- United States

- /

- Real Estate

- /

- NasdaqCM:RITR

Will Reitar Logtech Holdings' (RITR) AI Logistics Push in Qatar Reshape Its Global Expansion Narrative?

Reviewed by Sasha Jovanovic

- Reitar Logtech Holdings recently announced the formal signing of a Strategic Cooperation Memorandum of Understanding with AI logistics company NEXX to jointly invest in a Smart Fulfillment Center project in Doha, Qatar, as part of broad plans for logistics automation in the region.

- This initiative not only launches a large-scale, AI-driven logistics facility but also aligns with Qatar's 2030 National Vision and the digital corridor ambitions of China's Belt and Road Initiative.

- We'll explore how Reitar's focus on Middle East infrastructure and phased global expansion shapes the company's investment narrative going forward.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

What Is Reitar Logtech Holdings' Investment Narrative?

To be a shareholder in Reitar Logtech Holdings, you need to believe in the company's ability to execute on ambitious growth through logistics automation and regional partnerships, despite recent operational and financial volatility. The announced Smart Fulfillment Center in Qatar, in partnership with NEXX, represents a substantial step toward establishing a foothold in the Middle East logistics market, a region shown to have strong e-commerce expansion and government backing for digital infrastructure. This new project, leveraging advanced AI and tokenization features, could help shift short-term narratives from recent concerns such as shrinking margins and share price swings, positioning Reitar as an early mover in next-generation logistics. That said, the company’s limited earnings growth, inexperienced board, and low return on equity remain meaningful risks, and much rests on successful project kickoff and further execution. For now, this deal is material: it adds credibility and fresh momentum, but execution and profitability will remain in the spotlight. However, with a new project on the way, investors can’t ignore ongoing volatility and execution risk.

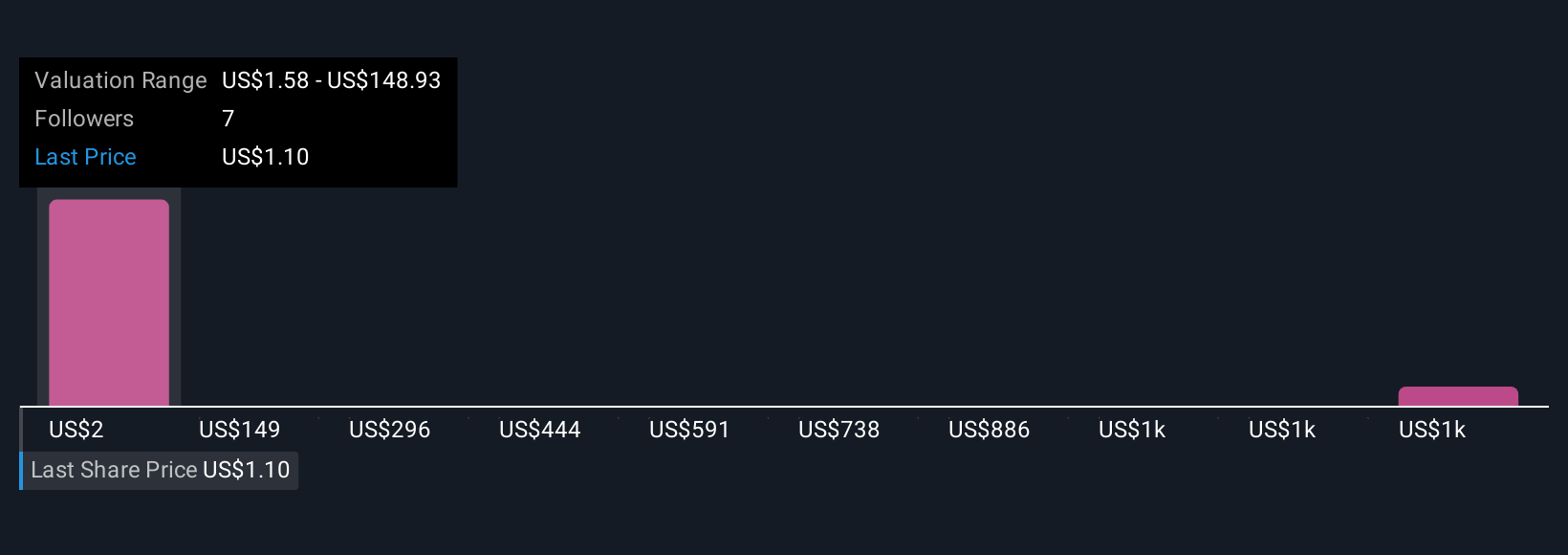

Insights from our recent valuation report point to the potential overvaluation of Reitar Logtech Holdings shares in the market.Exploring Other Perspectives

Explore 7 other fair value estimates on Reitar Logtech Holdings - why the stock might be worth 43% less than the current price!

Build Your Own Reitar Logtech Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Reitar Logtech Holdings research is our analysis highlighting 3 important warning signs that could impact your investment decision.

- Our free Reitar Logtech Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Reitar Logtech Holdings' overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:RITR

Reitar Logtech Holdings

Through its subsidiaries, provides construction management and engineering design services in Hong Kong.

Adequate balance sheet with slight risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)