- United States

- /

- Real Estate

- /

- NYSE:COMP

Compass (COMP): Reassessing Valuation After Google Tests Direct Home Listing Search Tool

Reviewed by Simply Wall St

Compass (COMP) slid about 4% after investors digested reports that Google is testing home listing results directly in search, which could pose a potential long term headwind for traffic, agent engagement, and platform economics.

See our latest analysis for Compass.

Even with today’s pullback on the Google news, Compass’s 30 day share price return of roughly 10% and powerful year to date share price return near 80% suggest positive momentum. A standout three year total shareholder return above 300% shows the longer term thesis is still very much alive.

If this kind of platform risk has you thinking about diversification, it could be worth exploring fast growing stocks with high insider ownership as a way to uncover other high conviction growth stories.

With the stock still trading at a near 30% discount to one intrinsic value estimate, but hovering close to Wall Street’s price target, investors now face a key question: Is Compass undervalued or already pricing in its next leg of growth?

Most Popular Narrative Narrative: 1.2% Overvalued

With Compass last closing at $10.34 versus a most popular narrative fair value near $10.22, the story leans only slightly rich and hinges on ambitious integration upside.

The combined platform is expected to generate pro forma 2025 revenue of roughly $12.8B, which, when paired with targeted cost synergies, is seen as a catalyst for operating leverage and multiple expansion.

Curious how a modest premium price leans on bold revenue scaling, margin lift, and a richer future earnings multiple than today? Want to see the full playbook?

Result: Fair Value of $10.22 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, structural shifts in commission models and heightened regulatory scrutiny could compress margins and disrupt agent retention, pressuring Compass’s growth-dependent valuation narrative.

Find out about the key risks to this Compass narrative.

Another Angle on Valuation

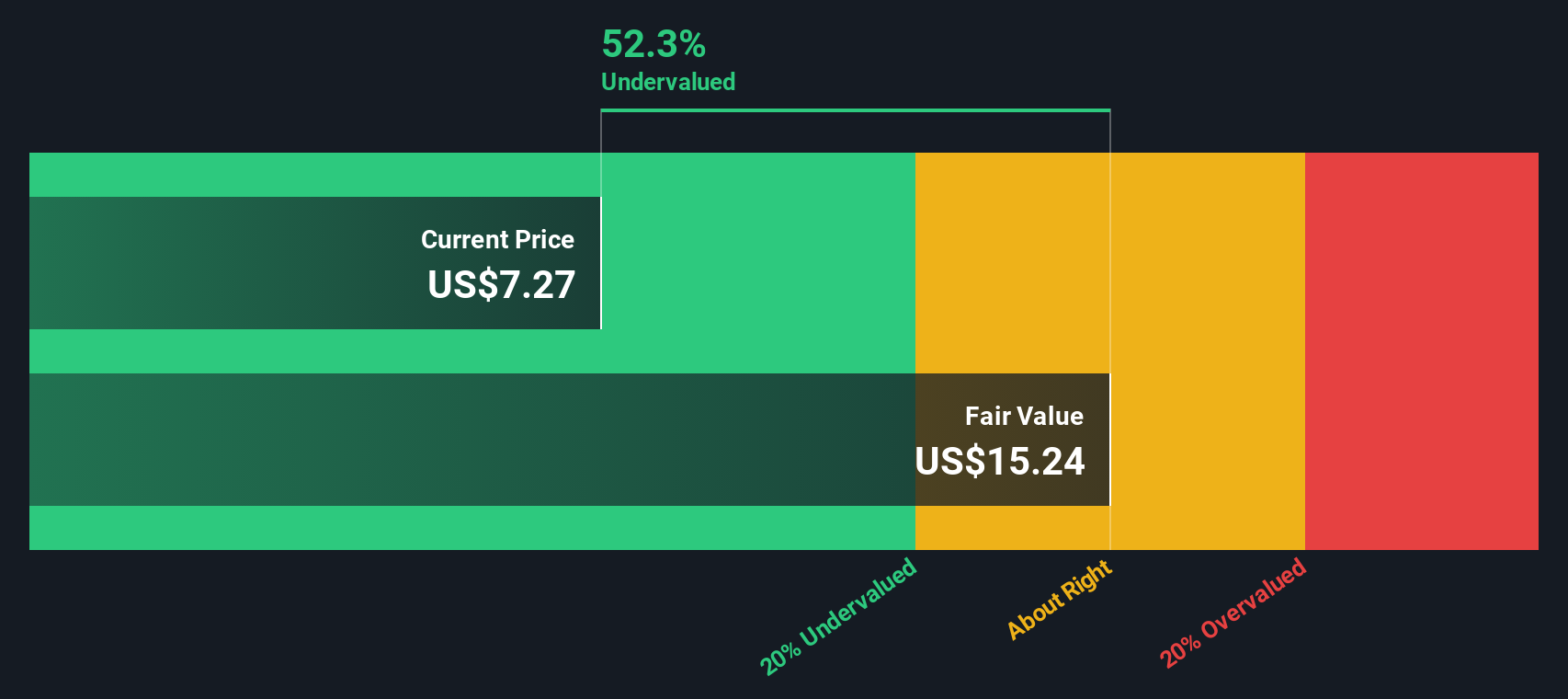

While the narrative based fair value hints at slight overvaluation, the SWS DCF model paints a different picture, suggesting Compass is trading about 30% below its estimated intrinsic value. If the cash flow story proves right, is the market underestimating how durable Compass’s economics really are?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Compass Narrative

If you see the data differently or want to stress test your own assumptions, you can build a personalized Compass narrative in just minutes with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Compass.

Looking for more investment ideas?

Do not stop at Compass. Sharpen your edge by tapping into focused stock ideas that align with your strategy before the next wave of opportunities passes you by.

- Capture potential multi-baggers early by scanning these 3627 penny stocks with strong financials with robust balance sheets and room to run.

- Position yourself at the frontier of innovation by targeting these 25 AI penny stocks shaping the future of intelligent automation and data driven decision making.

- Explore more predictable income streams by reviewing these 13 dividend stocks with yields > 3% that combine yields with underlying fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:COMP

Good value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)