- United States

- /

- Real Estate

- /

- NasdaqCM:REAX

Can Real Brokerage’s (REAX) Private Label Program Accelerate Its Northern California Growth Ambitions?

Reviewed by Simply Wall St

- Showcase Real Estate has joined The Real Brokerage Inc. (NASDAQ:REAX) through its Private Label program, bringing 45 agents and enhancing Real's reach in Northern California, according to a recent announcement from Showcase.

- This move enables Showcase to preserve its local brand while unlocking access to Real Brokerage’s national platform and advanced AI-driven technology.

- We'll explore how expanding Real’s agent network and technology adoption through the Private Label program could influence the overall investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Real Brokerage Investment Narrative Recap

At the heart of the Real Brokerage investment case is the belief that digitally enabled agent growth and sustained technology adoption can drive stronger market share and efficiency gains, even as margins are under pressure. The latest addition of Showcase Real Estate’s 45 agents through the Private Label program adds incremental presence in Northern California, but the impact on key short-term catalysts, such as margin improvement and revenue diversification, appears limited given the modest size. The most important near-term risk remains margin compression from a growing proportion of capped, high-producing agents, which could weigh on net earnings despite revenue growth.

Among recent announcements, the launch of the Real Wallet financial platform stands out alongside the Showcase agent expansion, as both initiatives further Real’s efforts to increase agent retention and engagement while seeding higher-margin ancillary income streams. With the company seeking to scale offerings like Real Wallet, investors continue to monitor early adoption and cross-selling progress as signals for whether ancillary growth can offset pressure on core brokerage margins.

Yet, in contrast to the promise of platform scale, investors should be aware of the ongoing risk to margins as capped agent volumes increase…

Read the full narrative on Real Brokerage (it's free!)

Real Brokerage's outlook anticipates $2.8 billion in revenue and $26.3 million in earnings by 2028. This is based on a projected annual revenue growth rate of 20.3% and reflects a $39 million increase in earnings from the current level of -$12.7 million.

Uncover how Real Brokerage's forecasts yield a $6.33 fair value, a 23% upside to its current price.

Exploring Other Perspectives

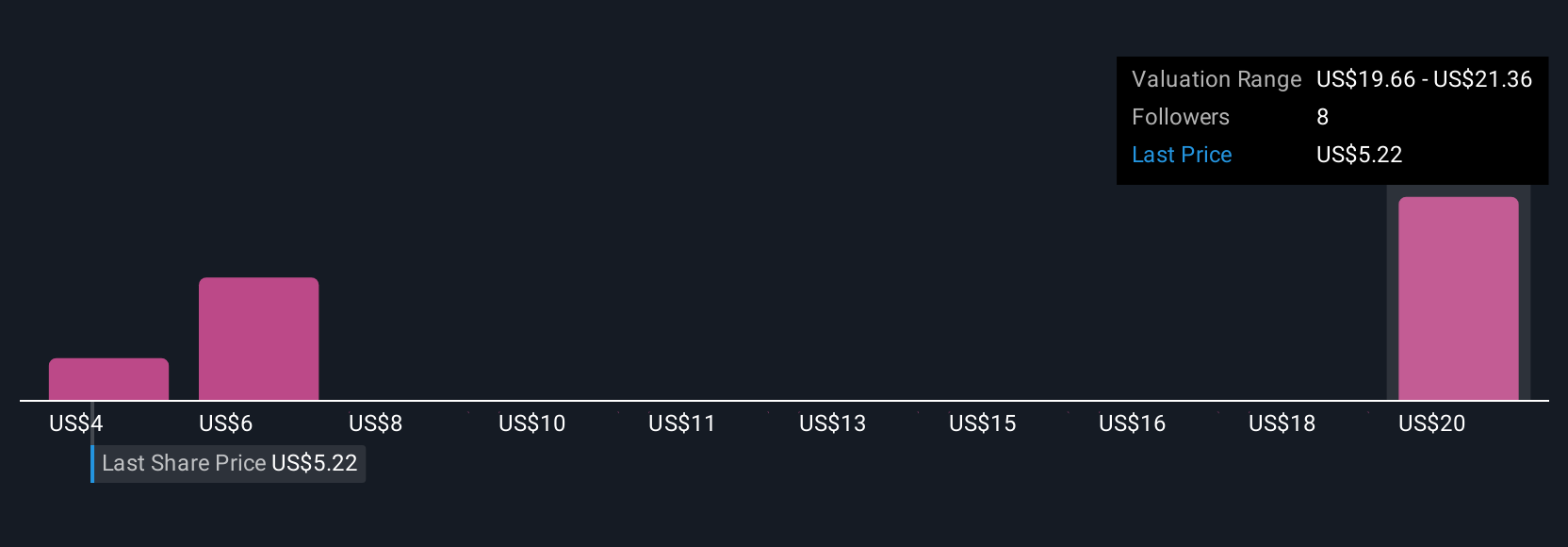

Simply Wall St Community members offered four fair value estimates for Real Brokerage, ranging from US$4.42 up to US$21.25 per share. These differing views reflect uncertainty around gross margin trends and highlight how investor opinions can vary widely, explore these perspectives to see how they might change your outlook.

Explore 4 other fair value estimates on Real Brokerage - why the stock might be worth 14% less than the current price!

Build Your Own Real Brokerage Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Real Brokerage research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Real Brokerage research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Real Brokerage's overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 27 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:REAX

Real Brokerage

Operates as a real estate technology company in the United States and Canada.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)