- United States

- /

- Real Estate

- /

- NYSE:FOR

Forestar Group (FOR): Margin Decline Reinforces Concerns About Slowing Growth Despite Favorable Valuation

Reviewed by Simply Wall St

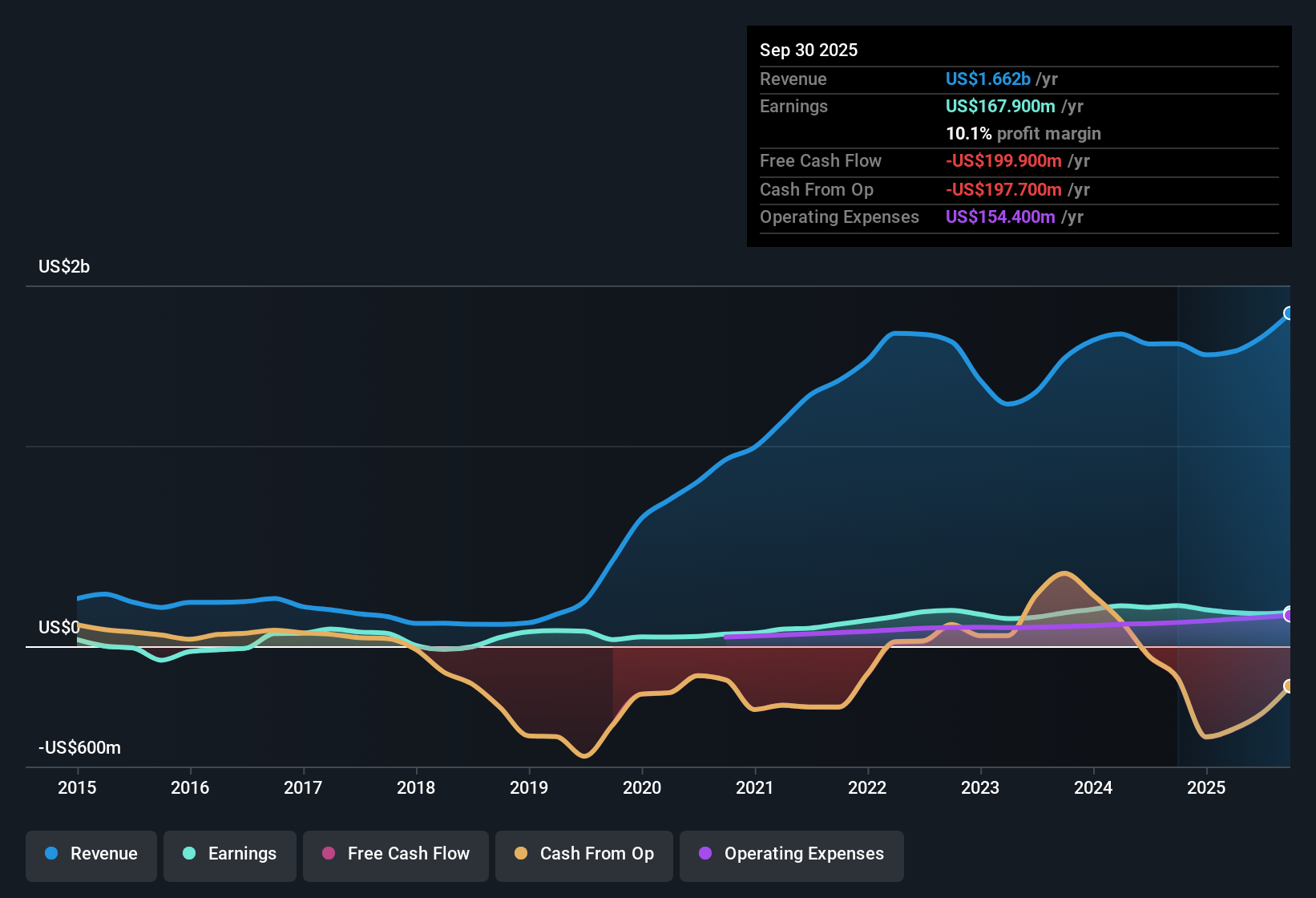

Forestar Group (FOR) turned in high quality earnings, with profits rising at a 15.2% annual clip over the past five years. The company's latest net profit margin slipped to 10.1% from 13.5% last year, and forward-looking forecasts now expect annual earnings growth of 8.78% and revenue growth of 4.9%. Both of these figures lag the broader US market averages. Notably, the company’s price-to-earnings ratio stands at 8.2x, which is better value than both its industry and peer group. However, shares currently trade well above the discounted cash flow estimate, reflecting a market that remains cautiously optimistic even as future growth moderates.

See our full analysis for Forestar Group.The next section will put these latest figures in context, comparing Forestar Group’s reported numbers to the most widely held market narratives and expectations.

See what the community is saying about Forestar Group

Backlog Soars 26%, Locking In $2.3 Billion Future Revenue

- Forestar’s record backlog of lots under contract grew 26% year-over-year, representing $2.3 billion in future secured revenue and now covering 38% of the company’s owned lots.

- Analysts' consensus view suggests that this backlog, supported by integration with D.R. Horton and expansion into high-demand markets, helps insulate Forestar from near-term housing demand swings.

- The predictable lot pipeline is expected to drive above-average sales volume and lower earnings volatility, even as national housing supply remains constrained.

- The backlog supports management’s confidence in multi-year revenue and earnings growth despite the industry’s cyclical headwinds.

- To see how this sustained growth could shape Forestar’s long-term value, dive deeper into our complete Consensus Narrative for context. 📊 Read the full Forestar Group Consensus Narrative.

Gross Margins Slip Toward Low End of Range

- Gross profit margins fell from 22.5% to 20.4% over the last year and are expected by management to stay near the lower end of their historical range, with net profit margins currently at 10.1% versus 13.5% a year ago.

- Consensus narrative highlights that pricing power and a favorable product mix are helping Forestar partially offset higher costs, but persistent affordability challenges, elevated mortgage rates, and aggressive pricing could weigh down future margins.

- While stabilized development costs help prevent a steeper margin decline, bears might worry that these levels signal risk for further compression if cost inflation or regional slowdowns re-accelerate.

- Analysts note that margin stability becomes even more critical as net profit guidance drops to 8.0% over the next 3 years, pressuring future earnings quality.

Valuation Gap: Shares Trade Well Above DCF Fair Value

- Forestar trades at $27.07 per share, significantly above the DCF fair value of $3.63, with a price-to-earnings ratio of 8.2x versus the US real estate industry average of 25.3x and the peer average of 11x.

- Consensus narrative flags this mismatch, noting that while Forestar screens as cheap on a PE basis, the sizable premium to calculated fair value may reflect the market’s faith in backlog durability and exposure to long-term housing trends.

- Even with analyst price targets clustered around $30.00, the current share price already anticipates some future growth, so any margin miss or sales slowdown could impact valuation quickly.

- This tension highlights how investors must weigh a favorable comparative PE ratio against a potentially overstretched price relative to fundamental DCF value.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Forestar Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a distinct take on Forestar’s figures? Share your perspective and shape your personal market story in just a few minutes. Do it your way

A great starting point for your Forestar Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Despite Forestar’s appealing price-to-earnings ratio and backlog strength, its shares are trading far above fair value. Profit margins are under increasing pressure from rising costs and market constraints.

If you want better value for your portfolio, consider these 853 undervalued stocks based on cash flows where you can target opportunities at a more attractive price relative to their fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FOR

Forestar Group

Operates as a residential lot development company in the United States.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)