- United States

- /

- Leisure

- /

- NYSE:MODG

Undervalued Small Caps With Insider Activity In June 2025

Reviewed by Simply Wall St

The United States market has shown a steady performance, remaining flat over the last week but rising 9.9% over the past year, with annual earnings growth forecasted at 15%. In such an environment, identifying small-cap stocks that are potentially undervalued and exhibit insider activity can be key to uncovering promising investment opportunities.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Lindblad Expeditions Holdings | NA | 0.9x | 34.33% | ★★★★★★ |

| Columbus McKinnon | NA | 0.4x | 42.01% | ★★★★★☆ |

| S&T Bancorp | 10.3x | 3.6x | 45.47% | ★★★★☆☆ |

| Thryv Holdings | NA | 0.7x | 29.48% | ★★★★☆☆ |

| MVB Financial | 13.9x | 1.8x | 34.71% | ★★★☆☆☆ |

| Standard Motor Products | 11.7x | 0.4x | -2222.30% | ★★★☆☆☆ |

| Farmland Partners | 9.1x | 9.2x | -17.11% | ★★★☆☆☆ |

| BlueLinx Holdings | 13.8x | 0.2x | -73.34% | ★★★☆☆☆ |

| Titan Machinery | NA | 0.2x | -352.07% | ★★★☆☆☆ |

| Vital Energy | NA | 0.4x | -6.90% | ★★★☆☆☆ |

We'll examine a selection from our screener results.

Potbelly (PBPB)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Potbelly operates a chain of sandwich shops and has a market cap of $0.15 billion.

Operations: Potbelly generates revenue primarily from its sandwich shops, with recent figures showing $465.13 million. The company's gross profit margin has shown an upward trend, reaching 35.98% in the latest period. Operating expenses include significant allocations for general and administrative costs, which were $48.07 million in the most recent period.

PE: 8.0x

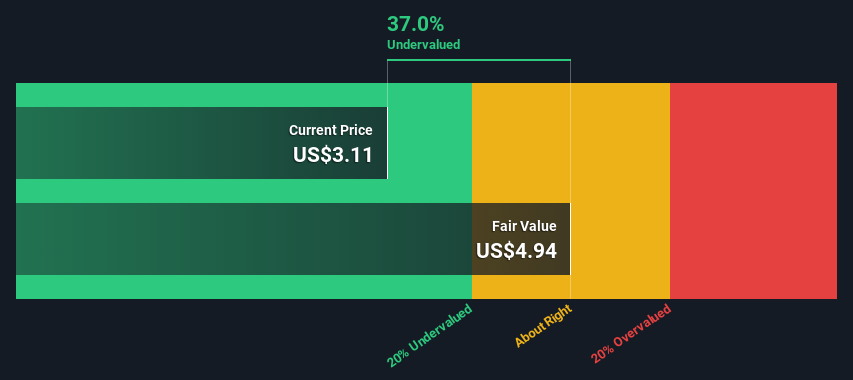

Potbelly, a small company in the U.S., recently reported first-quarter revenue of US$113.68 million, with net losses narrowing significantly to US$0.06 million from US$2.77 million a year prior. The company plans to expand by adding at least 38 new shops this year and has completed share repurchases worth US$2.53 million since May 2024. Insider confidence is evident with recent purchases, indicating potential optimism despite forecasts suggesting an average earnings decline of 80% annually over the next three years.

- Take a closer look at Potbelly's potential here in our valuation report.

Examine Potbelly's past performance report to understand how it has performed in the past.

Hudson Pacific Properties (HPP)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Hudson Pacific Properties operates as a real estate investment trust focusing on office and studio properties, with a market cap of approximately $1.43 billion.

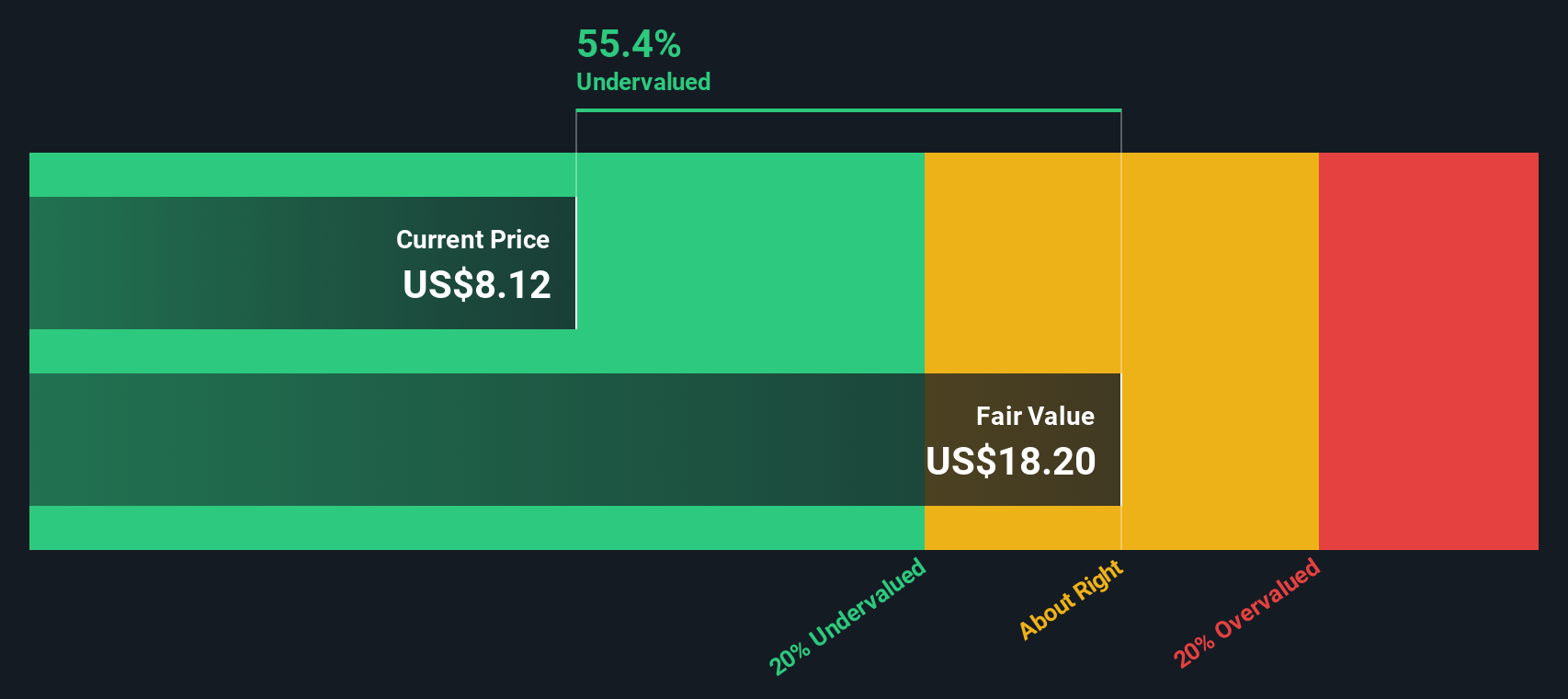

Operations: Hudson Pacific Properties generates revenue primarily from its office and studio segments, with the office segment contributing significantly more. The company's gross profit margin has shown a declining trend from 64.15% in late 2017 to 44.10% by mid-2025, indicating increased cost pressures or changes in pricing strategy over time. Operating expenses and depreciation & amortization remain substantial components of its cost structure, impacting overall profitability.

PE: -2.8x

Hudson Pacific Properties, a smaller U.S. company, recently completed a $599 million follow-on equity offering with KeyBanc, Morgan Stanley, and Goldman Sachs as co-lead underwriters. Despite reporting a net loss of $69 million in Q1 2025 and facing profitability challenges for the next three years, insider confidence is evident through recent share purchases. The company declared a preferred dividend for Q2 2025 and maintains funding primarily through external borrowing rather than customer deposits.

- Click here and access our complete valuation analysis report to understand the dynamics of Hudson Pacific Properties.

Evaluate Hudson Pacific Properties' historical performance by accessing our past performance report.

Topgolf Callaway Brands (MODG)

Simply Wall St Value Rating: ★★★★★☆

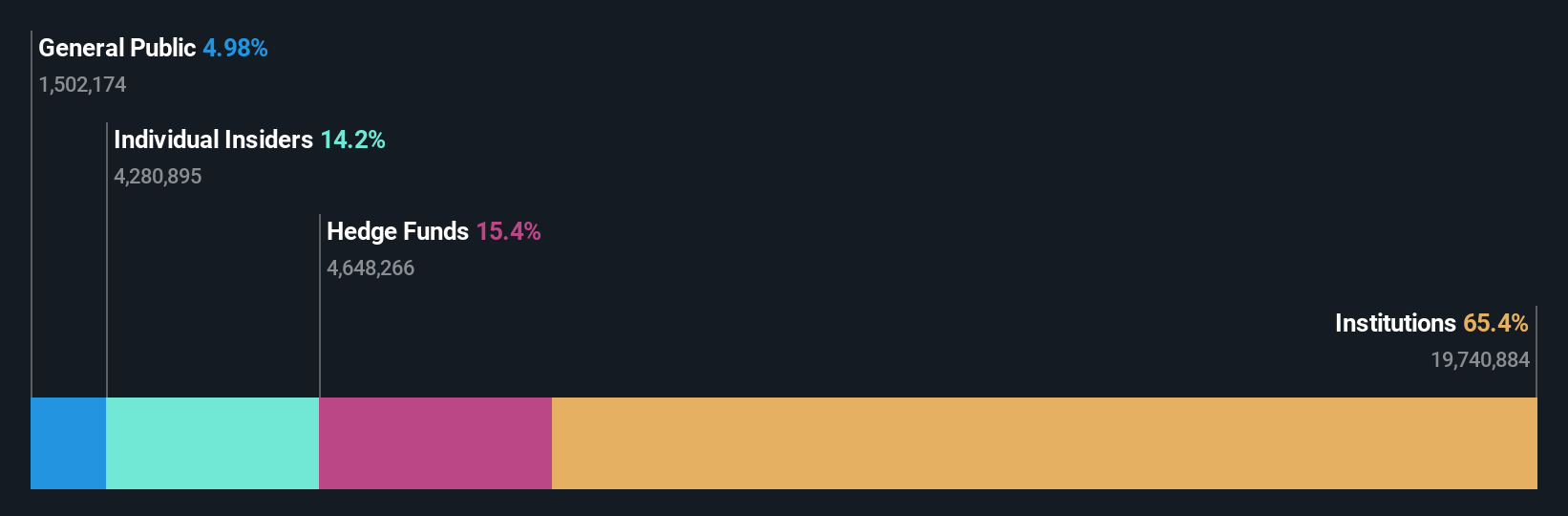

Overview: Topgolf Callaway Brands operates in the golf and active lifestyle sectors, with a market capitalization of approximately $3.68 billion, focusing on segments such as Topgolf entertainment venues, golf equipment, and active lifestyle products.

Operations: Topgolf Callaway Brands generates revenue primarily from three segments: Topgolf, Golf Equipment, and Active Lifestyle. The company's gross profit margin has shown fluctuations, reaching a high of 45.37% in mid-2017 before declining to around 31.70% by the end of 2024. Operating expenses are significant, with General & Administrative Expenses being a major component. Non-operating expenses have had a notable impact on net income in recent periods, contributing to negative net income margins as observed in late 2024 and early 2025.

PE: -1.1x

Topgolf Callaway Brands, a dynamic player in the leisure and sports industry, is expanding with new venues in Florida and New Jersey. Despite its small cap status, it projects full-year revenues between US$4 billion to US$4.18 billion for 2025. Insider confidence is reflected through recent share purchases, indicating potential value recognition by those close to the company. Although earnings dipped slightly in Q1 2025 compared to last year, ongoing business expansions could drive future growth opportunities.

- Navigate through the intricacies of Topgolf Callaway Brands with our comprehensive valuation report here.

Explore historical data to track Topgolf Callaway Brands' performance over time in our Past section.

Turning Ideas Into Actions

- Unlock our comprehensive list of 88 Undervalued US Small Caps With Insider Buying by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Topgolf Callaway Brands might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MODG

Topgolf Callaway Brands

Designs, manufactures, and sells golf equipment, golf and lifestyle apparel, and other accessories in the United States, Europe, Asia, and Internationally.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives