- United States

- /

- REITS

- /

- NYSE:BNL

Here's Why We Think Broadstone Net Lease (NYSE:BNL) Is Well Worth Watching

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Broadstone Net Lease (NYSE:BNL). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Broadstone Net Lease with the means to add long-term value to shareholders.

See our latest analysis for Broadstone Net Lease

How Fast Is Broadstone Net Lease Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That makes EPS growth an attractive quality for any company. Impressively, Broadstone Net Lease has grown EPS by 25% per year, compound, in the last three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

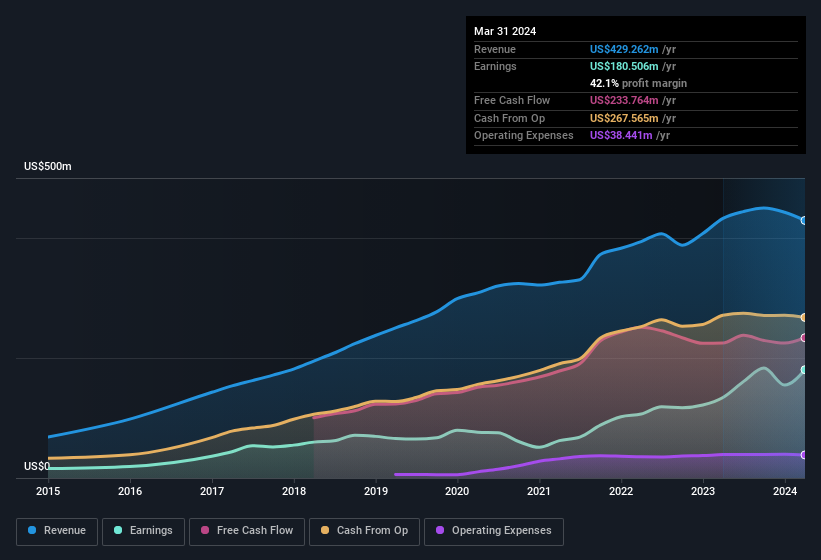

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Broadstone Net Lease reported flat revenue and EBIT margins over the last year. That's not a major concern but nor does it point to the long term growth we like to see.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Broadstone Net Lease's future profits.

Are Broadstone Net Lease Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

While Broadstone Net Lease insiders did net US$98k selling stock over the last year, they invested US$427k, a much higher figure. This overall confidence in the company at current the valuation signals their optimism. Zooming in, we can see that the biggest insider purchase was by CEO & Director John Moragne for US$148k worth of shares, at about US$14.77 per share.

The good news, alongside the insider buying, for Broadstone Net Lease bulls is that insiders (collectively) have a meaningful investment in the stock. Indeed, they hold US$33m worth of its stock. That's a lot of money, and no small incentive to work hard. Despite being just 1.1% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. The cherry on top is that the CEO, John Moragne is paid comparatively modestly to CEOs at similar sized companies. The median total compensation for CEOs of companies similar in size to Broadstone Net Lease, with market caps between US$2.0b and US$6.4b, is around US$6.8m.

Broadstone Net Lease offered total compensation worth US$4.2m to its CEO in the year to December 2023. That seems pretty reasonable, especially given it's below the median for similar sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Is Broadstone Net Lease Worth Keeping An Eye On?

You can't deny that Broadstone Net Lease has grown its earnings per share at a very impressive rate. That's attractive. Furthermore, company insiders have been adding to their significant stake in the company. These things considered, this is one stock worth watching. It's still necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Broadstone Net Lease (at least 2 which are a bit concerning) , and understanding these should be part of your investment process.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Broadstone Net Lease, you'll probably love this curated collection of companies in the US that have an attractive valuation alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Broadstone Net Lease might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BNL

Broadstone Net Lease

BNL is an industrial-focused, diversified net lease REIT that invests in primarily single-tenant commercial real estate properties that are net leased on a long-term basis to a diversified group of tenants.

Average dividend payer with low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026