- United States

- /

- Residential REITs

- /

- NYSE:AMH

If EPS Growth Is Important To You, American Homes 4 Rent (NYSE:AMH) Presents An Opportunity

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

In contrast to all that, many investors prefer to focus on companies like American Homes 4 Rent (NYSE:AMH), which has not only revenues, but also profits. While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Check out our latest analysis for American Homes 4 Rent

How Fast Is American Homes 4 Rent Growing?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That makes EPS growth an attractive quality for any company. Impressively, American Homes 4 Rent has grown EPS by 31% per year, compound, in the last three years. So it's not surprising to see the company trades on a very high multiple of (past) earnings.

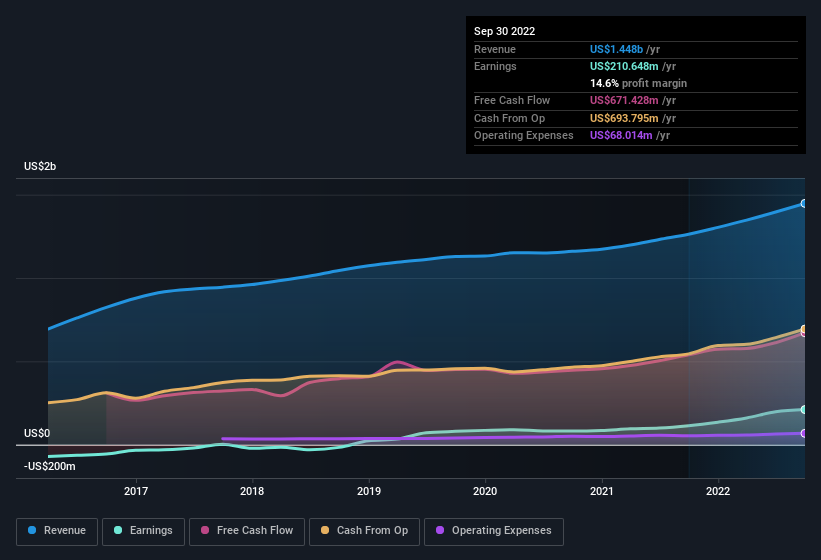

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. EBIT margins for American Homes 4 Rent remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 15% to US$1.4b. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of American Homes 4 Rent's forecast profits?

Are American Homes 4 Rent Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

The US$197k worth of shares that insiders sold during the last 12 months pales in comparison to the US$43m they spent on acquiring shares in the company. This bodes well for American Homes 4 Rent as it highlights the fact that those who are important to the company having a lot of faith in its future. It is also worth noting that it was Independent Trustee Tamara Gustavson who made the biggest single purchase, worth US$28m, paying US$37.01 per share.

Along with the insider buying, another encouraging sign for American Homes 4 Rent is that insiders, as a group, have a considerable shareholding. Notably, they have an enviable stake in the company, worth US$962m. Holders should find this level of insider commitment quite encouraging, since it would ensure that the leaders of the company would also experience their success, or failure, with the stock.

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. The cherry on top is that the CEO, David Singelyn is paid comparatively modestly to CEOs at similar sized companies. Our analysis has discovered that the median total compensation for the CEOs of companies like American Homes 4 Rent, with market caps over US$8.0b, is about US$12m.

American Homes 4 Rent's CEO took home a total compensation package of US$4.6m in the year prior to December 2021. First impressions seem to indicate a compensation policy that is favourable to shareholders. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Does American Homes 4 Rent Deserve A Spot On Your Watchlist?

You can't deny that American Homes 4 Rent has grown its earnings per share at a very impressive rate. That's attractive. Furthermore, company insiders have been adding to their significant stake in the company. These things considered, this is one stock worth watching. Even so, be aware that American Homes 4 Rent is showing 4 warning signs in our investment analysis , and 2 of those are a bit concerning...

The good news is that American Homes 4 Rent is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:AMH

American Homes 4 Rent

AMH (NYSE: AMH) is a leading large-scale integrated owner, operator and developer of single-family rental homes.

Established dividend payer slight.

Similar Companies

Market Insights

Community Narratives