- United States

- /

- Office REITs

- /

- NYSE:CDP

COPT Defense Properties (CDP) Profitability Rebound Reinforces Bull Thesis Despite Financial Strength Concerns

Reviewed by Simply Wall St

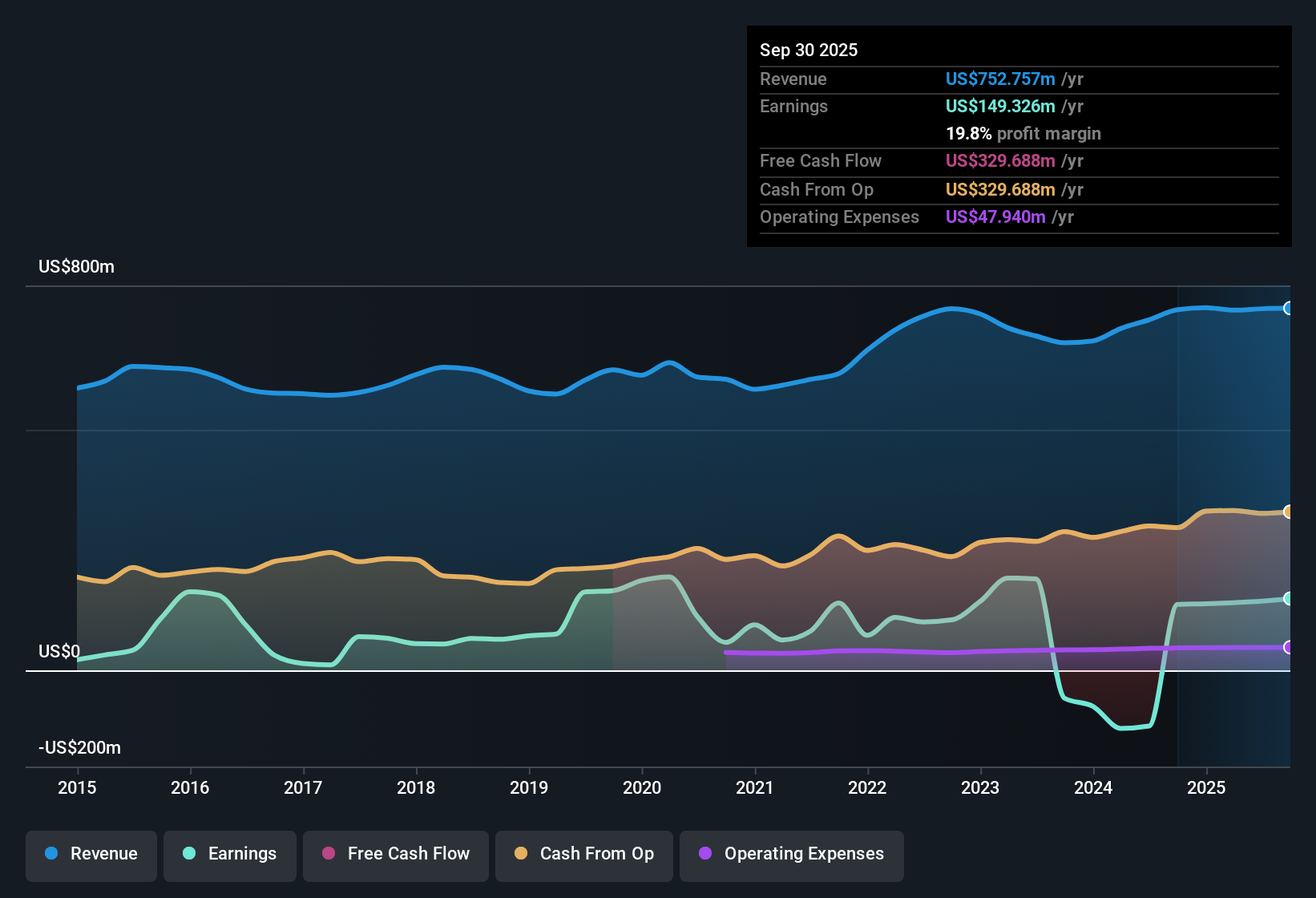

COPT Defense Properties (CDP) saw its earnings decline by 5.5% per year over the past five years, but the company turned profitable in the most recent period. Net profit margins improved enough to mark a shift to profitability. Revenue is forecast to grow at 3.5% per year, well below the US market average of 10.3%, and profit growth expectations are similarly modest at just 0.4% per year, both trailing industry trends. As investors consider these results, the key takeaways are the move to profitability, appealing valuation, and signs of high quality earnings, set against more muted growth forecasts and some concerns about the company’s financial position.

See our full analysis for COPT Defense Properties.Next up, let’s compare these headline numbers with the prevailing narratives around COPT Defense Properties and see where expectations get challenged or confirmed.

See what the community is saying about COPT Defense Properties

Profit Margin Hits 19.1% Despite Below-Market Growth

- COPT Defense Properties reported a net profit margin of 19.1%, even as revenue is forecast to grow at just 3.0% annually over the next three years, trailing the US market average of 10.3% and the office REITs industry benchmarks.

- According to the analysts' consensus view, the company’s uniquely high retention rates of 90%+ and stable demand for mission-critical defense and tech facilities maintain solid revenue visibility, which is expected to help offset slower growth.

- Persistent digital transformation and expansion of secure government IT infrastructure are highlighted as durable drivers behind current high occupancy and above-average long-term rent growth.

- The consensus also singles out the company’s strategic advantage at key defense nodes, supporting lasting pricing power and further margin stability, even in the face of muted top-line growth.

- Strong fundamentals underpin the view that, while COPT may expand slower than peers, its specialized positioning enables greater margin resilience and steadier long-term income streams amid industry volatility.

- To see how COPT’s margin durability fits into the full story, including the tug-of-war between stable income and moderate growth, check out the consensus narrative for a deeper dive. 📊 Read the full COPT Defense Properties Consensus Narrative.

Price-to-Earnings at 22.1x Undercuts Peers

- The company currently trades at a price-to-earnings ratio of 22.1x, lower than both the peer average of 44x and the global office REITs industry average of 22.5x. This indicates it is attractively valued relative to direct competitors and its sector.

- Analysts’ consensus narrative underscores this valuation appeal, noting that periods of profit and revenue growth alongside a consistent dividend render COPT Defense Properties a potentially good value proposition.

- The share price also sits well below DCF fair value ($28.17 vs. $39.20), giving investors a sizable upside cushion if the company's stability holds.

- Despite the valuation discount, consensus cautions that the upside potential depends on continued demand for defense-oriented spaces, as high tenant concentration could amplify vulnerability to changes in government spending.

Financial Position Remains a Key Watchpoint

- The primary risk cited is the company’s financial position, which is not currently described as strong according to the latest filings, a concern highlighted even in light of recent profitability and margin improvement.

- Consensus narrative warns that overreliance on defense budget allocations and concentrated tenant exposure, especially in specialized government markets, could lead to volatility in occupancy and revenue if federal budgets contract or contract awards are delayed.

- Current expansion plans, such as development of 1.3 million sq ft at 8.5%+ yields, require ongoing capital investment, potentially weighing on future margins if construction costs rise or lease-up pace falters.

- Maintaining competitive, secure facilities will demand substantial ongoing capital outlays, which could erode profitability if not matched by sustained rent growth and tenant retention.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for COPT Defense Properties on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Notice something in the numbers that others might miss? Take just a few minutes to turn your interpretation into a new narrative. Do it your way

A great starting point for your COPT Defense Properties research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Despite margin improvements, COPT Defense Properties still faces concerns over its financial strength because of debt loads and high capital requirements.

If you want companies built on sturdier finances and fewer balance sheet worries, focus on those with stronger fundamentals by checking solid balance sheet and fundamentals stocks screener (1983 results) right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CDP

COPT Defense Properties

COPT Defense Properties (the “Company” or “COPT Defense”), an S&P MidCap 400 Company, is a self-managed real estate investment trust (“REIT”) focused on owning, operating and developing properties in locations proximate to, or sometimes containing, key U.S.

Undervalued established dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)