- United States

- /

- Office REITs

- /

- NYSE:CIO

Market is not liking City Office REIT's (NYSE:CIO) earnings decline as stock retreats 12% this week

Even the best stock pickers will make plenty of bad investments. And there's no doubt that City Office REIT, Inc. (NYSE:CIO) stock has had a really bad year. The share price has slid 56% in that time. Longer term shareholders haven't suffered as badly, since the stock is down a comparatively less painful 2.9% in three years. More recently, the share price has dropped a further 22% in a month. Importantly, this could be a market reaction to the recently released financial results. You can check out the latest numbers in our company report.

After losing 12% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

See our latest analysis for City Office REIT

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

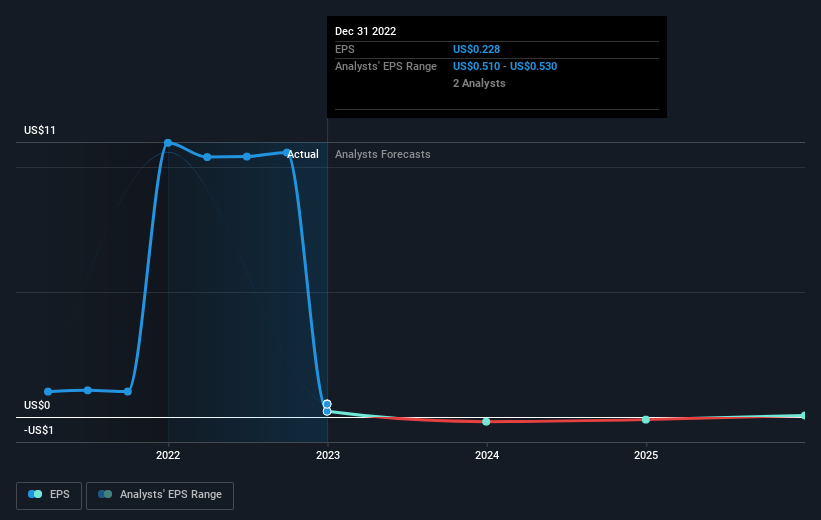

Unhappily, City Office REIT had to report a 98% decline in EPS over the last year. The share price fall of 56% isn't as bad as the reduction in earnings per share. It may have been that the weak EPS was not as bad as some had feared.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We know that City Office REIT has improved its bottom line over the last three years, but what does the future have in store? This free interactive report on City Office REIT's balance sheet strength is a great place to start, if you want to investigate the stock further.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of City Office REIT, it has a TSR of -53% for the last 1 year. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

While the broader market lost about 7.3% in the twelve months, City Office REIT shareholders did even worse, losing 53% (even including dividends). Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 2% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand City Office REIT better, we need to consider many other factors. Even so, be aware that City Office REIT is showing 5 warning signs in our investment analysis , and 2 of those are potentially serious...

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CIO

City Office REIT

The Company reported that its total portfolio as of March 31, 2025 contained 5.4 million net rentable square feet and was 84.9% occupied, or 87.6% including signed leases not yet occupied.

Undervalued second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives