- United States

- /

- Health Care REITs

- /

- NYSE:AHR

January 2025 US Stocks Estimated To Be Trading Below Fair Value

Reviewed by Simply Wall St

As the United States stock market rebounds from a recent selloff, investors are turning their attention to earnings reports and the Federal Reserve's policy meeting. Amidst this volatility, identifying stocks trading below their fair value can offer potential opportunities for those looking to navigate the current market landscape. Understanding what constitutes a good stock involves evaluating factors such as financial health, growth potential, and resilience in uncertain economic conditions.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Flushing Financial (NasdaqGS:FFIC) | $14.32 | $27.93 | 48.7% |

| Berkshire Hills Bancorp (NYSE:BHLB) | $28.83 | $56.63 | 49.1% |

| First National (NasdaqCM:FXNC) | $24.87 | $48.63 | 48.9% |

| Midland States Bancorp (NasdaqGS:MSBI) | $19.28 | $37.85 | 49.1% |

| Privia Health Group (NasdaqGS:PRVA) | $22.73 | $44.59 | 49% |

| Open Lending (NasdaqGM:LPRO) | $5.64 | $11.14 | 49.4% |

| Ubiquiti (NYSE:UI) | $397.44 | $776.50 | 48.8% |

| Verra Mobility (NasdaqCM:VRRM) | $26.73 | $52.19 | 48.8% |

| Equifax (NYSE:EFX) | $273.35 | $534.81 | 48.9% |

| Tenable Holdings (NasdaqGS:TENB) | $44.50 | $86.85 | 48.8% |

We'll examine a selection from our screener results.

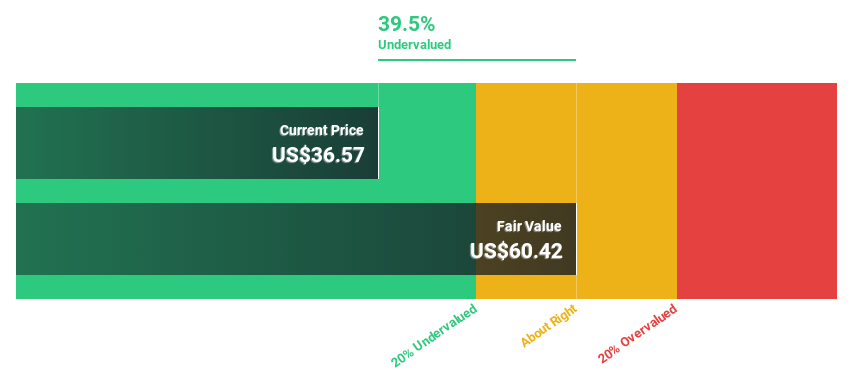

WesBanco (NasdaqGS:WSBC)

Overview: WesBanco, Inc. is a bank holding company for WesBanco Bank, Inc., with a market cap of approximately $2.36 billion.

Operations: WesBanco generates revenue through its banking operations, including commercial and retail banking services, as well as wealth management and trust services.

Estimated Discount To Fair Value: 45.6%

WesBanco is trading at US$35.03, significantly below its estimated fair value of US$64.42, suggesting it may be undervalued based on cash flows. The company's earnings are forecast to grow substantially at 47.2% annually, outpacing the broader U.S. market's growth rate of 14.7%. However, its return on equity is expected to remain low at 9.7% in three years. Recent earnings show improved net income and interest income year-over-year, supporting positive cash flow prospects.

- The growth report we've compiled suggests that WesBanco's future prospects could be on the up.

- Take a closer look at WesBanco's balance sheet health here in our report.

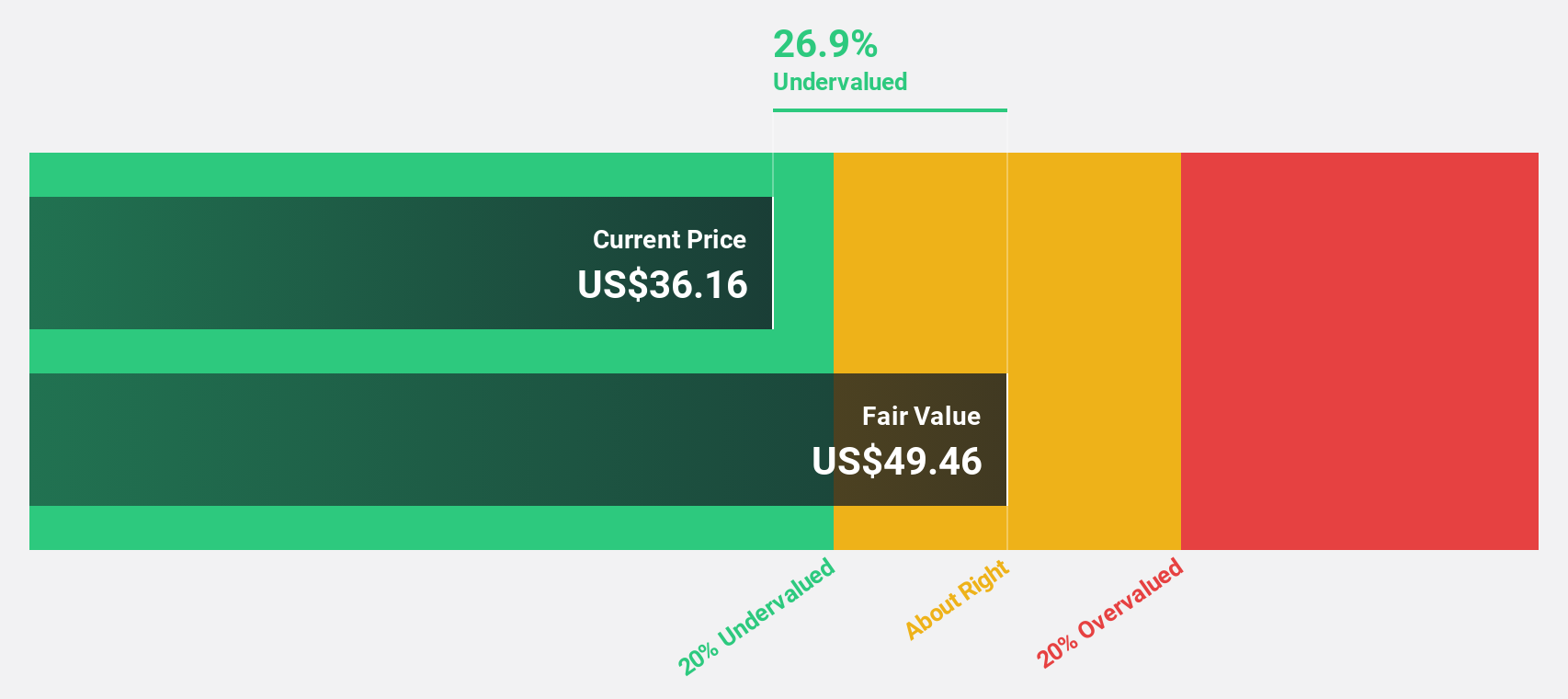

American Healthcare REIT (NYSE:AHR)

Overview: American Healthcare REIT, Inc. is a self-managed real estate investment trust specializing in acquiring, owning, and operating a diverse portfolio of clinical healthcare properties such as outpatient medical buildings and senior housing, with a market cap of approximately $4.58 billion.

Operations: The company's revenue segments include $137.72 million from outpatient medical buildings, $238.76 million from senior housing operating properties, $52.51 million from triple-net leased properties, and $1.58 billion from integrated senior health campuses.

Estimated Discount To Fair Value: 19.7%

American Healthcare REIT is trading at US$29.63, slightly below its fair value estimate of US$36.92, highlighting potential undervaluation based on cash flows. Despite a low forecasted return on equity of 3.6%, the company anticipates becoming profitable within three years with earnings growth expected at 38.67% annually. Recent activities include a $500 million follow-on equity offering and strategic acquisitions aimed at enhancing portfolio value, while maintaining dividend distributions despite current cash flow coverage challenges.

- According our earnings growth report, there's an indication that American Healthcare REIT might be ready to expand.

- Dive into the specifics of American Healthcare REIT here with our thorough financial health report.

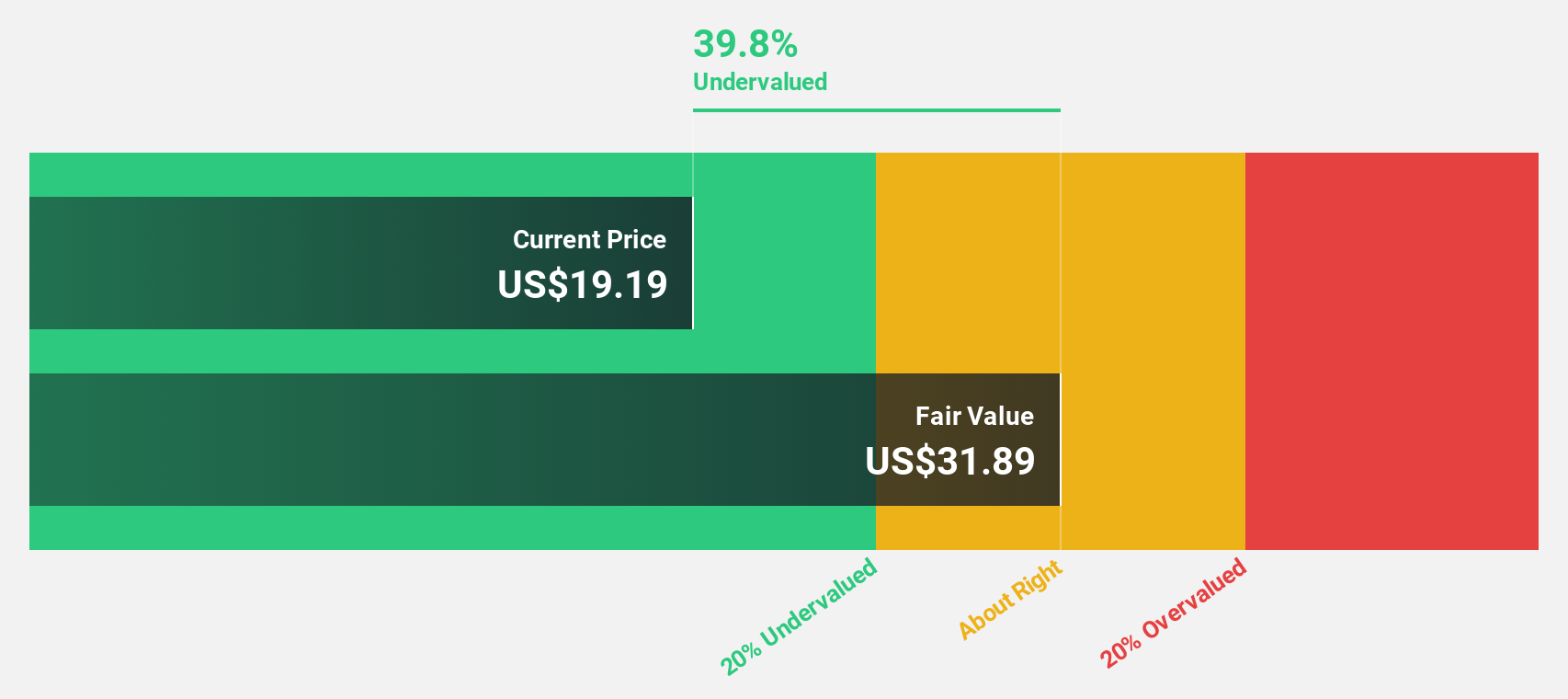

KE Holdings (NYSE:BEKE)

Overview: KE Holdings Inc. operates an integrated online and offline platform for housing transactions and services in China, with a market cap of approximately $20.98 billion.

Operations: The company's revenue segments include CN¥28.15 billion from new home transaction services, CN¥25.33 billion from existing home transaction services, CN¥14.30 billion from home renovation and furnishing, and CN¥8.91 billion from emerging and other services excluding home renovation and furnishing.

Estimated Discount To Fair Value: 39.8%

KE Holdings, trading at US$17.15, is significantly undervalued based on its discounted cash flow valuation of US$28.49. Despite insider selling and a drop in net profit margin from 7.5% to 5%, earnings are projected to grow at 20.9% annually, outpacing the US market's growth rate of 14.7%. The company completed a substantial share buyback worth $1.49 billion, enhancing shareholder value amidst steady revenue growth forecasts of 11.3% per year.

- Our earnings growth report unveils the potential for significant increases in KE Holdings' future results.

- Click here to discover the nuances of KE Holdings with our detailed financial health report.

Seize The Opportunity

- Get an in-depth perspective on all 167 Undervalued US Stocks Based On Cash Flows by using our screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AHR

American Healthcare REIT

A self-managed real estate investment trust that acquires, owns and operates a diversified portfolio of clinical healthcare real estate properties, focusing primarily on outpatient medical buildings, senior housing, skilled nursing facilities and other healthcare-related facilities.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives