- United States

- /

- Residential REITs

- /

- NYSE:AMH

Here's Why We Think American Homes 4 Rent (NYSE:AMH) Is Well Worth Watching

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

In contrast to all that, many investors prefer to focus on companies like American Homes 4 Rent (NYSE:AMH), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide American Homes 4 Rent with the means to add long-term value to shareholders.

Check out our latest analysis for American Homes 4 Rent

How Fast Is American Homes 4 Rent Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. That means EPS growth is considered a real positive by most successful long-term investors. American Homes 4 Rent's shareholders have have plenty to be happy about as their annual EPS growth for the last 3 years was 59%. While that sort of growth rate isn't sustainable for long, it certainly catches the eye of prospective investors.

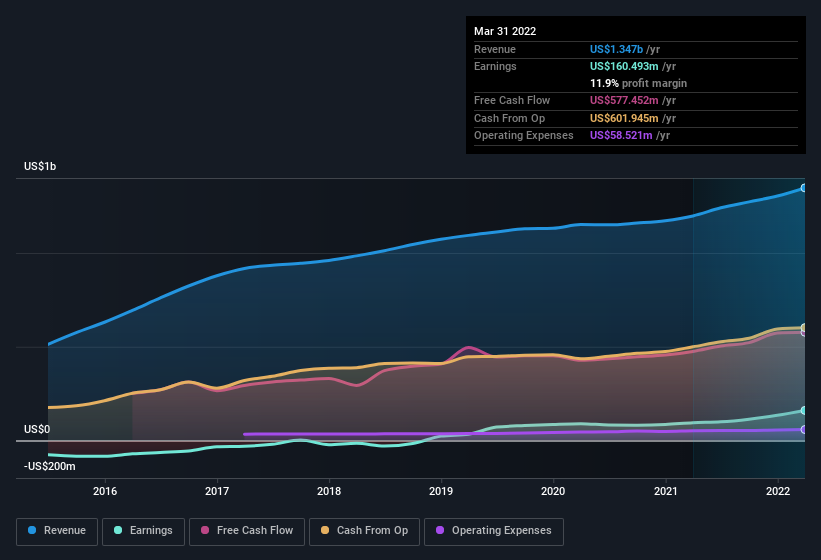

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. EBIT margins for American Homes 4 Rent remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 12% to US$1.3b. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of American Homes 4 Rent's forecast profits?

Are American Homes 4 Rent Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Although we did see some insider selling (worth US$1.4m) this was overshadowed by a mountain of buying, totalling US$28m in just one year. We find this encouraging because it suggests they are optimistic about American Homes 4 Rent'sfuture. We also note that it was the Independent Trustee, Tamara Gustavson, who made the biggest single acquisition, paying US$28m for shares at about US$37.01 each.

On top of the insider buying, it's good to see that American Homes 4 Rent insiders have a valuable investment in the business. We note that their impressive stake in the company is worth US$1.0b. Investors will appreciate management having this amount of skin in the game as it shows their commitment to the company's future.

Shareholders have more to smile about than just insiders adding more shares to their already sizeable holdings. That's because on our analysis the CEO, David Singelyn, is paid less than the median for similar sized companies. The median total compensation for CEOs of companies similar in size to American Homes 4 Rent, with market caps over US$8.0b, is around US$13m.

The American Homes 4 Rent CEO received total compensation of just US$4.6m in the year to December 2021. First impressions seem to indicate a compensation policy that is favourable to shareholders. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add American Homes 4 Rent To Your Watchlist?

American Homes 4 Rent's earnings per share growth have been climbing higher at an appreciable rate. To make matters even better, the company insiders who know the company best have put their faith in the its future and have been buying more stock. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest American Homes 4 Rent belongs near the top of your watchlist. Still, you should learn about the 4 warning signs we've spotted with American Homes 4 Rent (including 1 which is a bit concerning).

There are plenty of other companies that have insiders buying up shares. So if you like the sound of American Homes 4 Rent, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking to trade American Homes 4 Rent, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:AMH

American Homes 4 Rent

AMH (NYSE: AMH) is a leading large-scale integrated owner, operator and developer of single-family rental homes.

Established dividend payer slight.

Similar Companies

Market Insights

Community Narratives