- United States

- /

- Real Estate

- /

- NYSE:COMP

US Exchange: CoStar Group And 2 Other Stocks That May Be Trading Below Estimated Value

Reviewed by Simply Wall St

As the United States stock market experiences a surge, buoyed by strong bank earnings and favorable inflation data that have reignited hopes for Federal Reserve rate cuts, investors are keenly eyeing opportunities that may be trading below their intrinsic value. In such an environment, identifying stocks with solid fundamentals and potential for growth can be crucial for those looking to capitalize on market movements.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Atlantic Union Bankshares (NYSE:AUB) | $38.12 | $75.65 | 49.6% |

| Dime Community Bancshares (NasdaqGS:DCOM) | $32.25 | $61.63 | 47.7% |

| Berkshire Hills Bancorp (NYSE:BHLB) | $28.57 | $56.53 | 49.5% |

| Old National Bancorp (NasdaqGS:ONB) | $22.76 | $44.25 | 48.6% |

| German American Bancorp (NasdaqGS:GABC) | $39.96 | $78.06 | 48.8% |

| Kanzhun (NasdaqGS:BZ) | $14.01 | $27.22 | 48.5% |

| Dynatrace (NYSE:DT) | $50.52 | $96.67 | 47.7% |

| LifeMD (NasdaqGM:LFMD) | $4.90 | $9.77 | 49.8% |

| Bilibili (NasdaqGS:BILI) | $16.83 | $32.75 | 48.6% |

| Coeur Mining (NYSE:CDE) | $6.39 | $12.63 | 49.4% |

Let's uncover some gems from our specialized screener.

CoStar Group (NasdaqGS:CSGP)

Overview: CoStar Group, Inc. offers information, analytics, and online marketplace services to professionals in the commercial real estate, hospitality, and residential industries across multiple regions including the United States and Europe, with a market cap of approximately $28.54 billion.

Operations: The company's revenue segment is primarily derived from Internet Information Providers, generating approximately $2.67 billion.

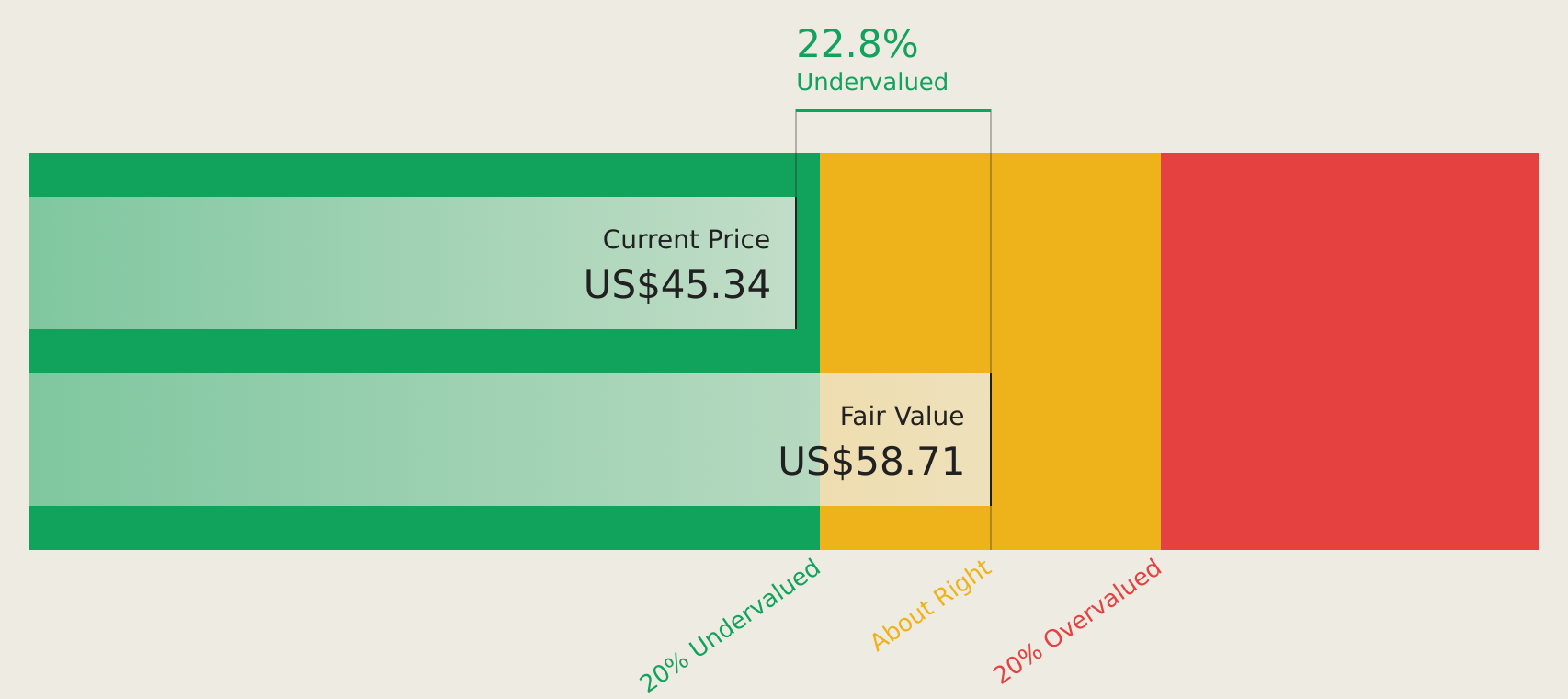

Estimated Discount To Fair Value: 29.0%

CoStar Group's stock is trading at US$73.22, significantly below its estimated fair value of US$103.15, suggesting it may be undervalued based on cash flows. Although recent profit margins have declined from 16.9% to 6.6%, the company's earnings are expected to grow substantially at 35% annually over the next three years, outpacing market averages. Despite some insider selling, revenue growth forecasts remain robust at 12.5% per year, exceeding broader U.S. market expectations.

- In light of our recent growth report, it seems possible that CoStar Group's financial performance will exceed current levels.

- Navigate through the intricacies of CoStar Group with our comprehensive financial health report here.

Old National Bancorp (NasdaqGS:ONB)

Overview: Old National Bancorp is a bank holding company for Old National Bank, offering a range of financial services to individual and commercial clients in the United States, with a market cap of approximately $7.38 billion.

Operations: The company generates revenue from its Community Banking segment, amounting to $1.75 billion.

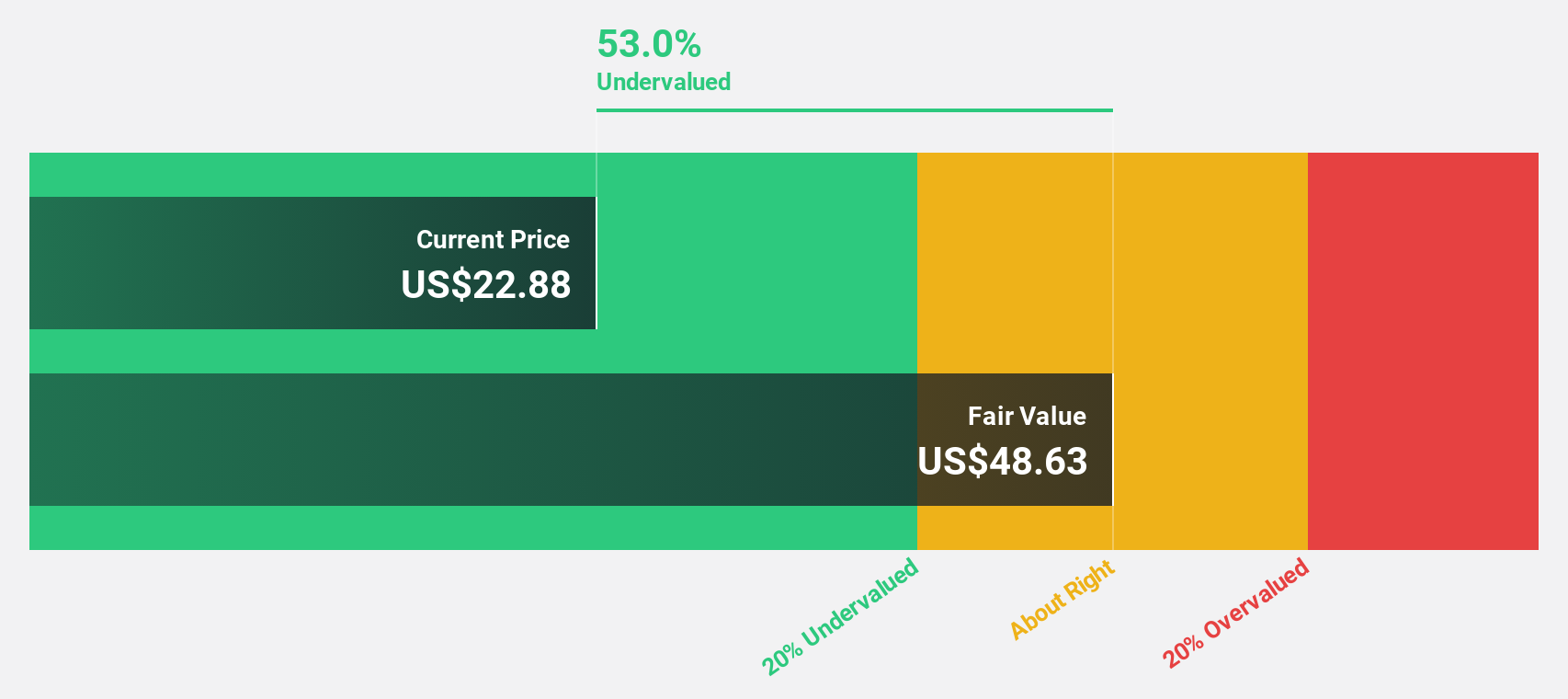

Estimated Discount To Fair Value: 48.6%

Old National Bancorp, trading at US$22.76, is valued below its estimated fair value of US$44.25, highlighting potential undervaluation based on cash flows. Despite recent shareholder dilution and a forecasted low return on equity of 11% in three years, earnings are expected to grow significantly by 30% annually, surpassing market averages. The company recently raised nearly US$400 million through a follow-on equity offering and maintains a reliable dividend yield of 2.46%.

- Our comprehensive growth report raises the possibility that Old National Bancorp is poised for substantial financial growth.

- Click to explore a detailed breakdown of our findings in Old National Bancorp's balance sheet health report.

Compass (NYSE:COMP)

Overview: Compass, Inc. operates as a real estate brokerage service provider in the United States with a market cap of approximately $2.85 billion.

Operations: The company's revenue is primarily derived from its Internet Information Providers segment, totaling $5.35 billion.

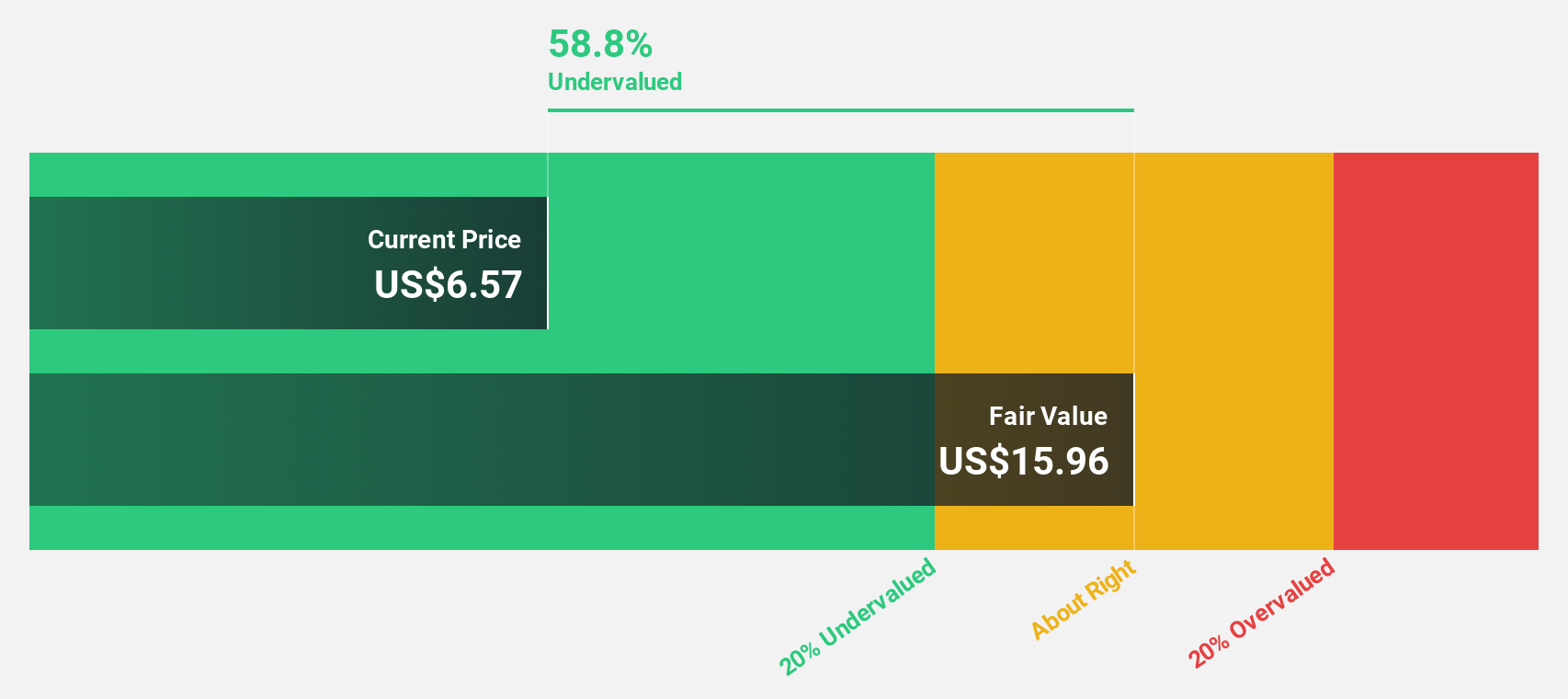

Estimated Discount To Fair Value: 32.6%

Compass, Inc., trading at US$6.66, is valued below its estimated fair value of US$9.88, suggesting potential undervaluation based on cash flows. The company forecasts revenue growth of 12.5% annually, outpacing the broader US market's 8.9%. Recent strategic alliances with Christie's International Real Estate aim to boost domestic and international expansion. Despite a current net loss, Compass expects profitability within three years, supported by raised earnings guidance for 2024's fourth quarter and full year revenues.

- According our earnings growth report, there's an indication that Compass might be ready to expand.

- Get an in-depth perspective on Compass' balance sheet by reading our health report here.

Summing It All Up

- Unlock our comprehensive list of 169 Undervalued US Stocks Based On Cash Flows by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Compass, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:COMP

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives