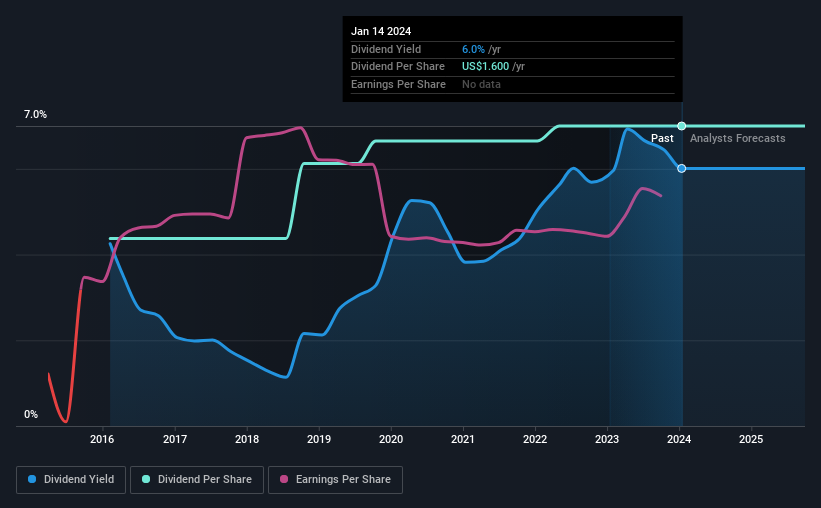

The RMR Group Inc. (NASDAQ:RMR) has announced that it will pay a dividend of $0.40 per share on the 15th of February. This makes the dividend yield 6.0%, which will augment investor returns quite nicely.

Check out our latest analysis for RMR Group

RMR Group Doesn't Earn Enough To Cover Its Payments

If the payments aren't sustainable, a high yield for a few years won't matter that much. Based on the last payment, RMR Group was quite comfortably earning enough to cover the dividend. This indicates that a lot of the earnings are being reinvested into the business, with the aim of fueling growth.

Over the next year, EPS is forecast to fall by 74.4%. Assuming the dividend continues along recent trends, we believe the payout ratio could reach over 200%, which could put the dividend under pressure if earnings don't start to improve.

RMR Group Doesn't Have A Long Payment History

Even though the company has been paying a consistent dividend for a while, we would like to see a few more years before we feel comfortable relying on it. The dividend has gone from an annual total of $1.00 in 2016 to the most recent total annual payment of $1.60. This works out to be a compound annual growth rate (CAGR) of approximately 6.1% a year over that time. RMR Group has been growing its dividend at a decent rate, and the payments have been stable. However, the payment history is very short, so there is no evidence yet that the dividend can be sustained over a full economic cycle.

Dividend Growth Potential Is Shaky

Investors could be attracted to the stock based on the quality of its payment history. However, initial appearances might be deceiving. Earnings per share has been sinking by 11% over the last five years. This steep decline can indicate that the business is going through a tough time, which could constrain its ability to pay a larger dividend each year in the future.

In Summary

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. In the past, the payments have been unstable, but over the short term the dividend could be reliable, with the company generating enough cash to cover it. We would probably look elsewhere for an income investment.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Just as an example, we've come across 2 warning signs for RMR Group you should be aware of, and 1 of them can't be ignored. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:RMR

RMR Group

Through its subsidiary, The RMR Group LLC, provides real estate asset management services in the United States.

Established dividend payer and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)