- United States

- /

- Real Estate

- /

- NYSE:CBRE

CBRE Group (CBRE): Evaluating Valuation After a Year of Quiet Outperformance

Reviewed by Simply Wall St

CBRE Group (CBRE) has moved into the spotlight this week and investors are starting to take notice. Without a single headline-driving announcement, it is the stock’s quiet momentum and year-long returns that have piqued curiosity. Sometimes, the real story is not a breaking event, but steady performance in a sector that is often ignored until a shift becomes too big to miss.

Looking at the bigger picture for CBRE Group, the company’s shares have delivered a strong 43% return over the past year, easily outpacing both peers and broad indices. Gains have accelerated in the past 3 months as well, hinting at renewed faith in the company’s fundamentals. This uptick comes on the back of annual revenue and income growth, though there has not been a single event to explain the rally. It comes down to the numbers and sentiment so far.

With CBRE Group gaining ground, the question for investors now is whether the stock has more room to run, or if the market is already building in all that future growth.

Most Popular Narrative: 3.2% Undervalued

The prevailing narrative judges CBRE Group as modestly undervalued, using assumptions that blend its recent performance, future growth prospects, and known risks. This evaluation weighs expected earnings gains, margin expansion, and capital strategies to estimate the company’s fair worth under current market conditions and applies a discount rate just under 9%.

CBRE’s strategic realignment of its Project Management and Building Operations & Experience segments has resulted in strong financial performance and is expected to drive future growth by enhancing operational synergies, including shared client access and opportunities for mergers and acquisitions. This is likely to positively impact both revenue and net margins.

Want to know the bold moves behind this valuation? The narrative’s secret sauce is a combination of high-conviction revenue growth, a future margin leap, and projected earnings that may surprise you. Curious about which financial levers drive this price target? Uncover the pivotal numbers that power the latest underappreciated story in real estate.

Result: Fair Value of $169.73 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, global economic uncertainty or ongoing interest rate volatility could easily cool CBRE's momentum just as quickly as it gained it.

Find out about the key risks to this CBRE Group narrative.Another View: Market Ratios Tell a Different Story

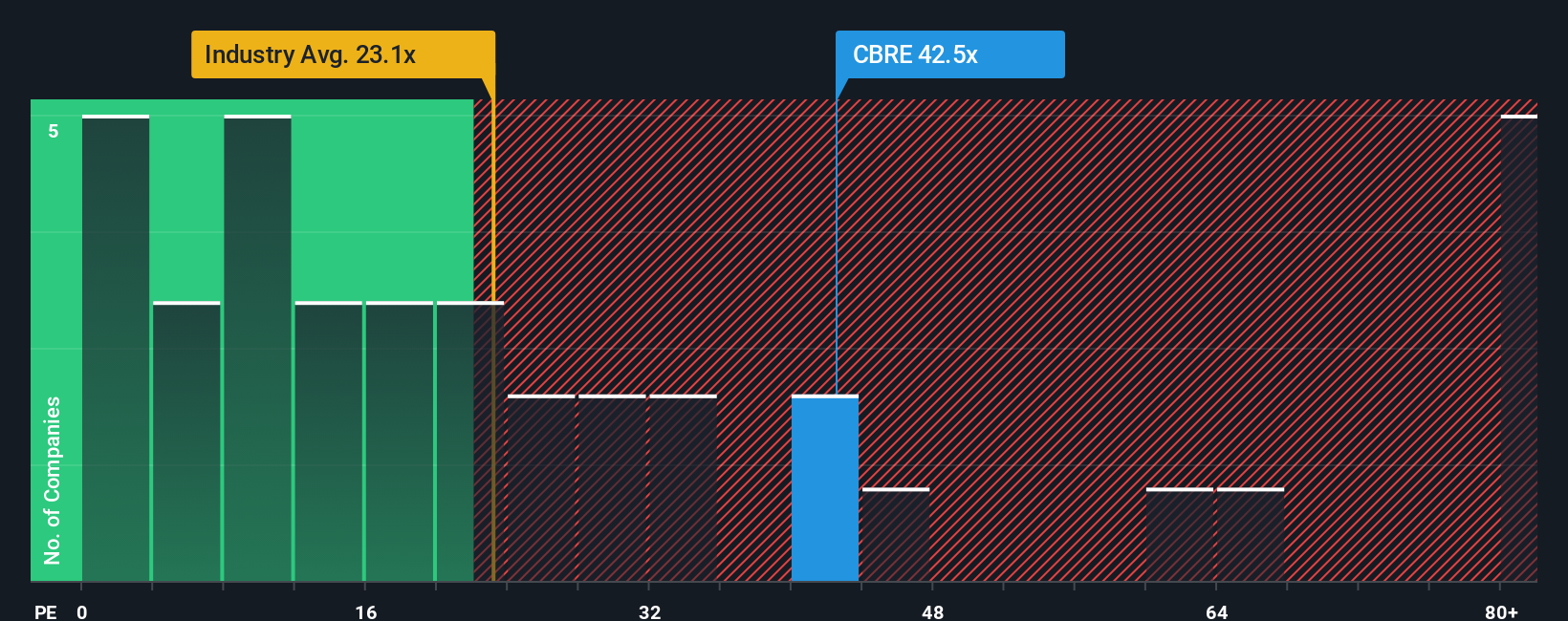

Looking at the stock from a market perspective, CBRE appears expensive when compared to the broader industry, based on common valuation ratios. Does this highlight a limit to the recent optimism, or are there factors that the ratios do not capture?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding CBRE Group to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own CBRE Group Narrative

If you like to dig deeper or think there’s a different story in the numbers, you can quickly craft your own perspective in just a few minutes: Do it your way.

A great starting point for your CBRE Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let a great opportunity slip by. Take your investing to the next level by using the Simply Wall Street Screener to find tomorrow’s great stocks today.

- Target high-yield potential by reviewing companies delivering dividend stocks with yields > 3%. These can enhance your portfolio’s cash flow.

- Spot under-the-radar bargains by investigating undervalued stocks based on cash flows. Stay one step ahead of the market crowd.

- Get ahead of the next big wave in technology by checking out quantum computing stocks. See which innovators could rewrite the rules in quantum computing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:CBRE

CBRE Group

Operates as a commercial real estate services and investment company in the United States, the United Kingdom, and internationally.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)