- United States

- /

- Real Estate

- /

- NYSE:FPH

US Market Undiscovered Gems to Watch in July 2025

Reviewed by Simply Wall St

As the U.S. market navigates through a wave of tariff uncertainties, with key indices like the S&P 500 and Nasdaq showing modest gains despite recent fluctuations, investors are keenly observing how these developments impact small-cap stocks. In this dynamic environment, identifying promising stocks often involves looking for companies that demonstrate resilience and potential growth amid economic challenges, making them worthy of attention as undiscovered gems in the market landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| West Bancorporation | 169.96% | -1.41% | -8.52% | ★★★★★★ |

| Oakworth Capital | 42.08% | 15.43% | 7.31% | ★★★★★★ |

| Metalpha Technology Holding | NA | 81.88% | -4.97% | ★★★★★★ |

| FRMO | 0.09% | 44.64% | 49.91% | ★★★★★☆ |

| Valhi | 43.01% | 1.55% | -2.64% | ★★★★★☆ |

| China SXT Pharmaceuticals | 64.25% | -29.05% | 10.33% | ★★★★★☆ |

| Pure Cycle | 5.11% | 1.07% | -4.05% | ★★★★★☆ |

| Gulf Island Fabrication | 19.65% | -2.17% | 42.26% | ★★★★★☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

| Vantage | 6.72% | -16.62% | -15.47% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

IBEX (IBEX)

Simply Wall St Value Rating: ★★★★★★

Overview: IBEX Limited offers comprehensive technology-driven customer lifecycle experience solutions globally, with a market cap of $407.32 million.

Operations: IBEX generates revenue primarily from its Business Process Outsourcing segment, which accounts for $535.67 million. The company's gross profit margin is 22.5%.

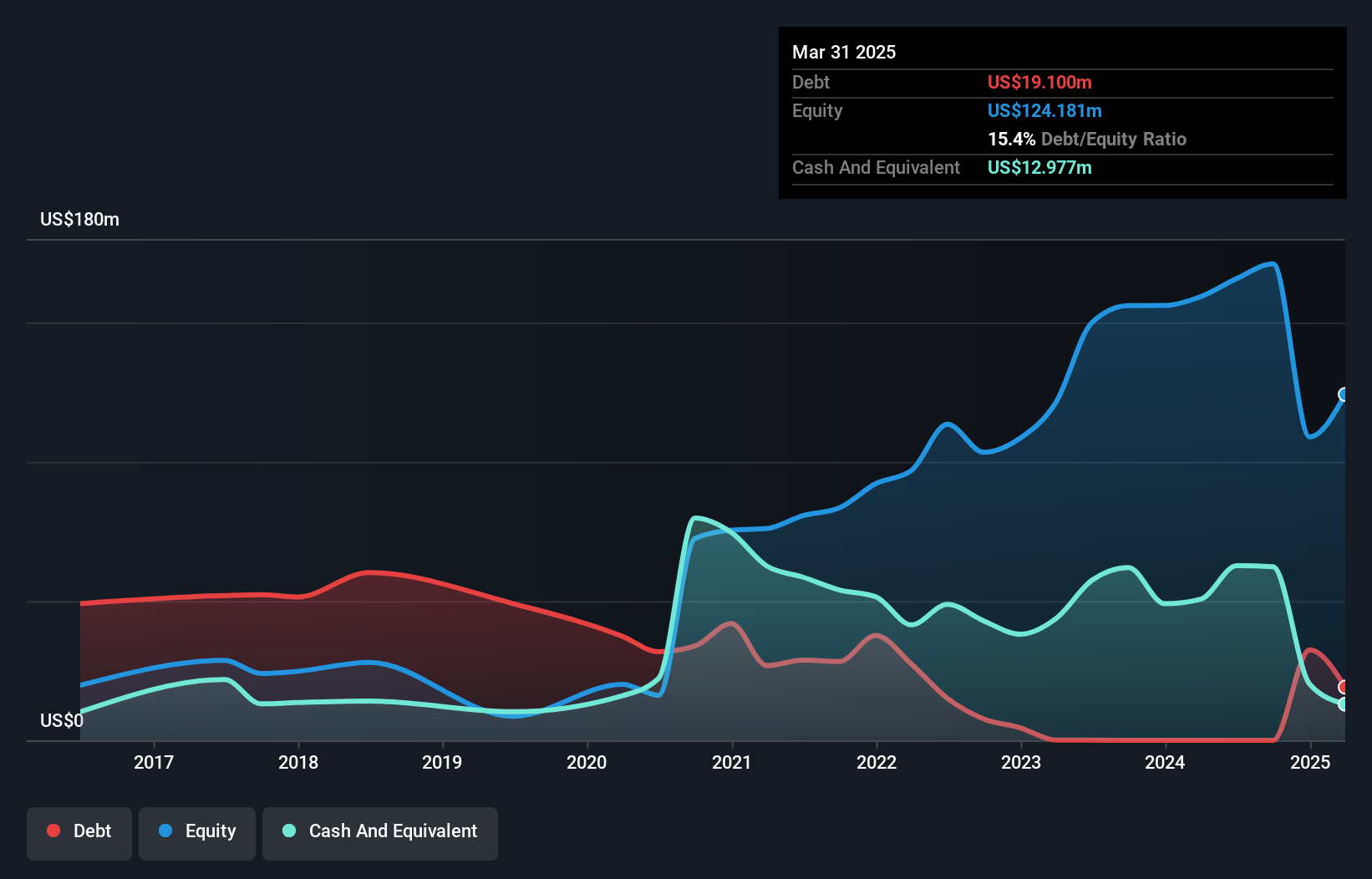

IBEX, a nimble player in the professional services sector, has been making waves with its impressive earnings growth of 31% over the past year, outpacing the industry average of 15.3%. The company's debt-to-equity ratio has significantly improved from 185.5% to just 15.4% over five years, showcasing strong financial management. Despite recent index reshuffling that saw IBEX drop from several value benchmarks and join growth indices like Russell 2000 Growth Benchmark, its shares trade at a good value compared to peers and are currently priced below fair market estimates by about 2.5%.

- Take a closer look at IBEX's potential here in our health report.

Examine IBEX's past performance report to understand how it has performed in the past.

Central Pacific Financial (CPF)

Simply Wall St Value Rating: ★★★★★★

Overview: Central Pacific Financial Corp. is the bank holding company for Central Pacific Bank, offering a variety of commercial banking products and services to businesses, professionals, and individuals in the United States, with a market cap of $787.70 million.

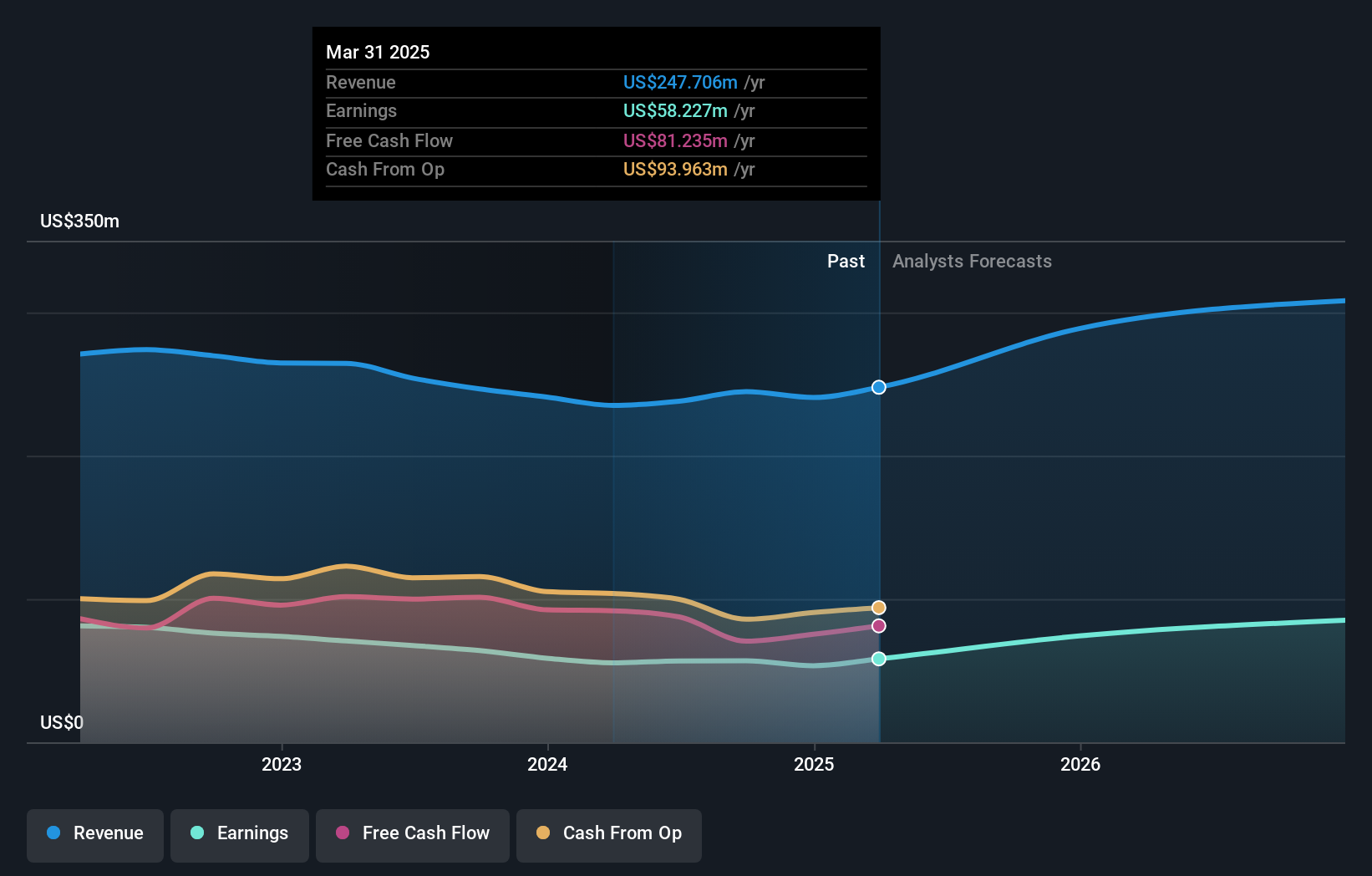

Operations: Central Pacific Financial derives its revenue primarily from its banking segment, totaling $247.71 million. The company's financial structure is centered around commercial banking services within the United States.

Central Pacific Financial, with assets totaling US$7.4 billion and equity of US$557.4 million, showcases a robust financial foundation. The bank's total deposits stand at US$6.6 billion against loans of US$5.3 billion, highlighting its strong deposit base which comprises 96% low-risk funding sources like customer deposits. Its allowance for bad loans is notably sufficient at 0.2% of total loans, ensuring stability amidst potential credit risks. Recent strategic moves include a shelf registration filing for up to $300 million and a share repurchase program involving 77,316 shares worth $2.14 million in early 2025, reflecting confidence in its market position and future growth prospects.

Five Point Holdings (FPH)

Simply Wall St Value Rating: ★★★★★★

Overview: Five Point Holdings, LLC designs, owns, and develops mixed-use planned communities in Orange County, Los Angeles County, and San Francisco County with a market cap of approximately $855.93 million.

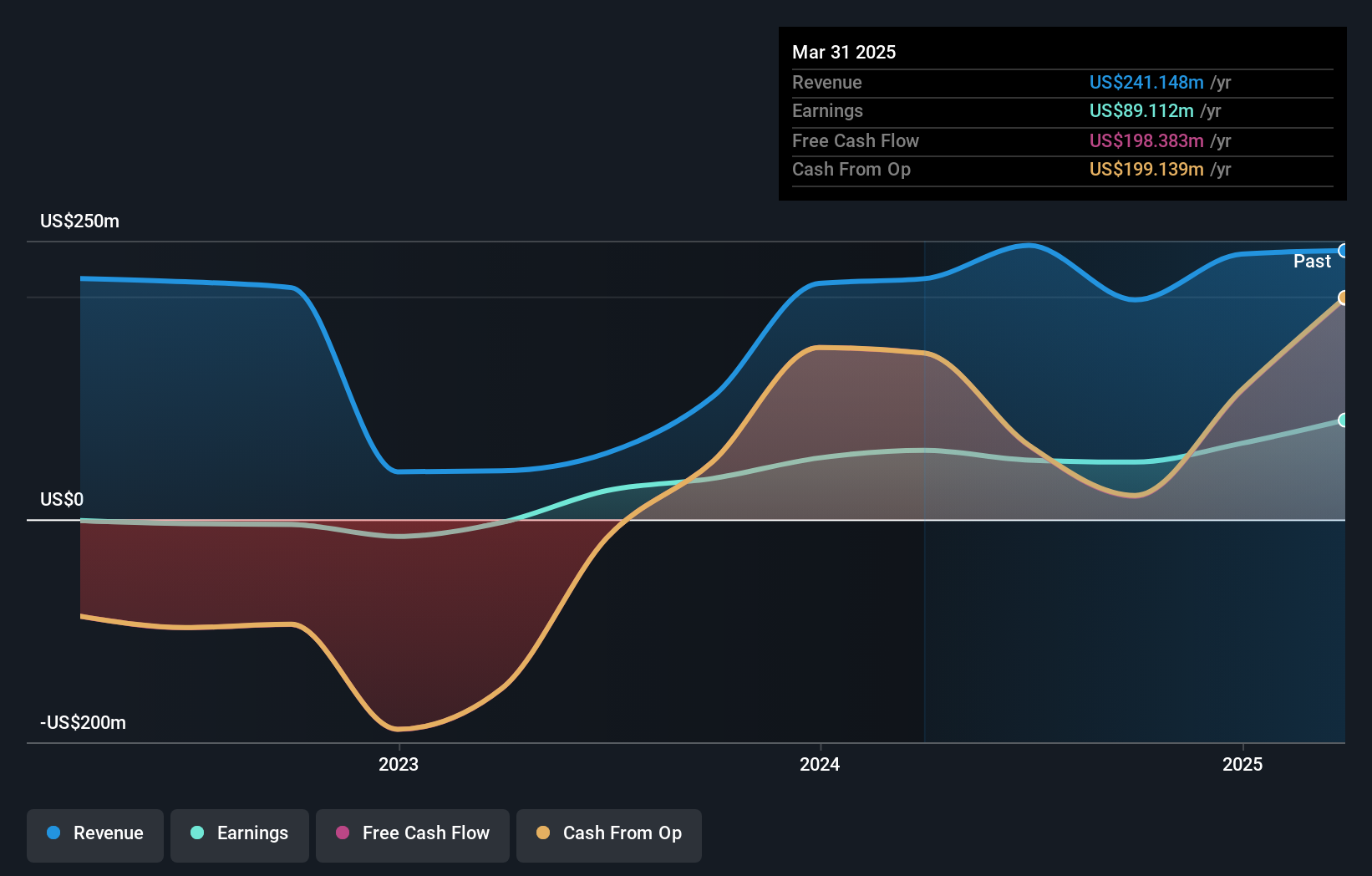

Operations: Five Point Holdings generates revenue primarily from its Great Park and Valencia segments, with Great Park contributing $905.39 million and Valencia adding $140.24 million. The company faces a significant deduction of $805.50 million due to the removal of the Great Park Venture segment.

Five Point Holdings, a nimble player in the real estate sector, has shown impressive earnings growth of 43.8% over the past year, outpacing the industry average of 25.8%. The company is trading at a substantial discount to its estimated fair value by 82.4%, suggesting potential undervaluation. With net income jumping from US$2.33 million to US$23.28 million year-over-year and revenue increasing from US$9.94 million to US$13.16 million, Five Point seems to be on solid ground financially with high-quality earnings and satisfactory debt levels indicated by a net debt-to-equity ratio of just 2.7%.

Make It Happen

- Click this link to deep-dive into the 278 companies within our US Undiscovered Gems With Strong Fundamentals screener.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FPH

Five Point Holdings

Designs, owns, and develops mixed-use planned communities in Orange County, Los Angeles County, and San Francisco County.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives