- United States

- /

- Specialized REITs

- /

- NYSE:CUBE

Does CubeSmart’s 17% Drop Signal a Potential Opportunity in 2025?

Reviewed by Bailey Pemberton

Thinking about what to do with your CubeSmart shares, or maybe whether now’s the right moment to jump in? You’re definitely not alone. While the broader storage REIT sector is always evolving, CubeSmart in particular has had investors and analysts weighing its growth story against some recent price slippage.

Let’s start by taking a step back. Over the past year, CubeSmart’s shares have dropped 16.9%, and it’s been a bumpy ride lately with a 3.0% dip in the last month alone. That short-term downward pressure might have you questioning the market’s confidence, but zoom out to three or five years and the picture changes. CubeSmart is still up 21.0% and 42.1%, respectively. This hints at a company with durable long-term growth potential, even if sentiment has cooled a bit recently.

So, what’s driving these moves? The self-storage industry has weathered some shifting consumer behavior trends lately, and market sentiment seems to be balancing solid fundamentals against bigger macroeconomic worries. But here’s where it gets truly interesting: CubeSmart is undervalued by multiple methods, earning a value score of 5 out of 6, which is no small feat for a company in a mature sector.

Curious what goes into that score, and how different valuation perspectives stack up? Let’s break down each approach and stick around, because at the end, I’ll share the one approach that can sometimes beat them all.

Why CubeSmart is lagging behind its peers

Approach 1: CubeSmart Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its expected adjusted funds from operations forward and then discounting those future cash flows back to today's dollars. For CubeSmart, this approach starts with the latest Free Cash Flow of $600.8 Million and examines how that figure is likely to grow over the next decade.

Analyst estimates predict CubeSmart's annual Free Cash Flow will rise steadily, with projections such as $580.2 Million in 2026, $636.1 Million in 2028, and ultimately reaching $817.8 Million by 2035, based on a combination of direct analyst inputs and Simply Wall St's extrapolations for the later years. These consistent increases reflect investors' confidence in CubeSmart's ability to generate and grow cash from its storage business throughout economic cycles.

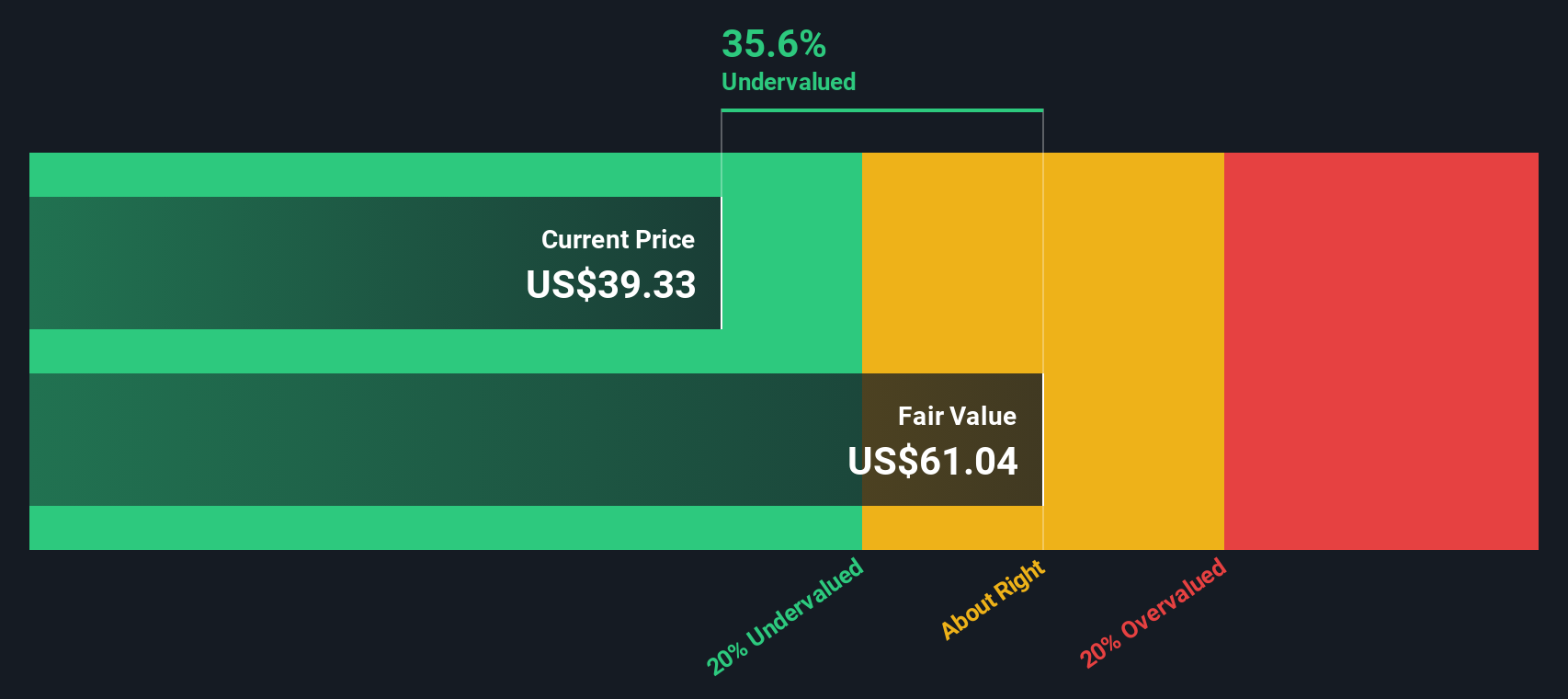

Applying the DCF method, the calculated intrinsic value of CubeSmart is $61.11 per share. Compared to the stock's current market price, this represents a 34.7% discount, suggesting that CubeSmart is trading significantly below what its long-term cash flow profile would justify.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests CubeSmart is undervalued by 34.7%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: CubeSmart Price vs Earnings

The Price-to-Earnings (PE) ratio is a popular measure for valuing profitable companies, as it relates a company's current share price to its per-share earnings. This metric is especially helpful when assessing established businesses with steady earnings, like CubeSmart, as it puts their current valuation into context relative to both growth potential and underlying risks.

Growth expectations and risk play a big role in what constitutes a "normal" or "fair" PE ratio. Companies with higher earnings growth or more stable cash flows often trade at higher multiples. In contrast, businesses facing uncertain prospects or industry headwinds may see lower ratios. So how does CubeSmart stack up?

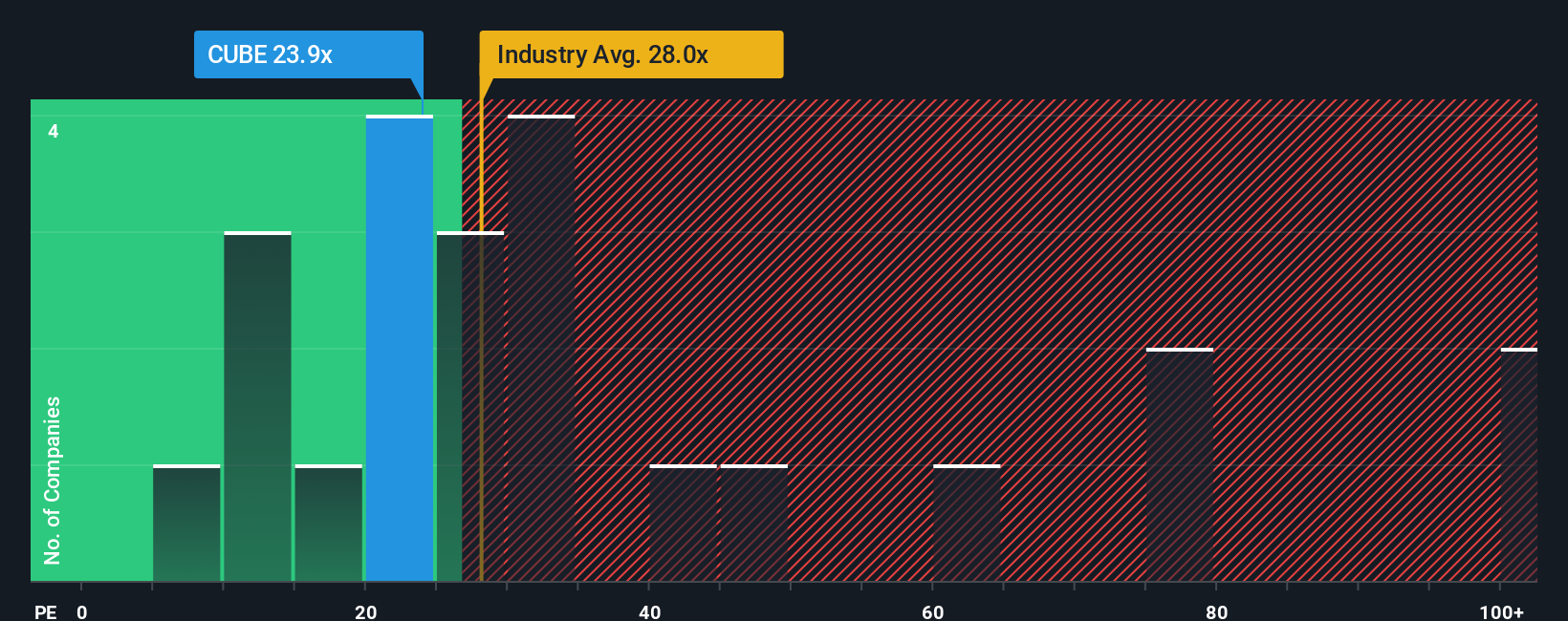

Currently, CubeSmart is trading at a PE ratio of 24.3x. For reference, the average PE ratio across the specialized REIT industry is 17.5x. Peers average an even higher 35.1x. Rather than focusing only on those broad benchmarks, it is also insightful to look at the "Fair Ratio," a proprietary metric from Simply Wall St. This figure, calculated at 31.8x, blends CubeSmart’s unique growth outlook, profit margins, and risk profile with industry context and its market capitalization for a more nuanced assessment.

The Fair Ratio offers a truer sense of value compared to simply lining up against peers or the broader sector, since it tailors the comparison to the company’s specific circumstances. In this case, CubeSmart’s actual PE of 24.3x is notably below its Fair Ratio of 31.8x. This points to a stock that is not fully appreciating its long-term strengths in the current market.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your CubeSmart Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal investment storyline. It lets you connect your view of CubeSmart’s business trends, forecasts, and industry context with actual financial models, tying together where you think CubeSmart is headed and what you believe it’s worth.

On Simply Wall St's Community page, millions of investors use Narratives to blend their unique perspectives with data, turning their opinions about revenue, profits, and risks into a living fair value for the company. Narratives are more than just numbers; they put your beliefs into a forecast, then calculate what CubeSmart should be worth, so you can quickly see if the current price is a buy, sell, or hold.

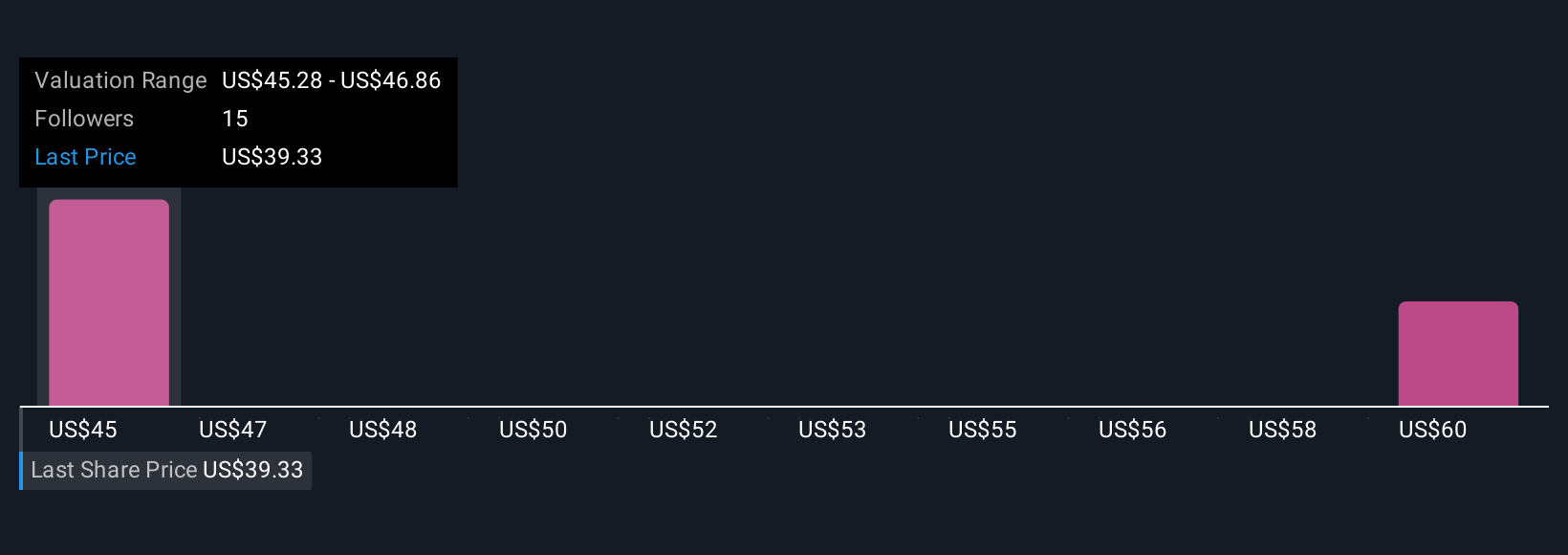

What makes Narratives powerful is that they update in real-time as new earnings reports or market news come in. This means your view and your decision-making advantage stay current. For CubeSmart, one investor’s optimistic narrative could set a fair value near $45.28 based on stable New York City demand and tightening supply. A more cautious perspective, worried about rising costs or Sunbelt headwinds, might lead to a much lower fair value. Narratives give you a smart, flexible way to invest with conviction and clarity, grounded in your own understanding.

Do you think there's more to the story for CubeSmart? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CUBE

CubeSmart

A self-administered and self-managed real estate investment trust.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)