- United States

- /

- Specialized REITs

- /

- NYSE:DLR

3 US Stocks Estimated To Be Trading At Discounts Up To 48.8%

Reviewed by Simply Wall St

As U.S. stock markets reach record highs amid a post-election rally, investors are keenly observing the opportunities presented by undervalued stocks in this buoyant environment. Identifying such stocks often involves looking for companies with strong fundamentals that may not yet be fully reflected in their current market prices, offering potential value even as major indices continue to climb.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| NBT Bancorp (NasdaqGS:NBTB) | $50.60 | $99.93 | 49.4% |

| UMB Financial (NasdaqGS:UMBF) | $126.50 | $245.25 | 48.4% |

| First National (NasdaqCM:FXNC) | $22.84 | $45.19 | 49.5% |

| Synovus Financial (NYSE:SNV) | $58.73 | $115.23 | 49% |

| Five Star Bancorp (NasdaqGS:FSBC) | $32.92 | $63.96 | 48.5% |

| XPEL (NasdaqCM:XPEL) | $45.67 | $91.12 | 49.9% |

| Pinterest (NYSE:PINS) | $30.39 | $59.50 | 48.9% |

| QuinStreet (NasdaqGS:QNST) | $23.42 | $46.52 | 49.7% |

| STAAR Surgical (NasdaqGM:STAA) | $30.42 | $59.65 | 49% |

| Alnylam Pharmaceuticals (NasdaqGS:ALNY) | $279.82 | $546.39 | 48.8% |

Below we spotlight a couple of our favorites from our exclusive screener.

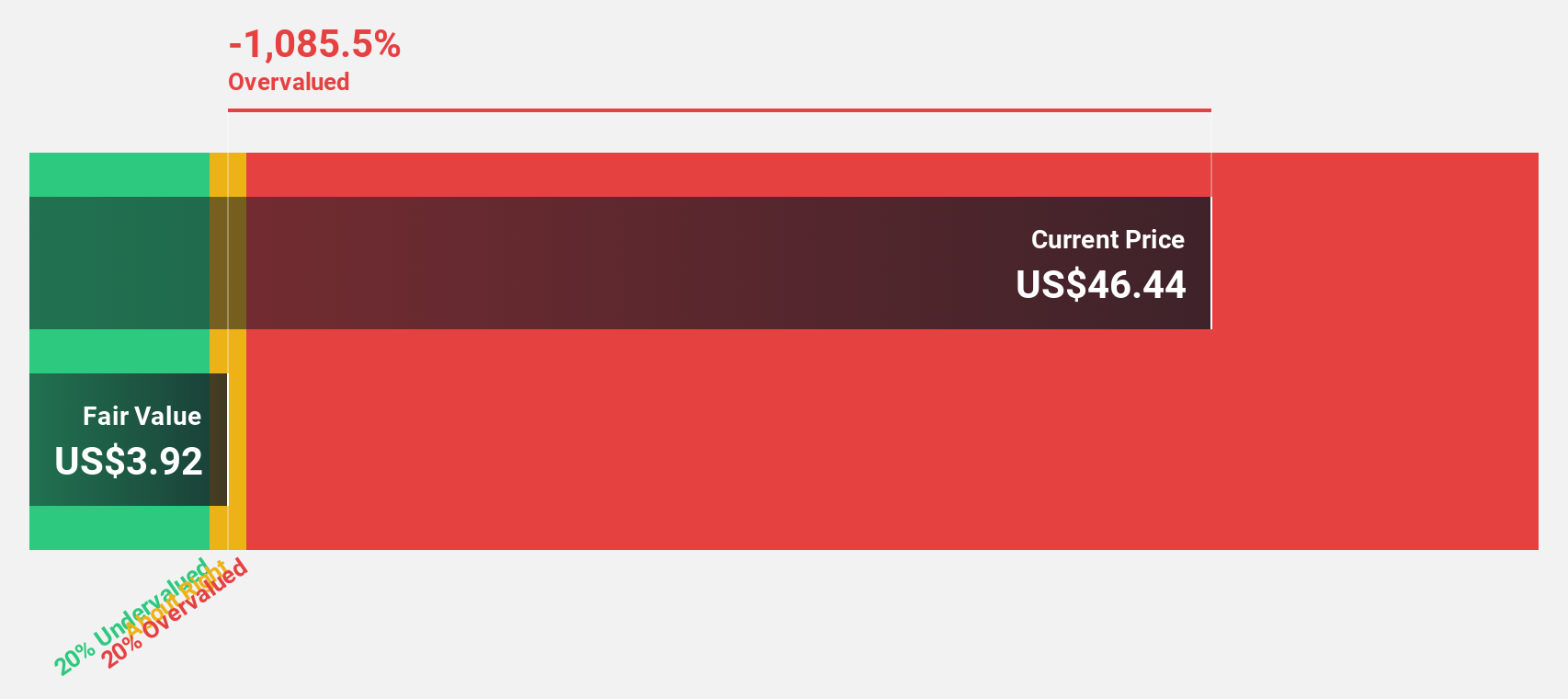

Rocket Lab USA (NasdaqCM:RKLB)

Overview: Rocket Lab USA, Inc. is a space company offering launch services and space systems solutions for the space and defense industries, with a market cap of approximately $6.71 billion.

Operations: The company generates revenue through its Space Systems segment, which accounts for $234.82 million, and its Launch Services segment, contributing $91.85 million.

Estimated Discount To Fair Value: 47.1%

Rocket Lab USA is trading at US$14.78, significantly below its estimated fair value of US$27.93, indicating potential undervaluation based on discounted cash flow analysis. Despite recent shareholder dilution and a volatile share price, revenue growth is projected to outpace the market at 29.3% annually, with profitability expected within three years. The company's strategic partnerships, including a NASA mission study and Kinéis satellite launches, could enhance future cash flows and business scalability under new COO Frank Klein's leadership.

- Our growth report here indicates Rocket Lab USA may be poised for an improving outlook.

- Click here to discover the nuances of Rocket Lab USA with our detailed financial health report.

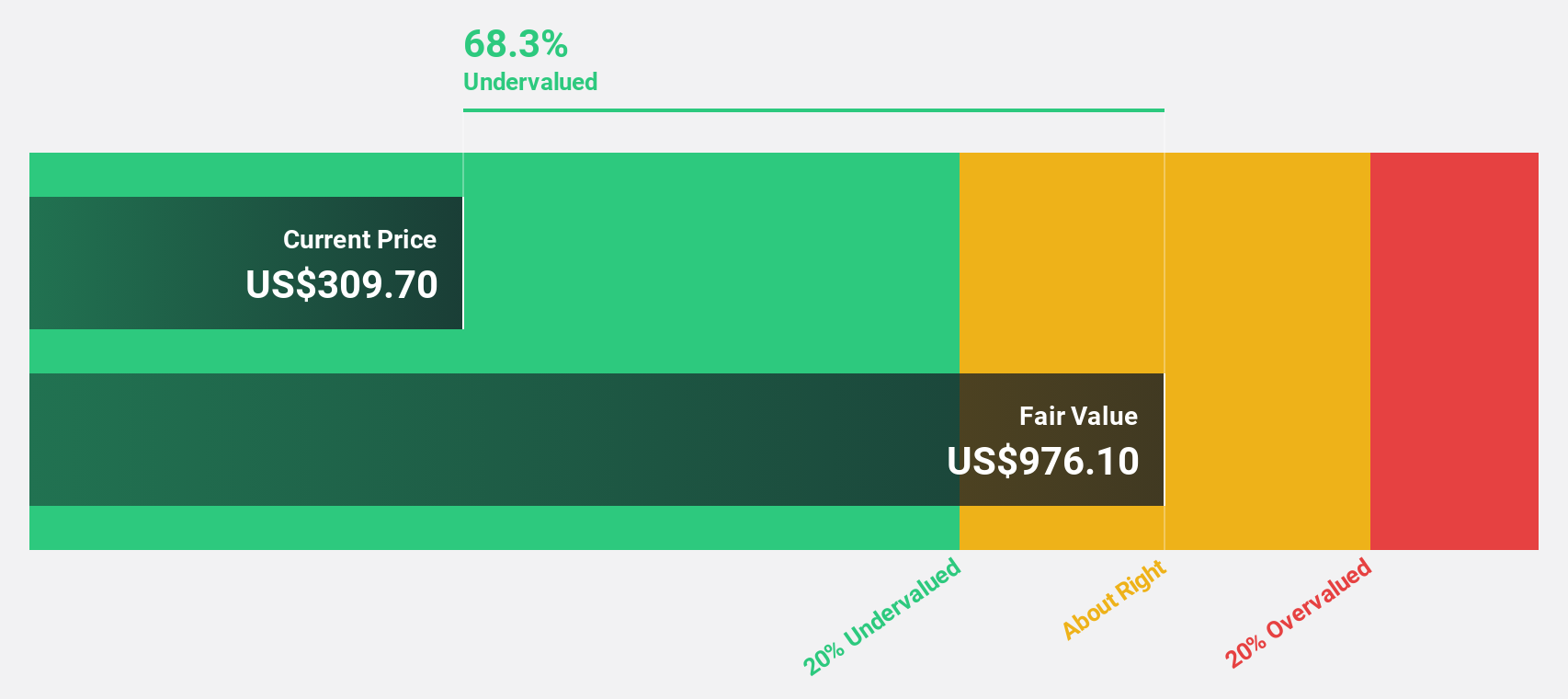

Alnylam Pharmaceuticals (NasdaqGS:ALNY)

Overview: Alnylam Pharmaceuticals, Inc. is a biopharmaceutical company specializing in the discovery, development, and commercialization of novel therapeutics based on ribonucleic acid interference, with a market cap of $35.78 billion.

Operations: The company's revenue from its segment focused on the discovery, development, and commercialization of RNAi therapeutics amounts to $2.09 billion.

Estimated Discount To Fair Value: 48.8%

Alnylam Pharmaceuticals, trading at US$279.82, is significantly below its estimated fair value of US$546.39, highlighting potential undervaluation based on cash flows. Although recent earnings showed a net loss and shareholder dilution, revenue for the nine months increased to US$1.66 billion from US$1.39 billion year-on-year. With an expected annual revenue growth of 22.4% and profitability anticipated within three years, Alnylam's financial outlook appears robust despite current challenges.

- According our earnings growth report, there's an indication that Alnylam Pharmaceuticals might be ready to expand.

- Get an in-depth perspective on Alnylam Pharmaceuticals' balance sheet by reading our health report here.

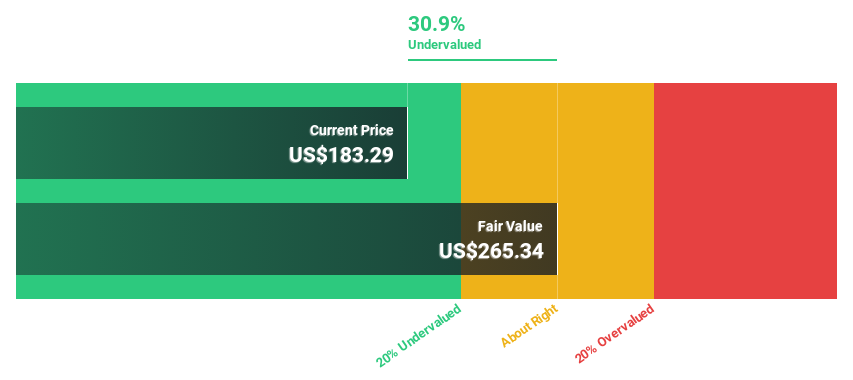

Digital Realty Trust (NYSE:DLR)

Overview: Digital Realty Trust operates by providing a comprehensive range of data center, colocation, and interconnection solutions, with a market cap of approximately $61.53 billion.

Operations: The company's revenue primarily comes from its REIT - Commercial segment, totaling $5.37 billion.

Estimated Discount To Fair Value: 31.1%

Digital Realty Trust, trading at US$182.85, is undervalued with an estimated fair value of US$265.5, reflecting a strong cash flow position. Despite a decline in net profit margins from 16.6% to 7.5%, earnings are forecasted to grow significantly at 21% annually over the next three years, outpacing the broader US market's growth rate of 15.6%. However, interest coverage remains weak and shareholders experienced dilution recently.

- Our comprehensive growth report raises the possibility that Digital Realty Trust is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of Digital Realty Trust stock in this financial health report.

Turning Ideas Into Actions

- Access the full spectrum of 198 Undervalued US Stocks Based On Cash Flows by clicking on this link.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DLR

Digital Realty Trust

Digital Realty Trust, Inc. (“Digital Realty” or the “company”) owns, acquires, develops, and operates data centers through its operating partnership subsidiary, Digital Realty Trust, L.P.

Established dividend payer with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives