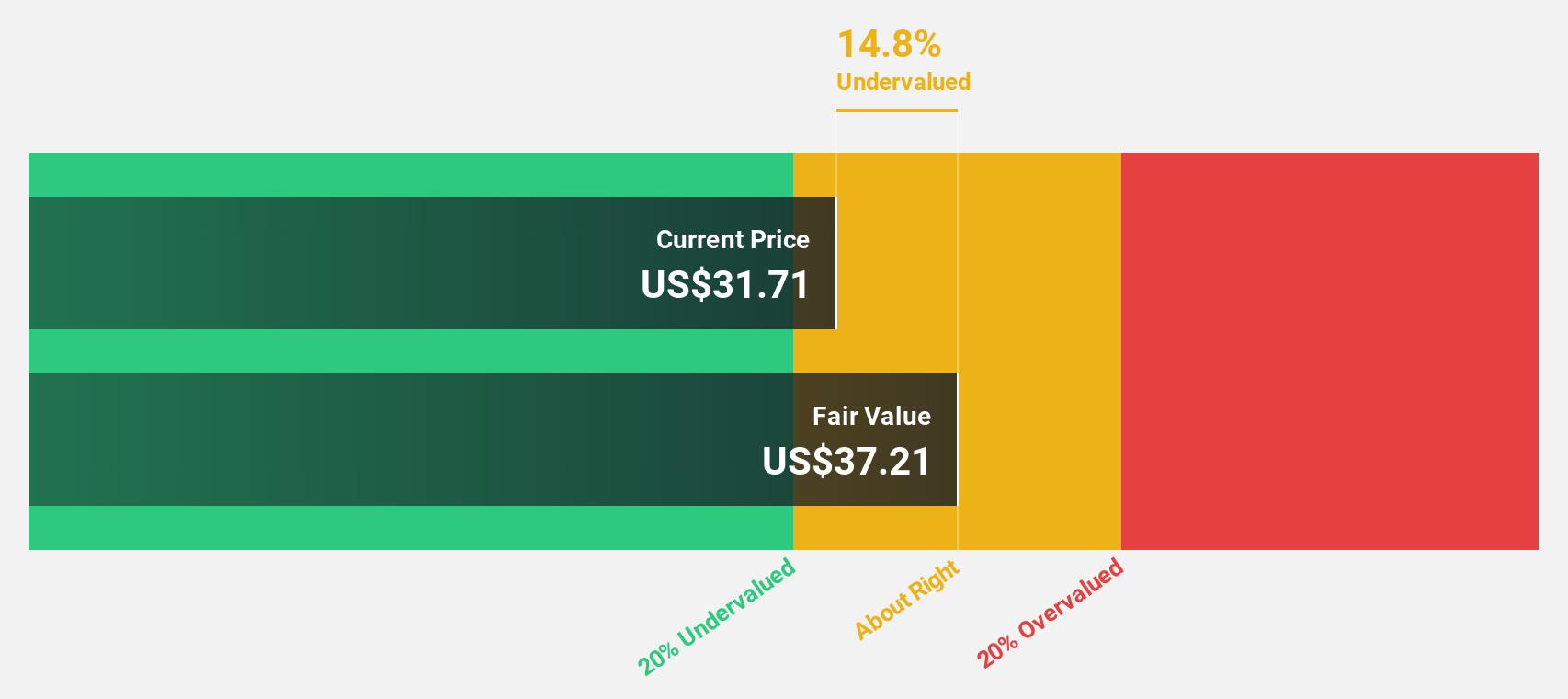

Estimated Discount To Fair Value: 14.8%

Millrose Properties is trading at US$31.71, below its estimated fair value of US$37.21, with significant forecasted earnings growth of 31.6% annually, surpassing the US market average. Despite a recent net income turnaround to US$105.06 million in Q3 2025 from a loss last year, its dividend yield of 9.21% isn't well covered by cash flows or earnings. The company has issued senior notes to refinance debt and support corporate purposes amidst strong revenue growth projections.

- Our earnings growth report unveils the potential for significant increases in Millrose Properties' future results.

- Dive into the specifics of Millrose Properties here with our thorough financial health report.

Next Steps

- Investigate our full lineup of 205 Undervalued US Stocks Based On Cash Flows right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MRP

Millrose Properties

Millrose purchases and develops residential land and sells finished homesites to homebuilders by way of option contracts with predetermined costs and takedown schedules.

High growth potential and good value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026