- United States

- /

- Retail REITs

- /

- NYSE:AKR

A Closer Look at Acadia Realty Trust’s (AKR) Valuation After Analyst Revisions and Latest Dividend Announcement

Reviewed by Kshitija Bhandaru

Acadia Realty Trust (NYSE:AKR) has attracted attention as analysts revised their ratings in different directions and institutional investors made notable changes to their holdings. The company also announced a quarterly dividend with a 4.2% yield.

See our latest analysis for Acadia Realty Trust.

Acadia Realty Trust’s share price has been under pressure this year, dipping 19.0% year-to-date; however, three- and five-year total shareholder returns of 69.1% and 137.0% remind investors of its longer-term resilience. Recent moves among institutional investors and a fresh quarterly dividend underscore shifting sentiment and ongoing discussions about the REIT’s value and growth outlook.

If you’re tracking how sentiment is shifting in real estate, now’s a good moment to expand your search and explore fast growing stocks with high insider ownership.

With mixed signals from analysts and shifting positions among large investors, the question remains: is Acadia Realty Trust undervalued at current levels, or is the market already factoring in the company’s next chapter of growth?

Most Popular Narrative: 13.2% Undervalued

Compared to Acadia Realty Trust's last close of $19.35, the most widely followed narrative assigns a fair value of $22.29, suggesting notable upside. This perspective rests on assumptions of accelerated growth and long-term redevelopment opportunities in affluent urban retail corridors.

The ongoing migration of major retailers from department stores and wholesale to direct-to-consumer "mission-critical" urban locations is fueling strong tenant demand for Acadia's street retail portfolio. This is driving sustained same-store rent growth and higher revenue through embedded mark-to-market lease opportunities.

Want to know the secret behind this bullish outlook? The narrative banks on sustained top-line momentum, margin shifts, and a future profit multiple seldom seen beyond high-growth tech. Find out which bold projections power this eye-catching fair value in the full story.

Result: Fair Value of $22.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sharp shifts in consumer habits or unexpected urban regulatory changes could quickly undermine the company’s growth trajectory and weaken the bullish case.

Find out about the key risks to this Acadia Realty Trust narrative.

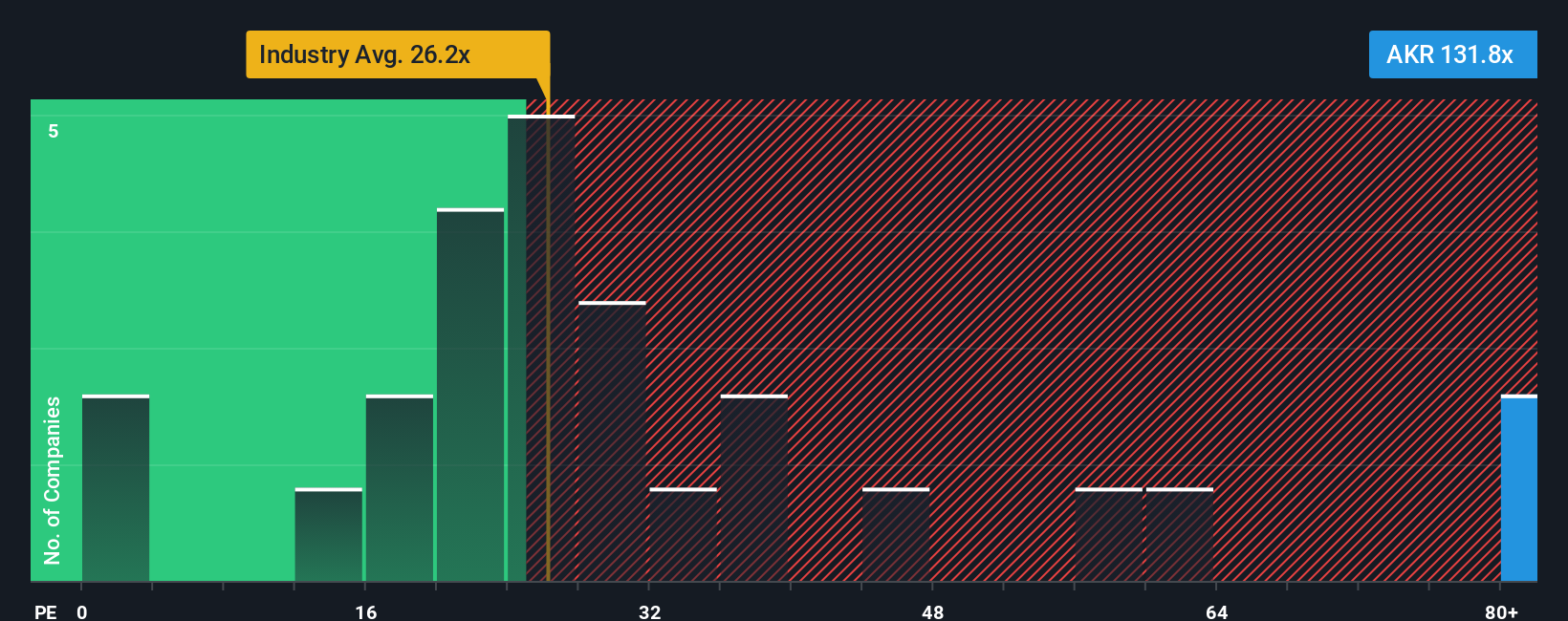

Another View: Price-to-Earnings Tells a Different Story

Looking at the price-to-earnings metric, Acadia Realty Trust trades at 131.9 times its current earnings. This is much higher than the industry average of 25.9 times and the peer average of 56.4 times. Even compared to a fair ratio of 31.9, the stock stands out as pricey. Such a large gap raises the risk that future expectations may be overly optimistic. Does the market really see a runway for such a premium, or is there more caution than the multiples suggest?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Acadia Realty Trust Narrative

If you think there’s another angle or want to take a hands-on approach, you can shape your own view of Acadia Realty Trust in just a few minutes. Do it your way.

A great starting point for your Acadia Realty Trust research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

You owe it to yourself to check out some of the most promising opportunities in today’s market. Making smart moves now could set you up for tomorrow’s wins.

- Tap into the next wave of artificial intelligence breakthroughs by checking out these 24 AI penny stocks, which are poised to shape how industries operate for years to come.

- Secure regular payouts and stability by reviewing these 18 dividend stocks with yields > 3%, featuring companies with yields above 3% that can strengthen your portfolio’s income stream.

- Ride the blockchain trend as financial systems evolve by exploring these 79 cryptocurrency and blockchain stocks, offering exposure to both cryptocurrency innovations and the broader digital asset ecosystem.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AKR

Acadia Realty Trust

An equity real estate investment trust focused on delivering long-term, profitable growth.

Slight risk with acceptable track record.

Similar Companies

Market Insights

Community Narratives