- United States

- /

- Real Estate

- /

- NasdaqGS:OPEN

Opendoor Technologies (OPEN): Reassessing Valuation After New Fintech-Focused Leadership and AI–Blockchain Turnaround Push

Reviewed by Simply Wall St

Opendoor Technologies (OPEN) just reshaped its C suite again, naming fintech veteran Lucas Matheson as President and confirming Christy Schwartz as permanent CFO. The company is sharpening its AI and blockchain focused turnaround narrative for investors.

See our latest analysis for Opendoor Technologies.

Those leadership moves land after a wild year, with the latest share price at $6.46 and a year to date share price return above 300%, but more recently a fading 30 day share price return and cautious sentiment after warrant dilution headlines.

If you are weighing Opendoor against other ways to play housing and fintech disruption, it could be worth scanning fast growing stocks with high insider ownership for the next set of faster growing, founder aligned names.

After a meme fueled surge that has pushed Opendoor far above cautious analyst targets despite ongoing losses, investors now face a sharper question: Is there still upside in this AI and tokenization pivot, or is future growth already priced in?

Most Popular Narrative: 116.4% Overvalued

With Opendoor Technologies last closing at $6.46 versus a narrative fair value near $2.99, the gap in expectations is hard to ignore.

The analysts have a consensus price target of $1.143 for Opendoor Technologies based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $2.0, and the most bearish reporting a price target of just $0.7.

Curious what kind of revenue path and margin rebound would need to unfold to defend a fair value below half today’s price? The narrative’s projections connect shrinking losses, shifting profit margins and a reset earnings multiple into one tightly woven valuation story. Want to see exactly how those moving parts add up?

Result: Fair Value of $2.99 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, stubborn macro headwinds and inventory risk, if mishandled, could quickly turn today’s aggressive AI and housing bet into a painful reset.

Find out about the key risks to this Opendoor Technologies narrative.

Another Lens on Value

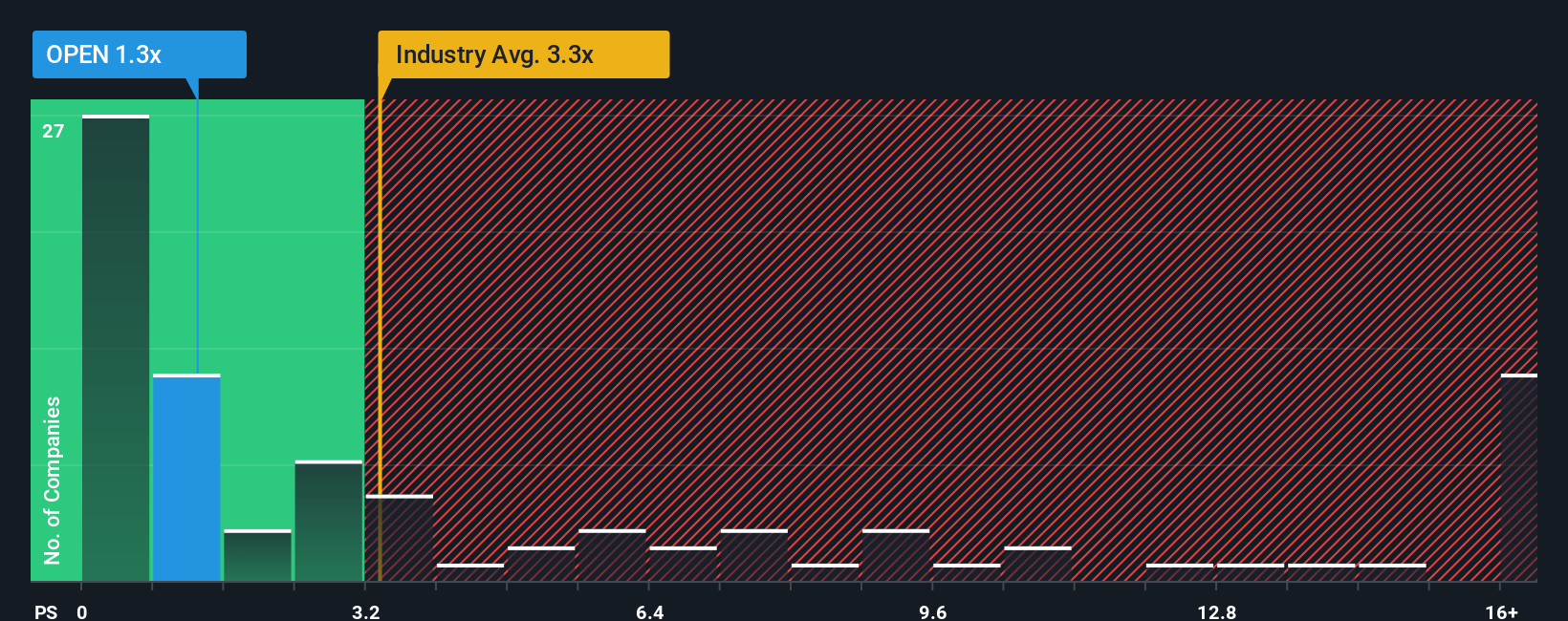

Step away from narrative fair value and the sales multiple tells a sharper story. Opendoor trades on a price to sales ratio of 1.3 times, richer than both the US real estate industry at 2.3 times and its own fair ratio of 0.7 times, implying meaningful downside if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Opendoor Technologies Narrative

If you see Opendoor’s prospects differently or want to stress test the assumptions yourself, you can spin up a custom view in minutes, Do it your way.

A great starting point for your Opendoor Technologies research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for your next investing move?

Do not stop at Opendoor. Use the Simply Wall St Screener now to uncover fresh opportunities before others crowd in and push prices higher.

- Capture potential hidden bargains early by checking out these 908 undervalued stocks based on cash flows that combine discounted prices with solid underlying cash flows.

- Position your portfolio for the next wave of innovation by reviewing these 26 AI penny stocks shaping critical breakthroughs in automation and intelligent software.

- Strengthen your income strategy by targeting these 13 dividend stocks with yields > 3% that offer yields above 3% alongside resilient business models.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OPEN

Opendoor Technologies

Operates a digital platform for residential real estate transactions in the United States.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)