- United States

- /

- Real Estate

- /

- NYSE:CBRE

CBRE Group (NYSE:CBRE) Sees 7% Price Dip Despite US$10,404 Million Revenue Growth

Reviewed by Simply Wall St

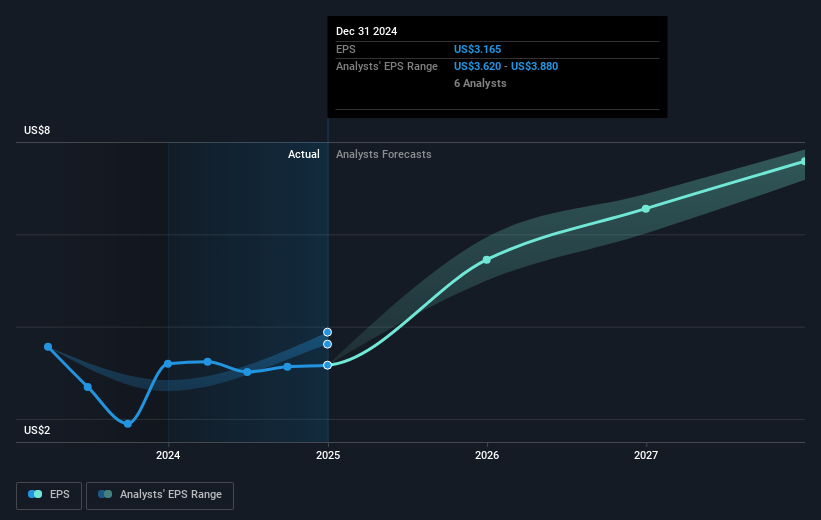

CBRE Group (NYSE:CBRE) experienced a 7% price decline last quarter, coinciding with several company events such as the amendment of its bylaws and an active share buyback program repurchasing over 6 million shares. Despite robust Q4 earnings, with revenue growth of $10,404 million from $8,950 million year-over-year, broader market factors including heightened tariffs on Canadian imports and fears of a potential recession likely influenced share performance. The market showed a general downturn during this period, with indices like the Dow Jones and S&P 500 also experiencing declines of more than 1%. The company's commitments to M&A initiatives and significant projects, such as the deployment of EV chargers with EVPassport, are positioned against this backdrop of economic uncertainty and market volatility, contributing to investor caution and affecting CBRE's share price movement.

See the full analysis report here for a deeper understanding of CBRE Group.

Over the past five years, CBRE Group has achieved a total return of 227.92%, reflecting its strong position in the market. This period has been marked by significant corporate actions, including a substantial share buyback program authorized at US$9 billion, underscoring a commitment to returning value to shareholders. The company's strategic M&A activity, such as the acquisition of Industrious National Management Company for US$400 million, aims to expand its flexible workspace offerings, aligning with evolving market trends.

CBRE's expansion efforts are further complemented by its partnership with EVPassport to deploy over 3,600 electric vehicle chargers across the U.S., responding to increased sustainability demands. Despite recent challenges, the company exceeded the broader market's annual return, as well as the US Real Estate industry's performance over the past year, affirming its resilience in navigating economic fluctuations and enhancing its market position.

- Analyze CBRE Group's fair value against its market price in our detailed valuation report—access it here.

- Gain insight into the risks facing CBRE Group and how they might influence its performance—click here to read more.

- Shareholder in CBRE Group? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CBRE

CBRE Group

Operates as a commercial real estate services and investment company in the United States, the United Kingdom, and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives