- United States

- /

- Office REITs

- /

- NYSE:DEI

Is Douglas Emmett a Bargain After a 38% Share Price Slide in 2025?

Reviewed by Bailey Pemberton

- Wondering if Douglas Emmett is a beaten down office REIT that the market has mispriced or a value trap in plain sight? This breakdown will walk you through what the numbers actually say about its value.

- Despite a tough run with the share price down 1.7% over the last week, 2.6% over the last month, and almost 38% year to date, moves like this often create the kind of valuation gaps long term investors look for.

- Much of the recent share price pressure has come as investors rethink the future of coastal office demand, especially in markets like Los Angeles and Honolulu where Douglas Emmett is heavily exposed. At the same time, headlines around higher interest rates and refinancing risks for office landlords have kept sentiment cautious, even as some investors start to hunt for distressed value opportunities in the space.

- Right now, Douglas Emmett scores a 3/6 valuation check score. This means it looks undervalued on half of our core metrics but not convincingly cheap on others. Next, we will unpack what different valuation approaches say about that score, and then finish with an even more practical way to think about the stock's true value.

Find out why Douglas Emmett's -38.9% return over the last year is lagging behind its peers.

Approach 1: Douglas Emmett Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth today by projecting its future adjusted funds from operations, then discounting those cash flows back to the present.

For Douglas Emmett, the model starts with last twelve months free cash flow of about $276.5 Million and projects how this could evolve over time. Analyst estimates and Simply Wall St extrapolations point to free cash flow of roughly $224.8 Million in 2026 and around $275.5 Million by 2035, suggesting modest but steady growth as the portfolio stabilizes and rents gradually recover.

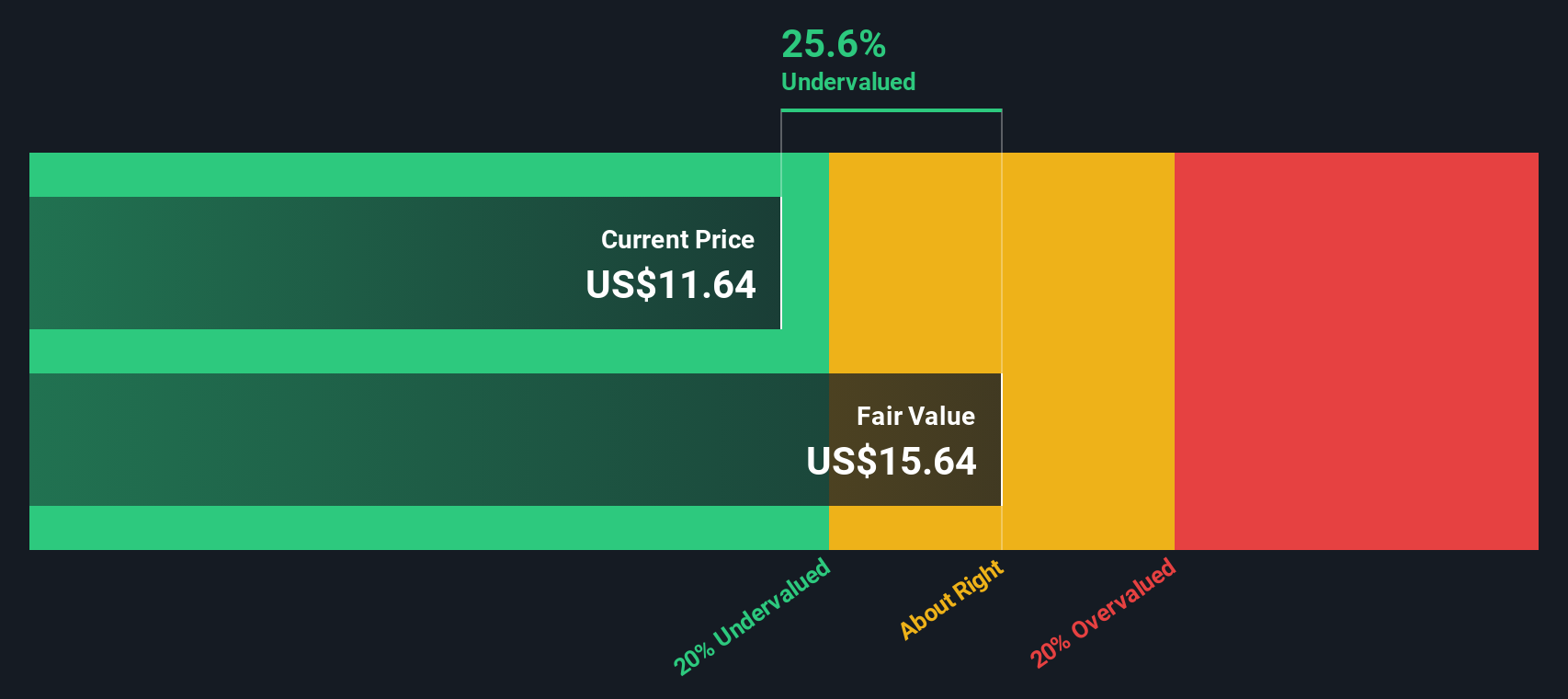

Using a 2 Stage Free Cash Flow to Equity model based on these projections, the DCF calculation arrives at an intrinsic value of approximately $15.73 per share. Compared with the current market price, this implies Douglas Emmett trades at about a 26.0% discount to its estimated fair value. This may indicate that the market is overly pessimistic about its long term cash generating ability.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Douglas Emmett is undervalued by 26.0%. Track this in your watchlist or portfolio, or discover 903 more undervalued stocks based on cash flows.

Approach 2: Douglas Emmett Price vs Earnings

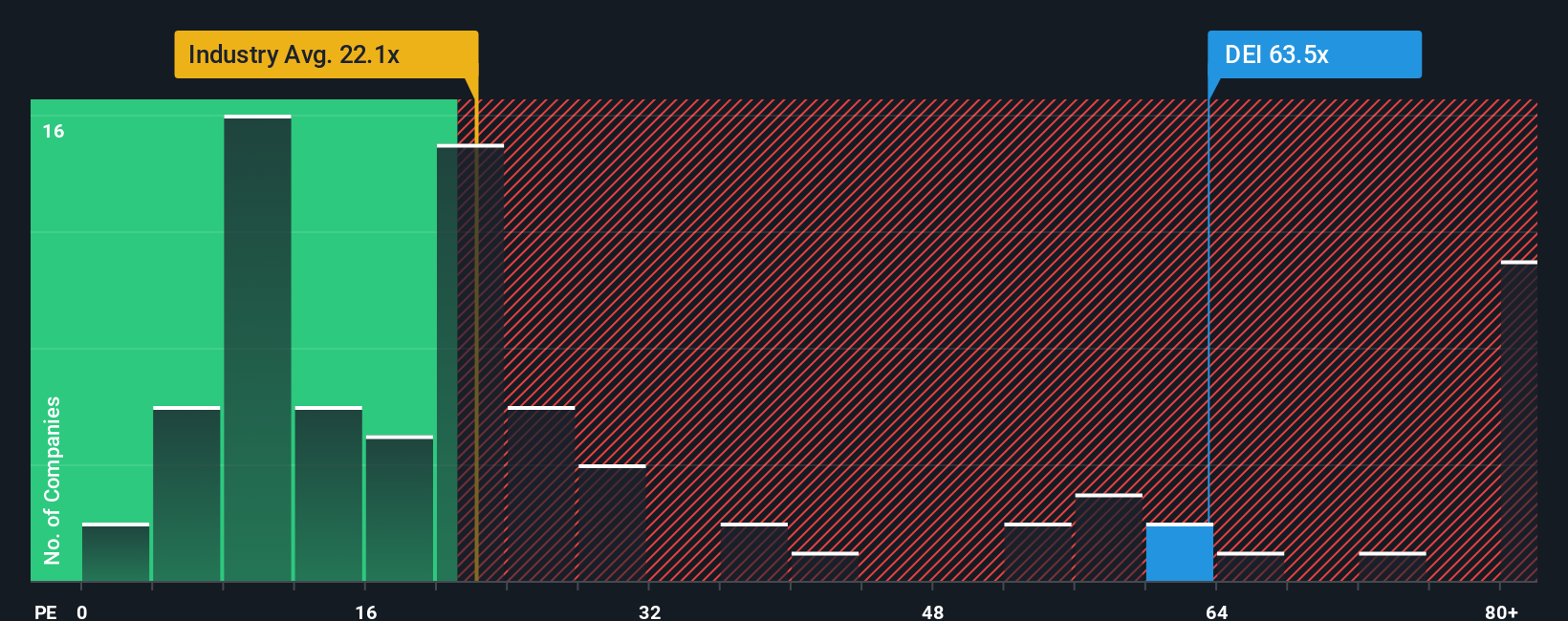

For profitable companies like Douglas Emmett, the price to earnings ratio is a useful shorthand for how much investors are willing to pay for each dollar of current earnings. A higher PE can be justified when markets expect stronger growth or see the business as relatively low risk, while slower growth or elevated risk typically calls for a lower, more conservative multiple.

Douglas Emmett currently trades on a PE of about 93.5x, which is far richer than the Office REITs industry average of roughly 22.3x and above the broader peer group average of around 23.4x. To move beyond these blunt comparisons, Simply Wall St uses a proprietary Fair Ratio, which estimates what a reasonable PE should be given Douglas Emmett’s growth outlook, risk profile, profitability, industry and market cap. On this basis, the Fair Ratio is 16.4x, implying the stock is priced far above what those fundamentals would normally support.

Because the actual PE of 93.5x is dramatically higher than the 16.4x Fair Ratio, the multiple based view suggests Douglas Emmett appears significantly overvalued on earnings.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1443 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Douglas Emmett Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to attach your story about a company to concrete numbers like your assumed fair value and your forecasts for future revenue, earnings and margins. This means the company’s story, your financial model and a fair value estimate are all linked in one place, inside an easy to use tool on Simply Wall St’s Community page. Millions of investors already rely on this tool to decide when to buy or sell by comparing their Narrative Fair Value to the current share price, with each Narrative automatically updating as new news or earnings arrive. For Douglas Emmett, you might see an optimistic Narrative that leans toward the higher analyst target of $21.00 based on confidence in redevelopment, occupancy recovery and capital markets execution. You might also see a more cautious Narrative anchored closer to the $13.00 bearish target that assumes softer office demand and higher discount rates. Together, these give you a clear, dynamic view of how different perspectives translate into different fair values and action plans.

Do you think there's more to the story for Douglas Emmett? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DEI

Douglas Emmett

Douglas Emmett, Inc. (DEI) is a fully integrated, self-administered and self-managed real estate investment trust (REIT), and one of the largest owners and operators of high-quality office and multifamily properties located in the premier coastal submarkets of Los Angeles and Honolulu.

Average dividend payer with slight risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)