- United States

- /

- REITS

- /

- NYSE:ALEX

Uncovering US Undiscovered Gems With Potential In July 2025

Reviewed by Simply Wall St

As the United States market navigates a complex landscape marked by tariff uncertainties and recent record highs in key indices like the S&P 500 and Nasdaq Composite, investors are keenly observing how these dynamics impact small-cap stocks. In this environment, identifying promising stocks often involves looking for companies with strong fundamentals that can withstand broader market fluctuations and capitalize on emerging opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Oakworth Capital | 42.08% | 15.43% | 7.31% | ★★★★★★ |

| Wilson Bank Holding | 0.00% | 7.88% | 8.09% | ★★★★★★ |

| FineMark Holdings | 122.25% | 2.34% | -26.34% | ★★★★★★ |

| FRMO | 0.09% | 44.64% | 49.91% | ★★★★★☆ |

| Valhi | 43.01% | 1.55% | -2.64% | ★★★★★☆ |

| China SXT Pharmaceuticals | 64.25% | -29.05% | 10.33% | ★★★★★☆ |

| Pure Cycle | 5.11% | 1.07% | -4.05% | ★★★★★☆ |

| Gulf Island Fabrication | 19.65% | -2.17% | 42.26% | ★★★★★☆ |

| Solesence | 82.42% | 23.41% | -1.04% | ★★★★☆☆ |

| Vantage | 6.72% | -16.62% | -15.47% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Mission Produce (AVO)

Simply Wall St Value Rating: ★★★★★★

Overview: Mission Produce, Inc. operates in the sourcing, farming, packaging, marketing, and distribution of avocados, mangoes, and blueberries to food retailers, wholesalers, and foodservice customers both in the United States and internationally with a market cap of $853.07 million.

Operations: Mission Produce generates revenue primarily from its Marketing & Distribution segment, contributing $1.30 billion, followed by Blueberries at $85.30 million and International Farming at $75 million. The company's financial performance is affected by intercompany eliminations of -$66.60 million.

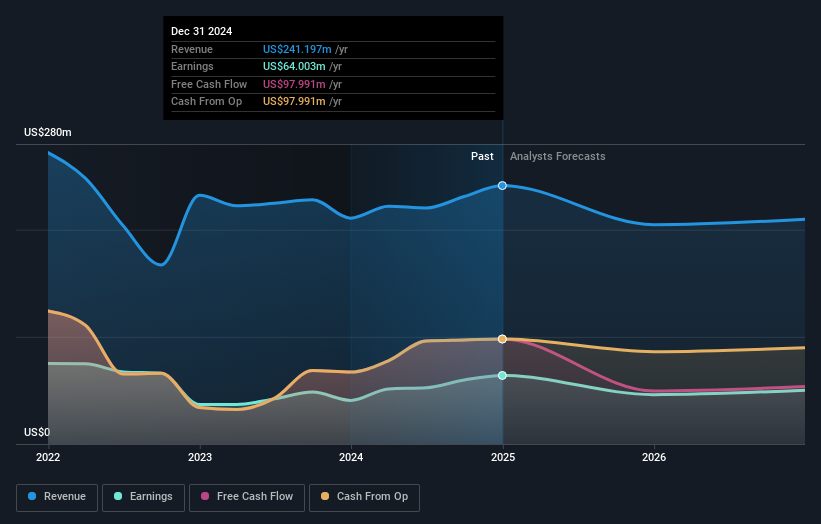

Mission Produce, a dynamic player in the produce sector, is expanding its footprint with new ventures in avocados, blueberries, and mangoes. The company recently reported sales of US$380 million for Q2 2025 compared to US$298 million last year. Despite a net income drop to US$3.1 million from US$7 million previously, Mission's strategic moves include opening a state-of-the-art packinghouse in Guatemala and repurchasing 517,801 shares for US$5.2 million this year. However, challenges like rising costs and supply chain issues persist as it navigates its growth trajectory amidst industry pressures.

Conduent (CNDT)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Conduent Incorporated offers digital business solutions and services across the commercial, government, and transportation sectors globally, with a market capitalization of approximately $453.12 million.

Operations: With a market capitalization of approximately $453.12 million, CNDT generates revenue primarily from its commercial ($1.59 billion), government ($942 million), and transportation ($575 million) segments. The company focuses on providing digital business solutions and services across these sectors globally.

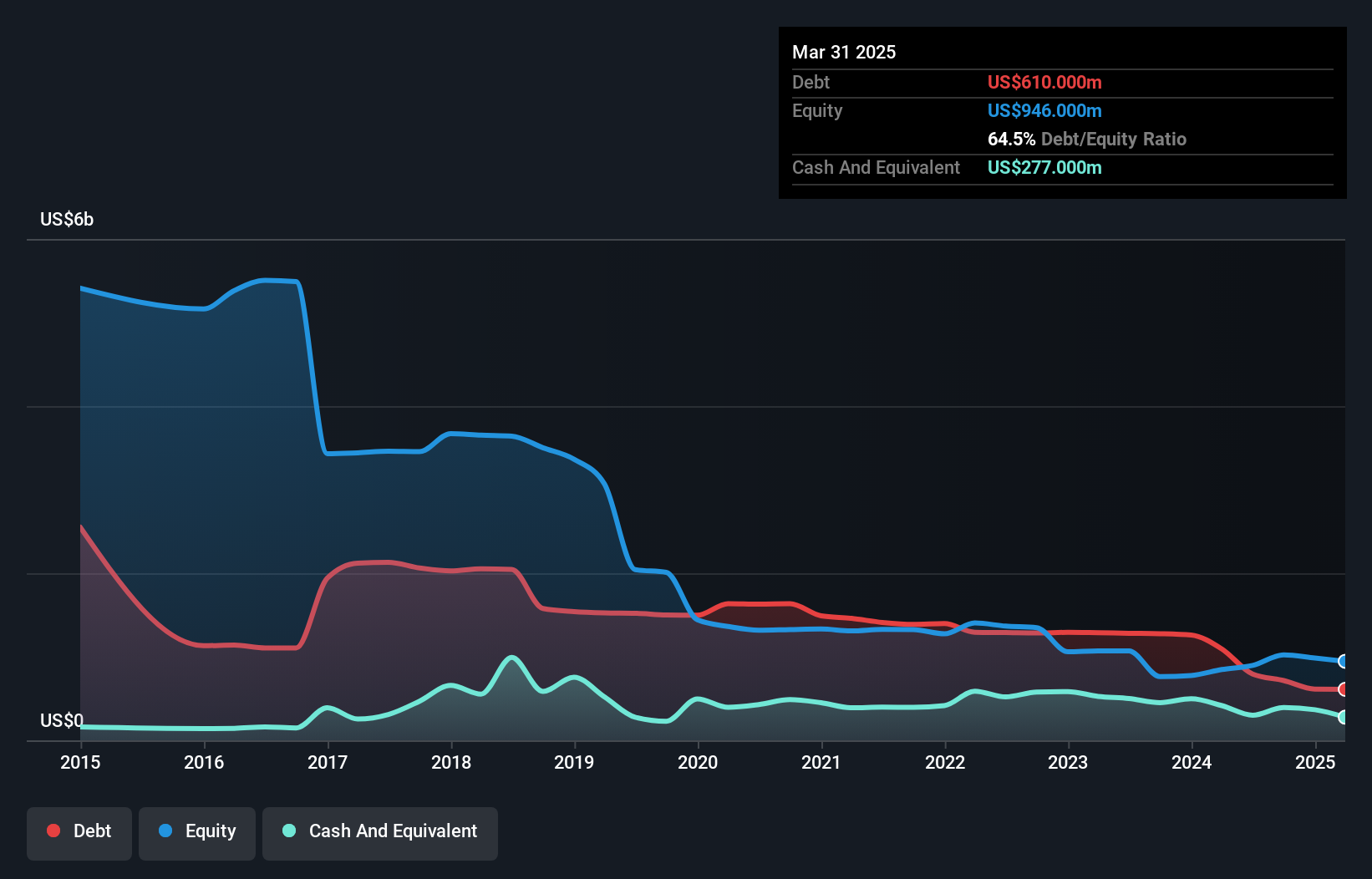

Conduent's recent performance paints a complex picture, with its net debt to equity ratio at 35.2%, deemed satisfactory, and a notable reduction in its debt to equity ratio from 120.1% to 64.5% over five years. Despite becoming profitable last year, the company reported a Q1 2025 net loss of US$51 million against sales of US$751 million, down from US$921 million the previous year. Executive shake-ups include appointing Giles Goodburn as CFO and Harsha Agadi as Chairman effective August 2025, while strategic moves focus on expanding transportation solutions like the innovative 3D Fare Gate Solution showcased recently.

Alexander & Baldwin (ALEX)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Alexander & Baldwin, Inc. (NYSE: ALEX) is a real estate investment trust specializing in Hawai'i commercial real estate, with a market cap of approximately $1.32 billion.

Operations: A&B generates revenue primarily from its commercial real estate segment, which contributed $199.54 million, while land operations added $29.66 million. The company focuses on Hawai'i commercial properties, including grocery-anchored shopping centers.

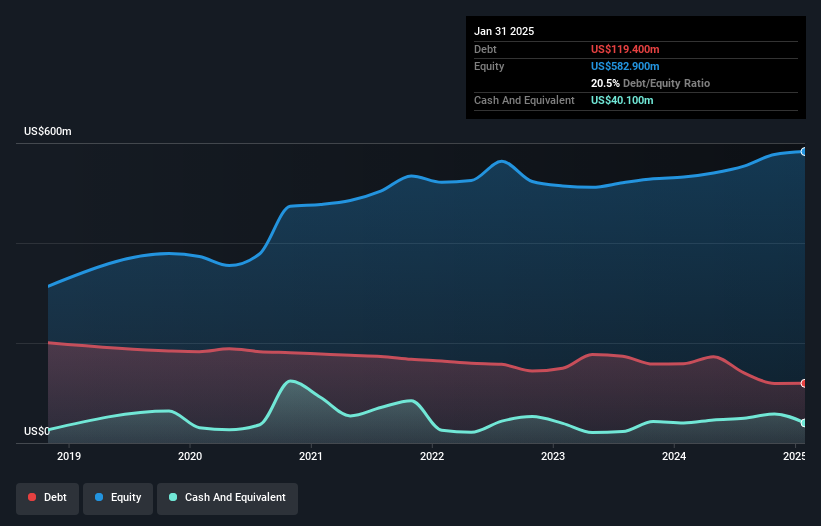

Alexander & Baldwin, a notable player in Hawaii's real estate market, has seen its earnings grow 26% over the past year, outpacing the REITs industry average of 6%. The company is trading at 43% below its estimated fair value and maintains a net debt to equity ratio of 42.5%, which is considered high. Recent strategic moves include redeveloping Komohana Industrial Park with new Class A buildings, expected to boost gross leasable area by 44%. Despite potential revenue declines due to economic uncertainties, Alexander & Baldwin's strong lease executions and improved occupancy rates hint at resilience in challenging times.

Summing It All Up

- Take a closer look at our US Undiscovered Gems With Strong Fundamentals list of 279 companies by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ALEX

Alexander & Baldwin

Alexander & Baldwin, Inc. (NYSE: ALEX) (A&B) is the only publicly-traded real estate investment trust to focus exclusively on Hawai'i commercial real estate and is the state's largest owner of grocery-anchored, neighborhood shopping centers.

Good value with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)