- United States

- /

- Real Estate

- /

- NYSE:TCI

Transcontinental Realty Investors' (NYSE:TCI) Soft Earnings Are Actually Better Than They Appear

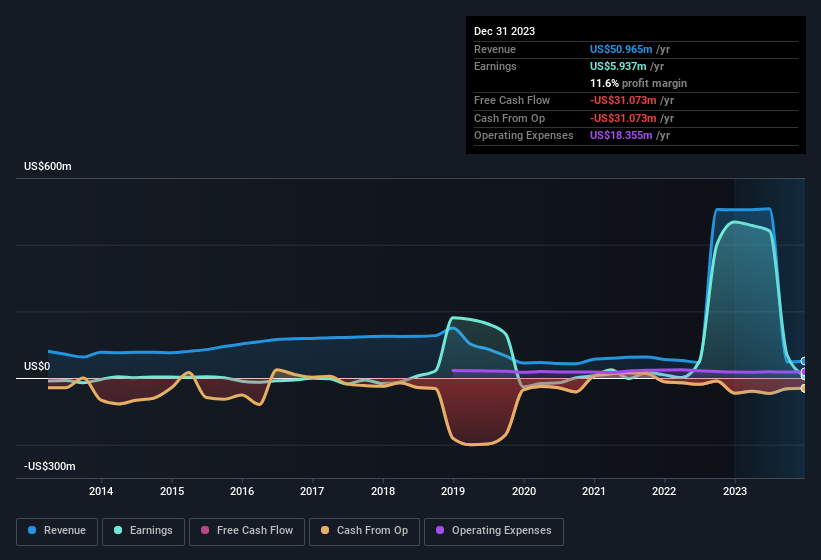

Soft earnings didn't appear to concern Transcontinental Realty Investors, Inc.'s (NYSE:TCI) shareholders over the last week. We think that the softer headline numbers might be getting counterbalanced by some positive underlying factors.

See our latest analysis for Transcontinental Realty Investors

The Impact Of Unusual Items On Profit

For anyone who wants to understand Transcontinental Realty Investors' profit beyond the statutory numbers, it's important to note that during the last twelve months statutory profit was reduced by US$3.6m due to unusual items. It's never great to see unusual items costing the company profits, but on the upside, things might improve sooner rather than later. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And, after all, that's exactly what the accounting terminology implies. Transcontinental Realty Investors took a rather significant hit from unusual items in the year to December 2023. All else being equal, this would likely have the effect of making the statutory profit look worse than its underlying earnings power.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Transcontinental Realty Investors.

Our Take On Transcontinental Realty Investors' Profit Performance

As we mentioned previously, the Transcontinental Realty Investors' profit was hampered by unusual items in the last year. Based on this observation, we consider it possible that Transcontinental Realty Investors' statutory profit actually understates its earnings potential! On the other hand, its EPS actually shrunk in the last twelve months. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. So if you'd like to dive deeper into this stock, it's crucial to consider any risks it's facing. For example, we've discovered 2 warning signs that you should run your eye over to get a better picture of Transcontinental Realty Investors.

This note has only looked at a single factor that sheds light on the nature of Transcontinental Realty Investors' profit. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

Valuation is complex, but we're here to simplify it.

Discover if Transcontinental Realty Investors might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:TCI

Transcontinental Realty Investors

A Dallas-based real estate investment company, holds a diverse portfolio of equity real estate located across the U.S., including office buildings, apartments, shopping centers, and developed and undeveloped land.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives