- United States

- /

- Office REITs

- /

- NYSE:JBGS

JBG SMITH Properties (JBGS): Evaluating Valuation Following Recent Share Price Dip

Reviewed by Kshitija Bhandaru

JBG SMITH Properties (JBGS) has recently seen its stock move slightly lower over the past week, with shares dipping about 7%. Investors are watching for signs of shifting market sentiment and underlying opportunities.

See our latest analysis for JBG SMITH Properties.

JBGS’s recent 7% slide over the week follows a longer stretch of mixed momentum, as the share price is still up more than 30% year-to-date. Looking further back, total shareholder returns tell a more resilient story with nearly 27% over three years, though the five-year result remains slightly negative. Overall, sentiment has improved this year, but investors seem to be weighing short-term volatility against the potential for continued recovery.

If this turnaround has you interested in broader opportunities, now is a great time to discover fast growing stocks with high insider ownership

With such a notable rally behind it, the key question now is whether JBG SMITH Properties’ recent dip signals an undervalued entry point or if market expectations have already factored in all potential upside for investors.

Price-to-Sales of 2.4x: Is it justified?

JBGS’s stock is currently trading at a price-to-sales (P/S) ratio of 2.4x, which is above both the peer average of 1.7x and the US Office REITs industry average of 2.3x. At the last close of $20.08, this elevated multiple suggests the market expects stronger fundamentals than those reflected in comparable companies.

The price-to-sales ratio compares a company’s market capitalization to its revenue, giving investors a sense of how much they are paying for each dollar of sales. In the real estate sector, where profitability can fluctuate due to large depreciation and variable occupancy, the P/S ratio can be a useful, if imperfect, way to benchmark valuation across peers.

Currently, the premium P/S multiple looks hard to justify, given statements point to falling revenue and persistent unprofitability for JBGS. Not only does the company trade well above the peer average, but the 2.4x ratio also exceeds Simply Wall St’s fair ratio estimate of 2.1x. This could be a sign the market may eventually move closer to that fair value level if fundamentals do not improve.

Explore the SWS fair ratio for JBG SMITH Properties

Result: Price-to-Sales of 2.4x (OVERVALUED)

However, slowing revenue growth and continued unprofitability remain potential risks that could challenge the case for a sustained recovery in JBGS shares.

Find out about the key risks to this JBG SMITH Properties narrative.

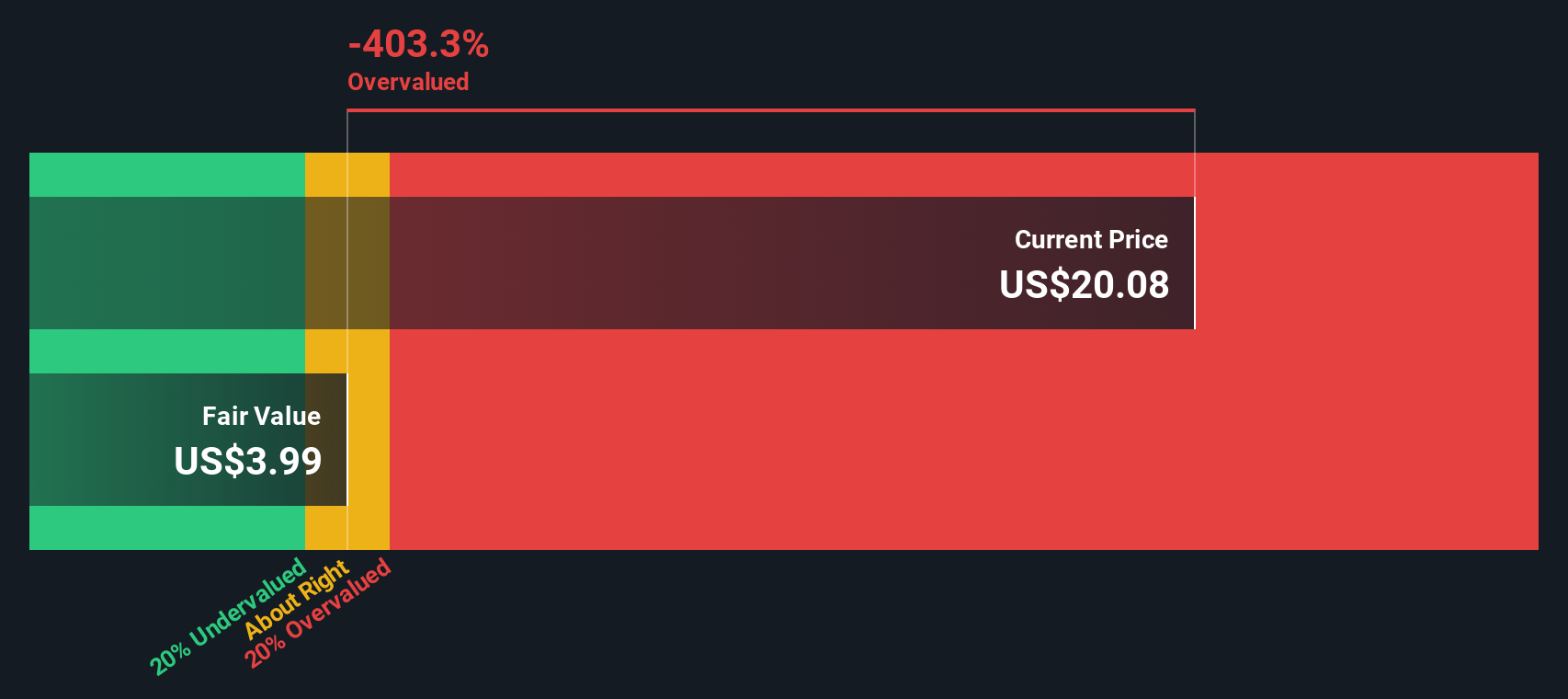

Another View: Discounted Cash Flow Model Paints a Harsher Picture

While the price-to-sales ratio shows JBGS trading above industry and peer averages, our DCF model provides an even starker assessment. According to the SWS DCF model, the company’s shares appear significantly overvalued compared to their estimated fair value. Could the market be overlooking deeper risks?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out JBG SMITH Properties for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own JBG SMITH Properties Narrative

If you have a different perspective or want to examine the numbers on your own terms, you can quickly build your own story for JBGS in just a few minutes. Do it your way.

A great starting point for your JBG SMITH Properties research is our analysis highlighting 3 important warning signs that could impact your investment decision.

Looking for more ways to invest smarter?

Don’t wait for the market to pass you by. Spot opportunities early with tailor-made stock ideas that you simply won’t want to overlook.

- Capture attractive yields and generate steady income by checking out these 19 dividend stocks with yields > 3% offering strong payouts above 3%.

- Uncover the latest disruptors in tech by seeing these 24 AI penny stocks that are transforming industries through artificial intelligence.

- Take advantage of stocks trading below their cash flow value by researching these 898 undervalued stocks based on cash flows in today’s market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JBGS

JBG SMITH Properties

JBG SMITH owns, operates, and develops mixed-use properties concentrated in amenity-rich, Metro-served submarkets in and around Washington, DC, most notably National Landing, that we believe have long-term growth potential and appeal to residential, office, and retail tenants.

Mediocre balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.