- United States

- /

- Real Estate

- /

- OTCPK:LUXH

Take Care Before Jumping Onto LuxUrban Hotels Inc. (NASDAQ:LUXH) Even Though It's 26% Cheaper

To the annoyance of some shareholders, LuxUrban Hotels Inc. (NASDAQ:LUXH) shares are down a considerable 26% in the last month, which continues a horrid run for the company. Longer-term shareholders would now have taken a real hit with the stock declining 8.0% in the last year.

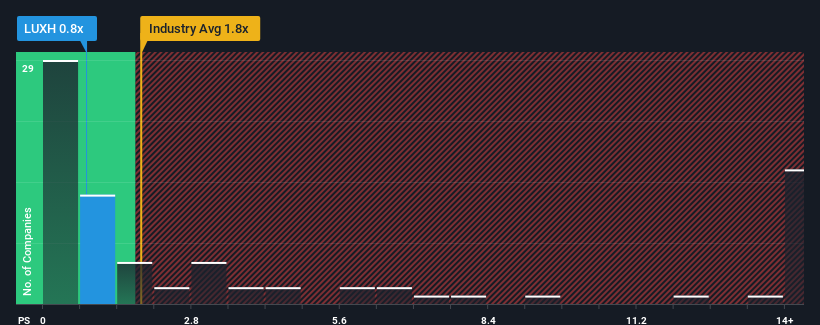

Since its price has dipped substantially, LuxUrban Hotels may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.8x, since almost half of all companies in the Real Estate industry in the United States have P/S ratios greater than 1.8x and even P/S higher than 8x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for LuxUrban Hotels

What Does LuxUrban Hotels' P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, LuxUrban Hotels has been doing relatively well. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on LuxUrban Hotels will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like LuxUrban Hotels' to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 159%. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 63% per year as estimated by the four analysts watching the company. That's shaping up to be materially higher than the 12% each year growth forecast for the broader industry.

In light of this, it's peculiar that LuxUrban Hotels' P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What Does LuxUrban Hotels' P/S Mean For Investors?

The southerly movements of LuxUrban Hotels' shares means its P/S is now sitting at a pretty low level. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

To us, it seems LuxUrban Hotels currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

There are also other vital risk factors to consider before investing and we've discovered 3 warning signs for LuxUrban Hotels that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OTCPK:LUXH

LuxUrban Hotels

Engages in the leasing of entire existing hotels on a long-term basis and rent out hotel rooms in the properties it leases.

Medium-low and slightly overvalued.

Similar Companies

Market Insights

Community Narratives