- United States

- /

- Retail REITs

- /

- NYSE:MAC

Assessing Macerich (MAC): Is There Untapped Value After a Year of Measured Gains?

Reviewed by Simply Wall St

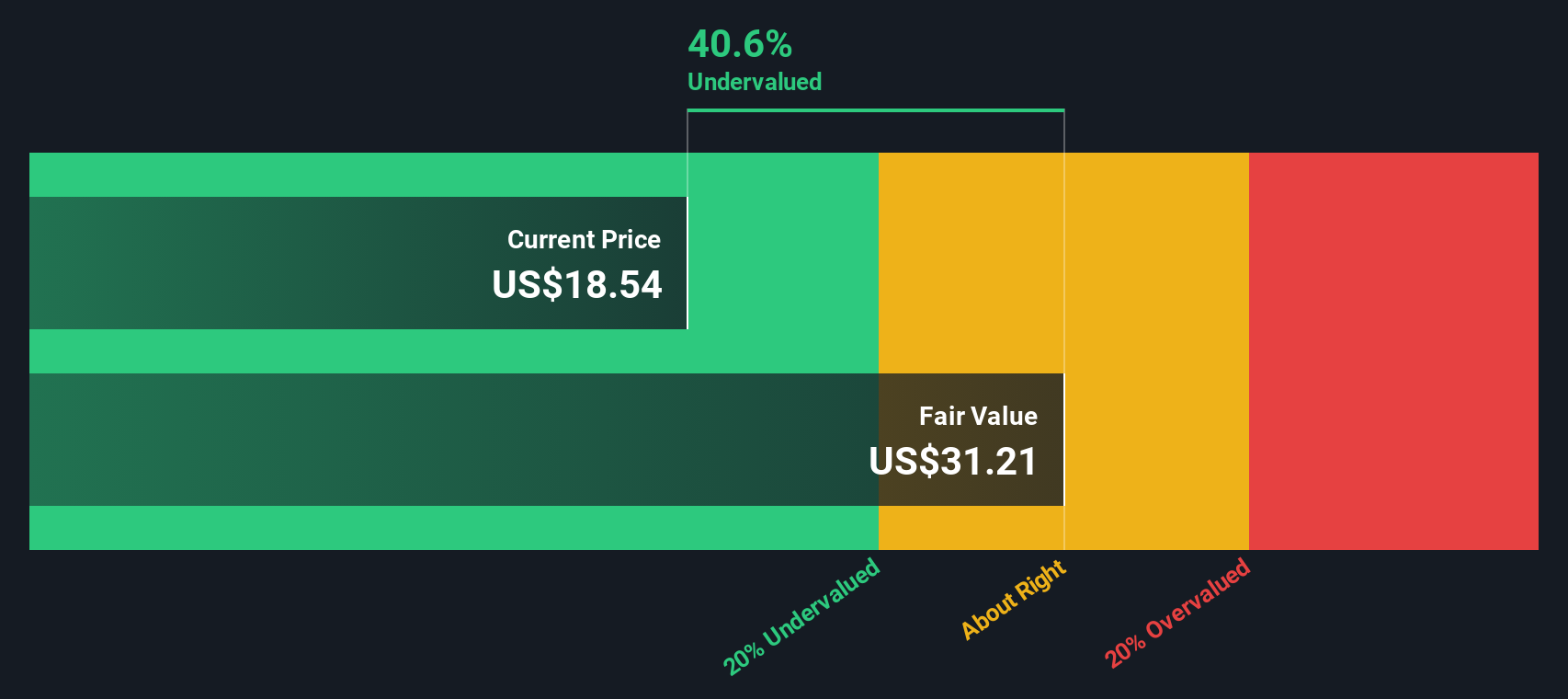

Macerich (MAC) has been flashing on the radar for investors trying to figure out whether it is time to act or hold steady. There is no headline-grabbing event moving the stock this week, but any meaningful shift in share price tends to spark questions, especially for a real estate operator navigating a market full of crosswinds. Sometimes the lack of noise itself can stir up conversations about what is already priced into shares and what could be flying under the radar.

Watching Macerich’s performance, the picture is mixed but not without interest. Over the past year, shares have gained 25%, outpacing many in the sector. Momentum in the past month and quarter has held steady at just over 10%. That said, not all long-term trends are positive. Returns from the start of the year still linger in the red. The company’s revenue growth remains modest, but net income growth has shown a sharp positive shift, something worth watching as the economic landscape evolves.

This all begs the question: after a year of moderate gains and a recent stretch of stability, is Macerich’s true value still underappreciated, or is the market already looking ahead and pricing in what comes next?

Most Popular Narrative: 4.6% Undervalued

According to the most widely followed narrative, Macerich shares are priced slightly below fair value, with analysts seeing untapped upside and a discount to intrinsic worth based on their assumptions and forecasts.

The focus on experiential and destination-oriented retail (e.g., DICK'S House of Sport, Cheesecake Factory, entertainment concepts) is revitalizing consumer engagement and increasing traffic. This positions the portfolio to benefit from experience-driven spending and allows for capturing higher net margins over time.

Want to know why the analysts are setting Macerich’s fair value above today’s price? The model is built on bold bets, mirroring shifts in margins, projected profit turnarounds, and a multiple that rivals even the most hyped sectors. The big reveal is that the assumptions powering this valuation would surprise even seasoned investors.

Result: Fair Value of $19.40 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent debt levels and the ongoing shift to e-commerce could quickly dampen Macerich’s outlook if market conditions turn against traditional malls.

Find out about the key risks to this Macerich narrative.Another View: DCF Tells a Deeper Story

While analyst targets highlight only a modest potential gain, our SWS DCF model suggests that the market may be missing significant hidden value. But are the model’s long-range forecasts the full story?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Macerich for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Macerich Narrative

If the story so far does not line up with your own thinking, or you would rather take matters into your own hands, you can pull together your own narrative in just a couple of minutes by using Do it your way.

A great starting point for your Macerich research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Angles?

Why stop with Macerich when you can tap into fresh stock ideas designed for forward-thinking investors? Use the Simply Wall Street Screener to quickly target opportunities primed for growth or income. The market does not wait, so make sure you do not either.

- Capitalize on stocks trading well below their true worth by using our tool for undervalued stocks based on cash flows.

- Target stable income streams with companies known for dividend stocks with yields > 3% as part of a resilient portfolio.

- Get ahead of the curve in the booming world of health tech leadership through our healthcare AI stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:MAC

Macerich

Macerich is a fully integrated, self-managed, self-administered real estate investment trust (REIT).

Good value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)