- United States

- /

- Pharma

- /

- NYSE:MRK

Merck (NYSE:MRK) Partners For Cancer Therapy Breakthroughs In Space Research

Reviewed by Simply Wall St

Merck (NYSE:MRK) saw its share price increase by 3% over the past week, possibly influenced by its partnership with Sierra Space to advance biopharmaceutical solutions in space. This collaboration, aiming to innovate cancer therapy delivery, represents a forward-thinking approach in the sector. Concurrently, Merck announced that the FDA accepted its application for KEYTRUDA, a cancer treatment, offering potential regulatory momentum. Meanwhile, broader market trends showed a 5% drop due to economic concerns and tech sector volatility, highlighted by the sell-off of Nvidia shares after an earnings miss. While other market indices like the Nasdaq and S&P 500 faced declines, investors' positive response to Merck's advancements could indicate a market perception of resilience in its long-term strategy. The easing inflation also buoyed the market towards the week's end, offsetting some earlier declines and possibly supportive of Merck's recent price movement, even as broader market stresses persisted.

Take a closer look at Merck's potential here.

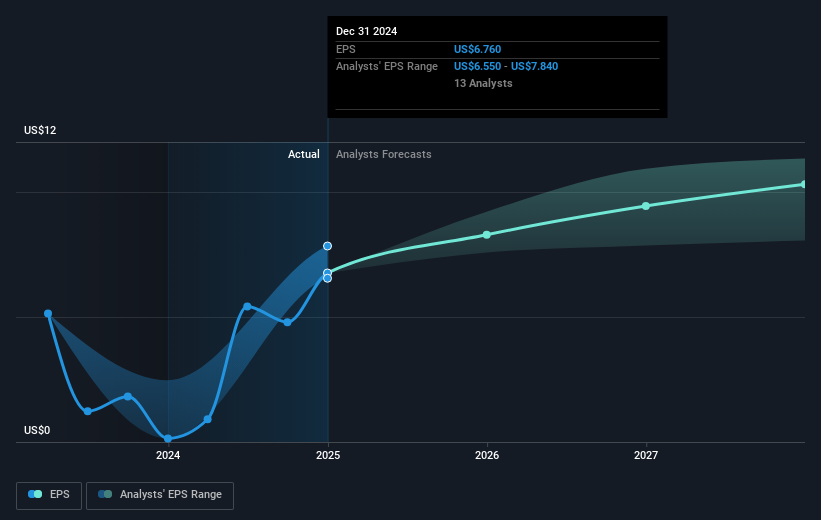

Over the past five years, Merck shares have delivered a total return of 35.71%, signaling consistent growth. This period has been marked by strategic collaborations, including the partnership with Sierra Space, enhancing Merck's capability for innovation in biopharmaceutical solutions in space. Noteworthy product approvals contributed to this trajectory, with the FDA's acceptance of KEYTRUDA for advanced carcinoma playing a prominent role in reinforcing market confidence in Merck's pipeline. Additionally, the company's earnings have shown robust growth, reflecting a very large year-over-year increase in profits last year, albeit with challenges in recent quarterly results.

Despite Merck's underperformance compared to both the US Pharmaceuticals industry and the broader US market over the past year, the company's ability to maintain a competitive Price-To-Earnings Ratio relative to its peers underscores its valuation appeal. Continuous expansion in its oncology offerings, underpinning a strong commitment to product pipeline growth, further supports the long-term return. Collaboration and approvals, such as those with Eisai and IDEAYA, have played fundamental roles in enhancing shareholder value over this extended timeframe.

- Unlock the insights behind Merck's valuation and discover its true investment potential

- Gain insight into the risks facing Merck and how they might influence its performance—click here to read more.

- Got skin in the game with Merck? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MRK

Outstanding track record, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives